We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

AA discounts purchased miles again: up to 85k bonus AA miles

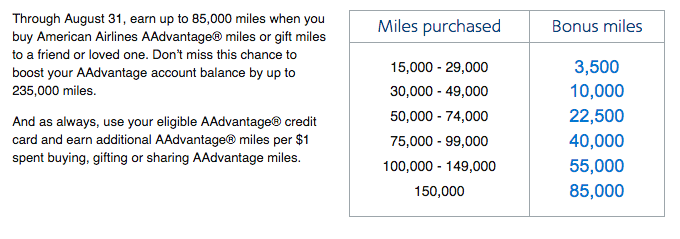

American Airlines is at it again with yet another discount on purchased miles. The last time around was a sweeter deal with over 100k bonus miles after purchasing 150kAA. The first thing that comes to my mind when I see discounts one period after another is what’s going to happen after August 31st at 11:59:59 when this offer ends? Will the next promo be better or worse? Right now I have a huge bevvy of AA miles from aligning all my 2016 travel with them, and leftover from credit card bonuses, banking bonuses, etc so I’m not really in the market for buying miles. But, like I said when about the 100k bonus, if you need miles for a trip this could be a great opportunity to offset some cost. Let’s take a look at the new 85k bonus AA miles offer.

The Offer:

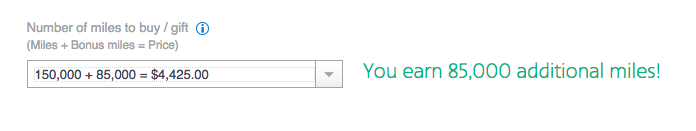

Here is the offer as laid out on aa.com As you can see it’s a tiered off like AA has done in the past, rewarding you with more bonus points the more that you spend. It’s also worth noting that taxes are applied to purchase price.

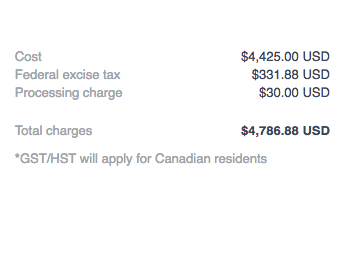

Maxing out the deal would set you back almost $4800. Roughly $0.02/mile

A note about the taxes

Hypothetically, if you decide to purchase miles for a trip to Asia and you’re redeeming those miles on partners of American like Japan Airlines or Cathay Pacific, you are entitled to claim the taxes paid for purchasing miles back on your tax return. An article by Gary Leff last year cites the IRS and says that the Federal Excise Tax imposed on these purchased miles aren’t applicable if the travel redeemed by the miles is on a foreign carrier. Something to consider as this would drop the price by $331.88 and lower the effective rate of points to 1.8 cents.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.