This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

80% bonus when purchasing Hilton Honors Points

Hilton is offering a pretty solid deal to buy points with an 80% bonus. It runs until February 17th and as long as you buy 5000 or more points between now and then…you’ll get the bonus. This isn’t the best deal we’ve seen recently: In the middle of last year Hilton offered a 100% on purchased points which placed the purchase price right about 0.5 cents per point, but this is a great deal if you’re in need. An 80% bonus equates to a slightly higher price, roughly 0.55 cents per point, and is capped at $800 or 144,000 total points. If you’re looking at a trip, to stay at a Hilton, and are short – this is a very good option to get an 80% bonus when purchasing Hilton Honors Points.

Here’s a link to the deal

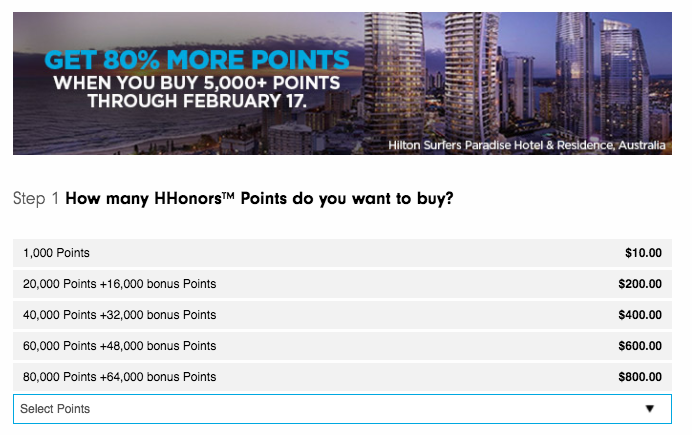

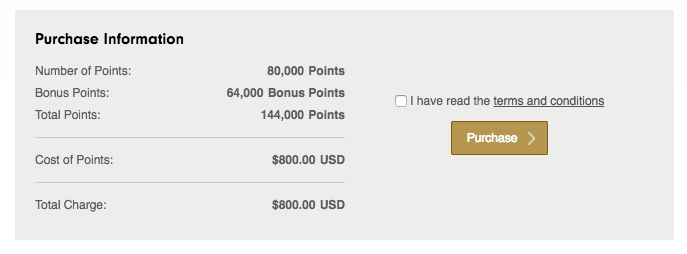

And a chart showing the relative prices and points

And if you buy the maximum…you’ll buy them at $0.00556 per point.

When could this make sense? Let’s take a look at the Conrad Dublin

It’s a gorgeous hotel with a great location. Images courtesy of Conrad.com

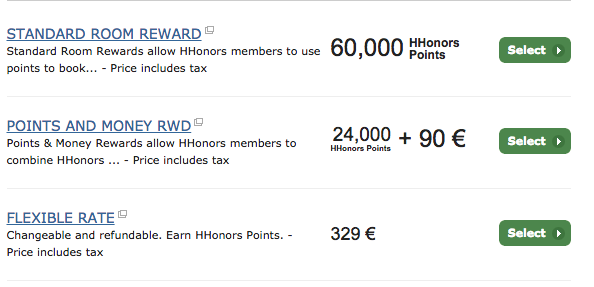

Let’s take a look at a random date and see the advantage of buying points. Here is the all points, points and cash, and revenue rates for the hotel in July 2017:

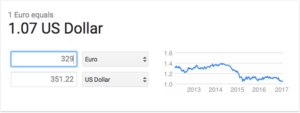

If you were to buy enough the 24,000 points and pay the 90 € = $140 + 96 or $236 – that’s a $115 savings per night compared to the flexible rate. Sometimes it makes sense to just buy the points.

Points + Cash is my favorite use of Hilton Honors purely because it increases the value and therefore stretches the use for more and more trips.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.