This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Beginner’s Guide: How to rotate credit

Rotating credit is one of the best ways of bolstering your credit score. It not only keeps your overall depth of credit in tact, but as a result, it won’t adversely affect your credit utilization. Credit Utilization refers to the total amount you currently owe to creditors divided by the total of all of your various credit lines. Ideally, you want to keep this percentage under 20%, but if you really want your score to improve, keep it under 10%. I’ve always done my best to keep single digit utilization for many years now because, in my opinion, it is the single most impactful part of your credit other than paying your bills on time. Rotating credit can keep your total depth of credit in tact even when you cancel a card – which is integral to keeping a healthy credit score. Let’s get into it.

Wait, before I learn how to Rotate Credit. What does it even mean to rotate credit?

Rotating credit means that you move credit from one card to another. Now, before you ask, this can only be done with credit lines issued from the same bank, and not all banks have the same rules. It can only be done if you have more than one card, or you are applying for a new card, within the same bank.

- Example: You have a Chase Sapphire Preferred® card with a 10,000 limit

- You apply for a Chase Hyatt card – they deny you because you have been given as much credit as they allow

- You can rotate some or your Chase Sapphire Preferred®line to you new Card for approval.

- You apply for a Chase Hyatt card – they deny you because you have been given as much credit as they allow

I have done this multiple times when opening Chase card because their suite of cards have been quite attractive to me over they years. I also do this when I’m closing an account to preserve my overall credit line and minimize my credit utilization which keep your credit score healthy.

- Example: You have a Chase Sapphire Preferred® and a Chase World of Hyatt card. You want to close your Chase Hyatt card with a $5k limit

- You can request to have that $5k limit moved over to the Chase Sapphire Preferred®to preserve that credit line.

The actual closure of a credit card has minimal effect on your credit score, what ACTUALLY lowers it in a substantial way…is losing the line of credit associated with that card. By rotating credit you can keep that line and help the health of your credit score.

What factors dictate how much credit a bank will give me?

A few of the factors

- Income

- Credit Score

- History with the bank

- How much credit you already have with that bank.

- the are many more factors, but these are weigh a heavy impact.

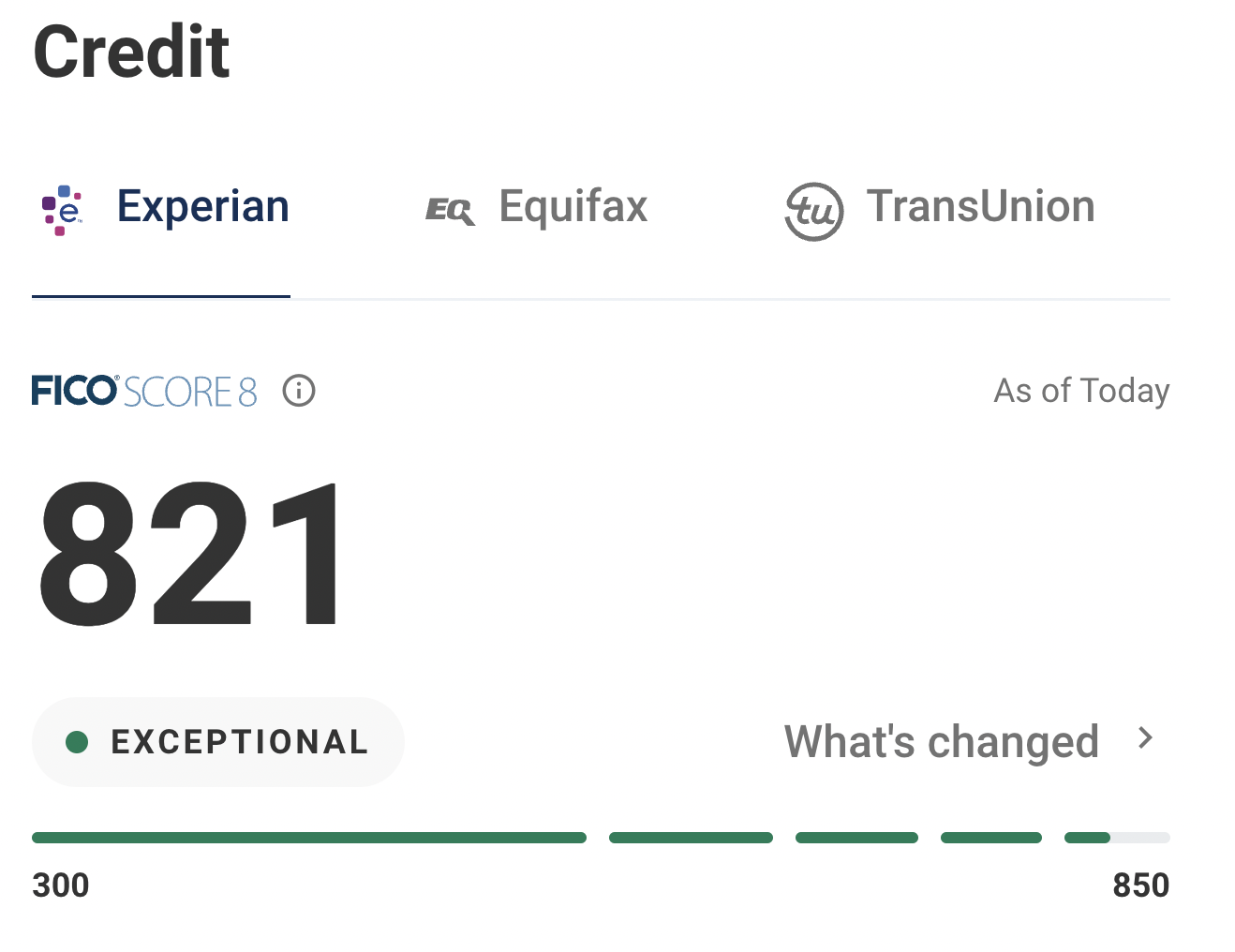

Each time you apply for a credit card the bank will give you a line of credit. At some point, as you sign up for more cards, the bank will limit the total line of credit they will give you. This happens even if you have perfect credit. Here’s a screen shot of my credit from Experian.

My credit isn’t perfect, but it’s very strong, and a result of keeping a close eye on my credit utilization. I rarely let a credit line disappear, and do everything I can to rotate it to another card prior to closure. But I hit ceilings with my creditors when it comes to getting a new card. Here’s some info I’ve learned that will help you rotate credit so you can keep your credit score healthy and improve your odds for approval

How to rotate credit bank by bank – from my own personal experience

Bank of America

- Pretty Easy

- Phone in to move – should be done over the phone

CHASE

- Super Easy to move lines

- NO pull of credit

- Just call and either the rep on the phone you get can do the transfer, or they will transfer you to someone who can.

- I’ve never been denied moving credit from one card to another

- On several applications I have hit my max line allowed and they have moved lines from an existing account to my new account in order to approve the application.

BarclayCard

- I’ve moved lines twice

- Both times were easy…not as easy as Chase and had to be transferred, but once in touch with the right person it was a fairly easy process

- NO hard pull

Citi

- Super annoying

- Always get referred and told they have NOOOO idea if they can do it

- Hard Pull ( much in the same way as you’d have with a new credit inquiry )

- Only way I’ve avoided the hard pull is at the time of a new card application. I’ve had success moving a line from an existing account to a new account in order to get approval.

Discover

- Not difficult

- Possible Hard Pull ( so may not be worth it )

- Phone in and ask to speak to Credit Operations

Amex

- This is only relevant to credit cards not charge or pay over time cards

- Easy with 3 options: phone, online chat, or just online

- Online: Account services, Payment/Credit, Transfer Avail credit

- Soft pull

- Word to the wise…if your limit is at or near 25k – could trigger financial review if you end up over that amount.

Wells Fargo

- Phone in

- Soft Pull

Final Thoughts

I would highly advise rotating your credit if you are opening and closing a lot of accounts. Since I first delved into the wonderful world of credit rotation ( years ago ) my credit score has consistently stayed over 800. I attribute a lot of this to keeping a very low utilization rate as well as paying all of my bills on time.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.