This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Confirmed Bonus: Upgrade Amex Biz Gold to Amex Biz Platinum

Just a little heads up to anyone who has taken advantage of this awesome offer. I was targeted a few months ago to earn 50k Membership Rewards after $10k spend in 5 months if I upgraded my current Amex Biz Gold to Platinum. The issue was that I already had an Amex Biz Platinum. At the time I confirmed with customer service, but I was a bit iffy. Still, I went ahead and pulled the trigger and have been working toward the 50k bonus. Well I got some great news and it’s this: Confirmed bonus on upgrade from Amex Biz Gold to Amex Biz Platinum

First, I canceled my original Amex Biz Platinum because the annual had hit

I was read a long list of benefits, but wasn’t offered any sort of retention. I told the rep, who was SUPER friendly, that I had two of the same card and didn’t need two Plats. She saw that and proceeded. Then, with a lot of anxiety in her voice, said she needed to transfer me to another person, an Awards Specialist.

I get transferred

Basically I was told that the upgrade offer may be invalid because I had already received a Sign up Bonus for my first Amex Biz Platinum – NOOOOOOOOOOOO!!!!!! I knew it was too good to be true – and she needed to speak to her boss. OH CRAP!

BUT!

She came back on the phone and said it was, in fact, a completely different offer and no worries. She went ahead and cancelled my original Amex Biz Plat, kept the upgraded one open and assured me that once I hit the 10k spend, the 50k bonus would appear in my account and all would be good.

BYAWWWWW!!!!! Confirmed again!

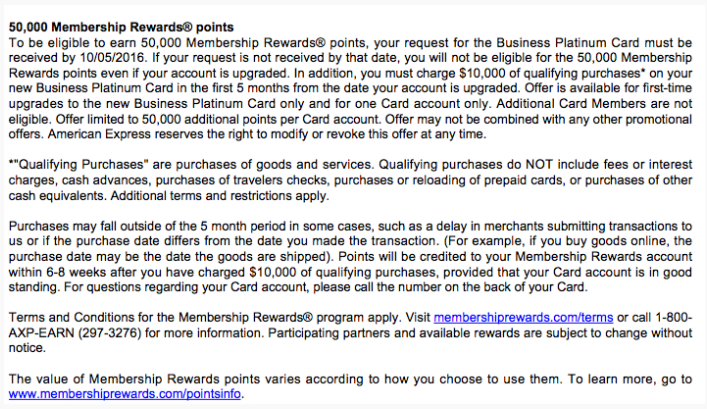

In case you were wondering – here are my original terms

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.