This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Easy way to search: Hyatt Cash and Points Group Code

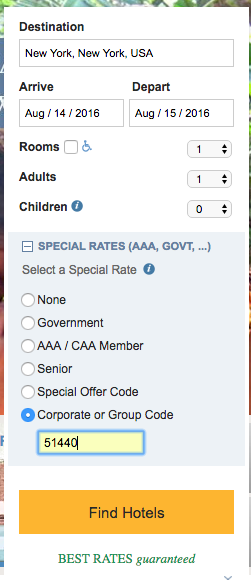

One of the best ways to stay at expensive hyatt properties and make your points stretch is to use the Hyatt Cash and Points rates. They can be extremely laborious to search for individually. I was looking at hotels in San Francisco and one popped up with Cash and Points – I clicked through to the final booking page and noticed that the Corporate or Group code was listed 51440. Once you have this group code you can actually input that into your search query thus getting only results with Cash and Points availability.

Let’s look at how Hyatt Cash and Points can increase the value of your points.

There are three options for booking:

- Cash

- Hyatt Gold Passport Points

- Hyatt Cash + Points

Option 1 : Cash

The Grand Hyatt San Francisco was nearly $400/night when I searched. That’s a no go.

Option 2: Points

I could use 20000 outright and get $0.02/point. I wouldn’t pay any taxes and the room would be free of cost. At this valuation I’m kind of getting fair market value. I either have earned these Hyatt points through stays, or transferred over from Chase Ultimate rewards. Either way, I’m not losing money at this valuation. But, I like to be profitable when it comes to redemptions, i.e. get more than the fair market value.

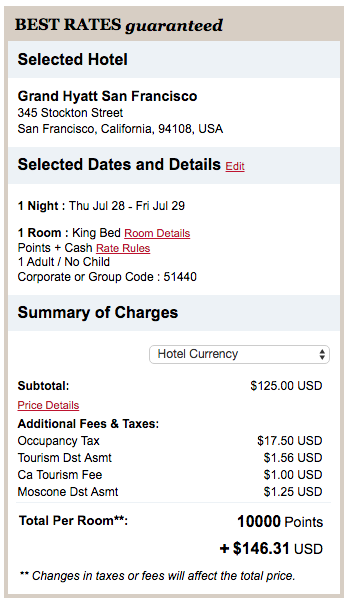

Option 3: Cash + Points

Using Hyatt Cash + Points the rate is knocked down to 10000 + $146 – a discount of $254 from $400. This means that my 10000 points saved me $254 or $0.0254/point. In addition to this, I actually earn points not only off the $125, but as a diamond, I earn an extra 1000 points at check in.

The net looks like this

- Pay 10000 GP points and $146

- Receive Stay credit

- 6.5x $125= 812.5

- check in bonus = 1000

- Net is 8187.5 for $254 value = over $0.03

Use 51440 when searching for Hyatt Cash and Points rates

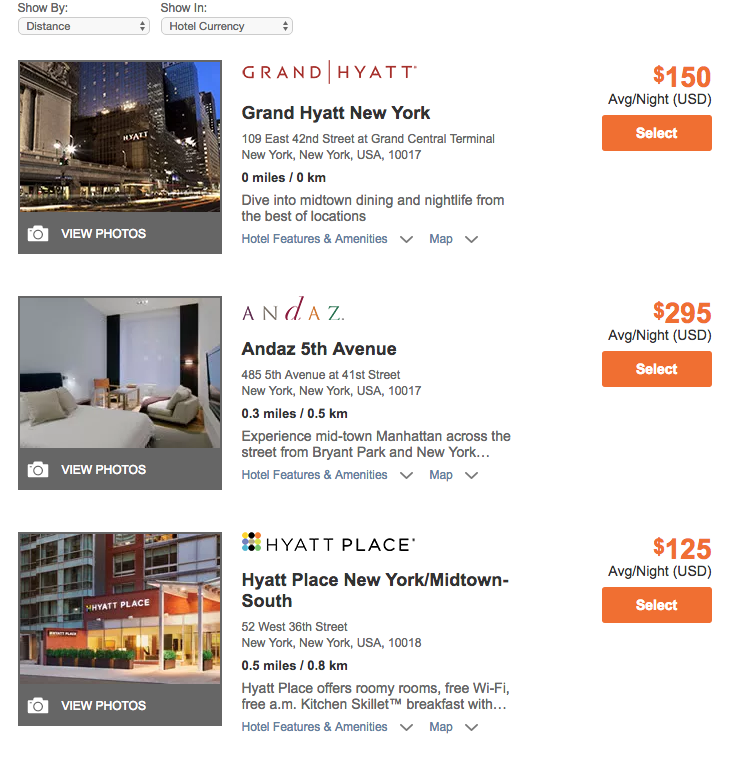

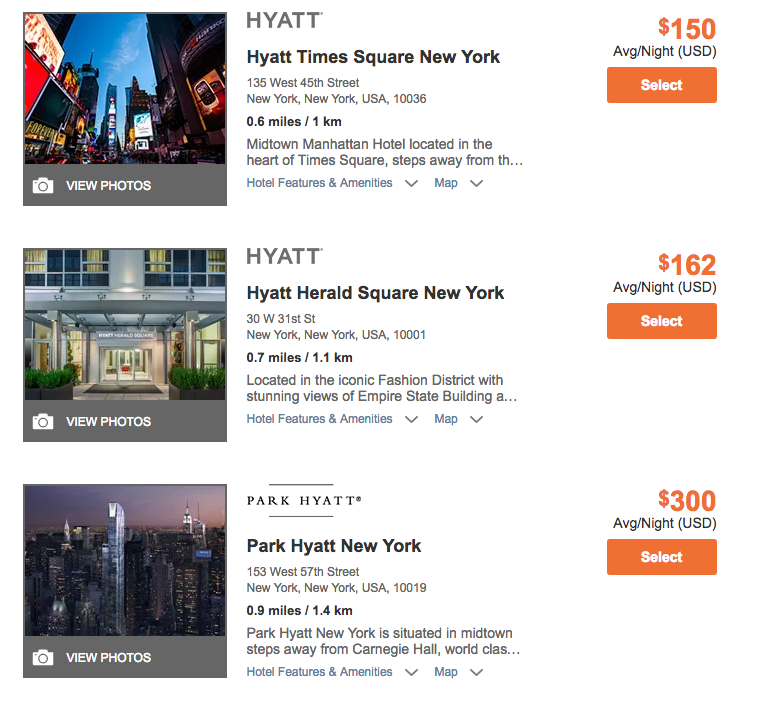

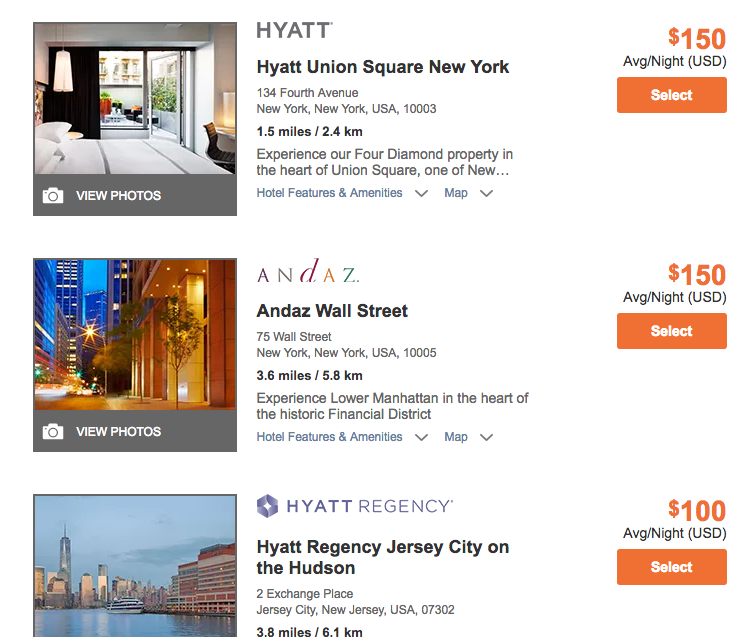

You will see the hotels listed that have the Hyatt Cash + Points rate listed for your search dates. I did a hypothetical search in New York in August…The list was ridiculously long for cash and points avail but I listed to show what the process would look like:

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.