This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

2 great Citi Gold benefits for Citi Prestige cardholders

I recently signed up for the Citi Prestige. I know…what have I been doing this past year?!?! Everyone has been raving and raving about the card and I held onto my Citi Thank You Premier only to apply for the Citi Prestige right before they devalued some of the benefits. I was still able to get 50,000 Thank You points for the sign up, and will have a full year’s use of the Admiral’s Club. I’m not really that concerned about the devaluations as I’ll still get $500 in free flight credits, Admiral’s club ( which I’ve already used), the buy3get1 free hotel perk, and a great Priority Pass membership. Now the card becomes even more valuable with 2 great Citi Gold benefits for Citi Prestige cardholders.

A little history:

Earlier in the year I had a Citi Gold checking account. I’m sure a lot of you made use of an incredible offer that provided 50k AA miles for a new Citi Gold checking account so I won’t spend much time on it. I had to spend a $1000 on a debit card and make some bill pays within the first 3 months, once completed, the points would post. Well my points posted 4 months later and I cancelled the account shortly thereafer. Ever since, my online Citi account still marks me as being an active Citi Gold member. Fantastic. I wasn’t sure whether my new Citi Prestige would qualify for Citi Gold benefits, but it did.

2 great Citi Gold benefits for Citi Prestige

-

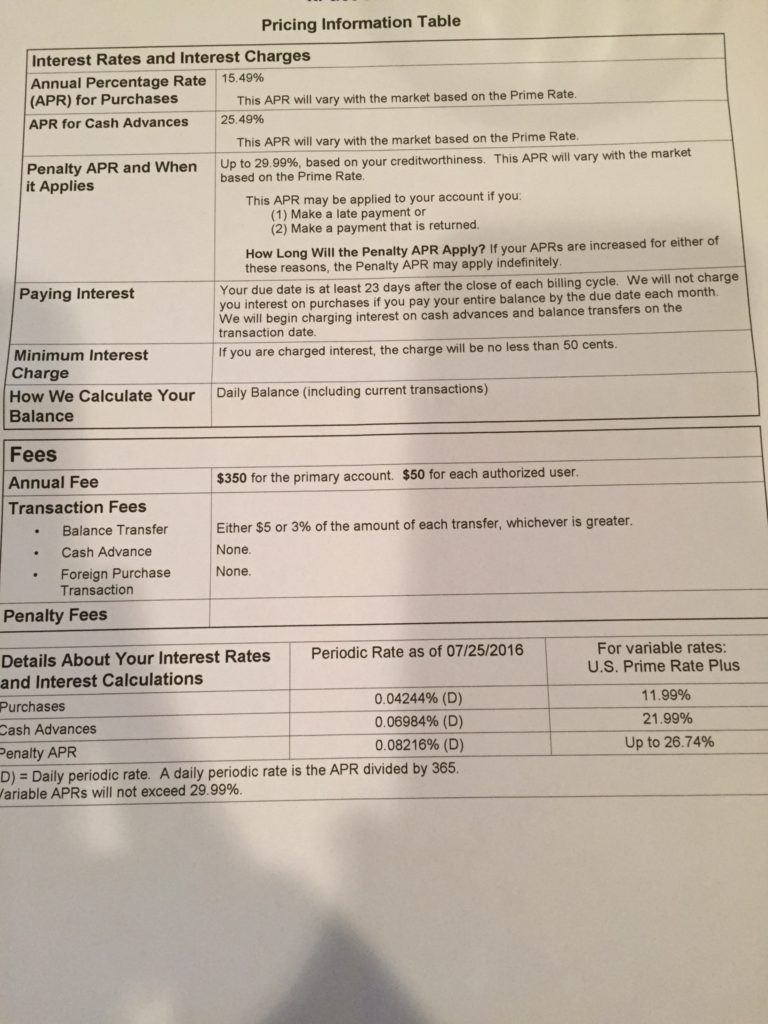

Annual fee is $350 vs $450.

-

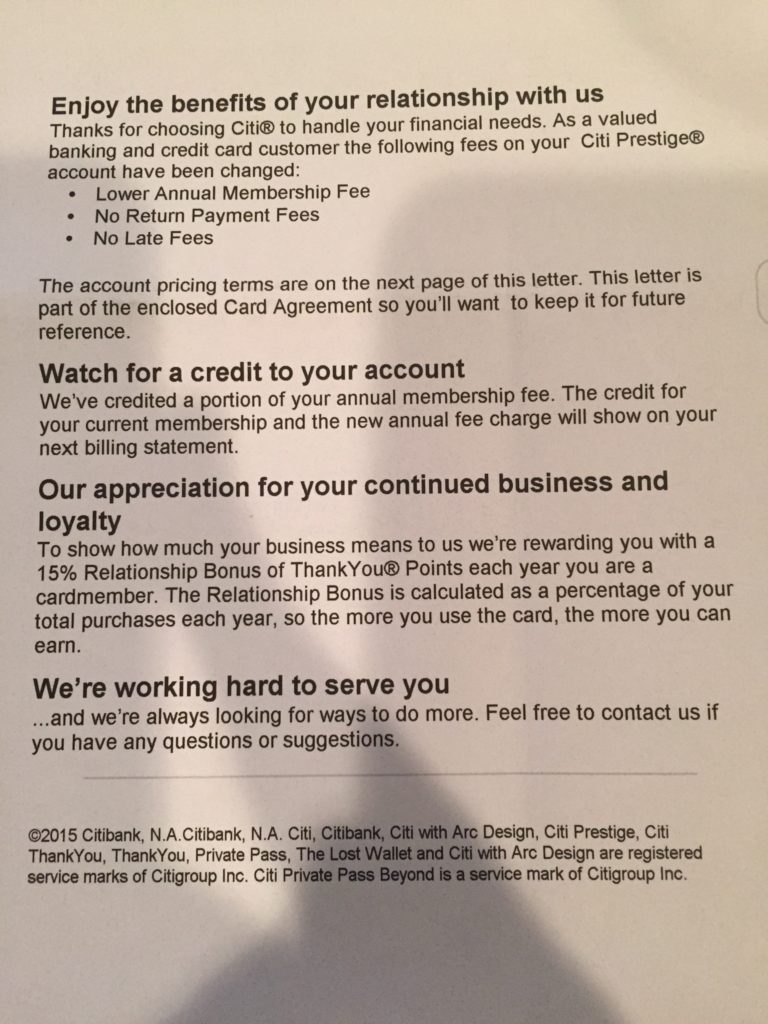

15% dividend on all points earned through purchases.

-

There are no late fees either…which is pretty awesome. Although I typically have mine set for auto-payment so this isn’t as big a deal for me.

Value, value, value!!!!! Thanks CitiGold – you rock!

- If we simply look at the $250 annual flight credit and offset that against the $350 annual fee I’ll be paying, I’m $150 ahead. That is unbelievable.

- 15% dividend is amazing as well. I’ll probably put a lot of my spend on this card in the upcoming year because of this feature. Although, this new Chase Sapphire Reserve is verrrrrry attractive to me

- If you notice it says that they are going to credit part of my annual fee. I’m assuming that credit will be $100 to discount the $450 to $350, but maybe i’ll get lucky and they’re giving me some sort of SUPER credit – I did apply before the devaluation, so maybe they are giving a customer appreciation, we are so sorry we fooled you, statement credit. A monkey can dream, right?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.