This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Amex Platinum $200 airline fee credited AA gift cards

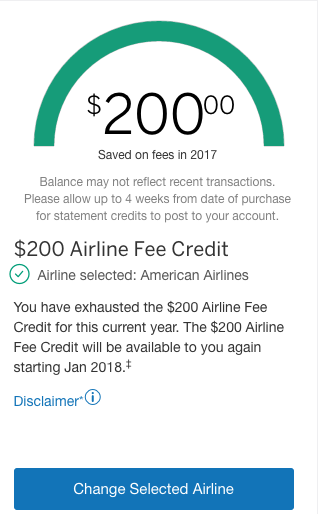

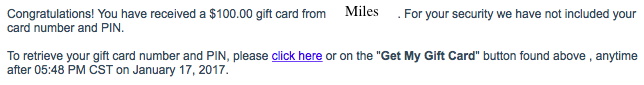

A few days ago I went ahead and charged a couple $100 AA gift cards to my Amex Business Platinum with the expectation they would be credited a few days later. If you don’t know about this strategy, it’s a great way to use up your Amex Platinum Airline fee credit on things other than “incidentals.” For whatever reason, AA gift cards code as incidentals with Amex and, as a result, the fees get reimbursed. This makes the fee credit far more valuable as it can be used for flights directly instead of bag fees, change fees, etc. Usually this wouldn’t be of any concern and it has gone off without a hitch in years past with credits every time. However, over the last 6 or 7 months I’ve had a few friends and family tell me that their AA gift cards hadn’t been refunded. This was cause of concern as it would significantly decrease the value of holding an Amex Plat. Good news! The Amex Platinum $200 airline fee credited AA gift cards and the strategy still works!

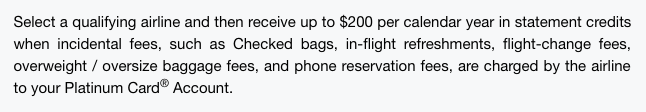

In case you are unfamiliar with the $200 Airline fee credit perk of Amex Platinum

When I upgraded my Amex Business Gold to Platinum last fall I tried the credit out and it worked for calendar year 2016. If I’m any indication of the current policy…it’s still working in 2017

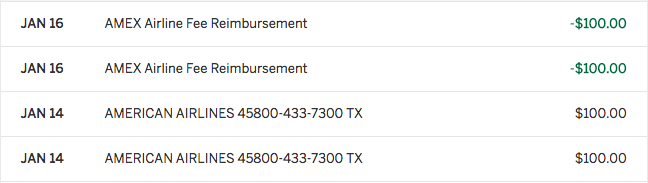

I’d read where people have had trouble if they buy gift cards on the same day. That wasn’t the case for me. I did have two independent transactions.

- You can not buy 1 – $200 gift card

- You must be 2 or more cards that total $200

- Use different transactions. Don’t but 2 cards in the same purchase.

It’s worth noting that when you purchase gift cards they aren’t immediately available for use. You have to wait 3 days.

As you can see from the Amex screen shot I purchased these gift cards on Jan 14th.

When I upgraded my Business Gold to Business Platinum I received 50,000 Amex MR. In addition, I’ve received $400 in airline credit. That nets out to just $50 in annual fee. Add in the Gogo in flight wifi passes…I’m net ahead + bonus points + lounge access + Fine Hotels and Resorts.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.