We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Should you Pay your taxes with a credit card?

Paying your taxes with a credit card is a pretty easy thing to do these days. In fact, the IRS has 3 official payment processors that are safe, secure, and are eager to charge you a fee to do it.

Yes, you WILL incur fees, but there are situations where the fees could be worth it. In fact, the only time it makes sense is when you earn more in points or cashback than the fees your paying, and therefore net tidy profit in the process. No…you’re not making a profit on the entirety of your tax bill, but you are earning something back by paying with a credit card vs paying cash, check, etc.

Let’s take a look at when it could be a good idea to pay your taxes with a credit card, but also when you should steer clear.

*Note I am not a tax professional and you should always consult one for advice. This is purely for educational purposes.

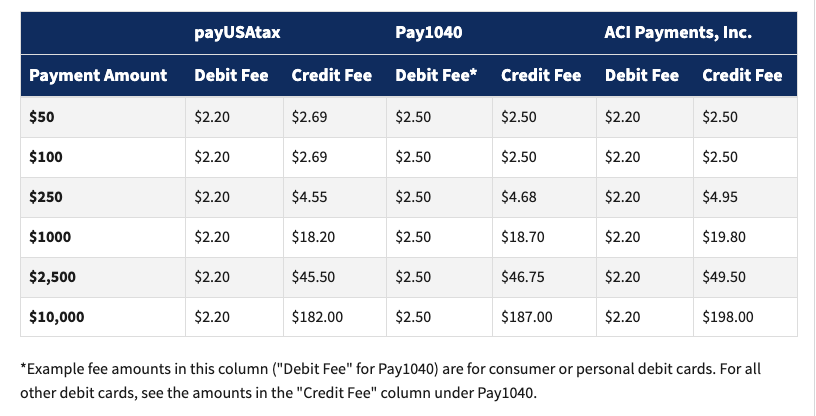

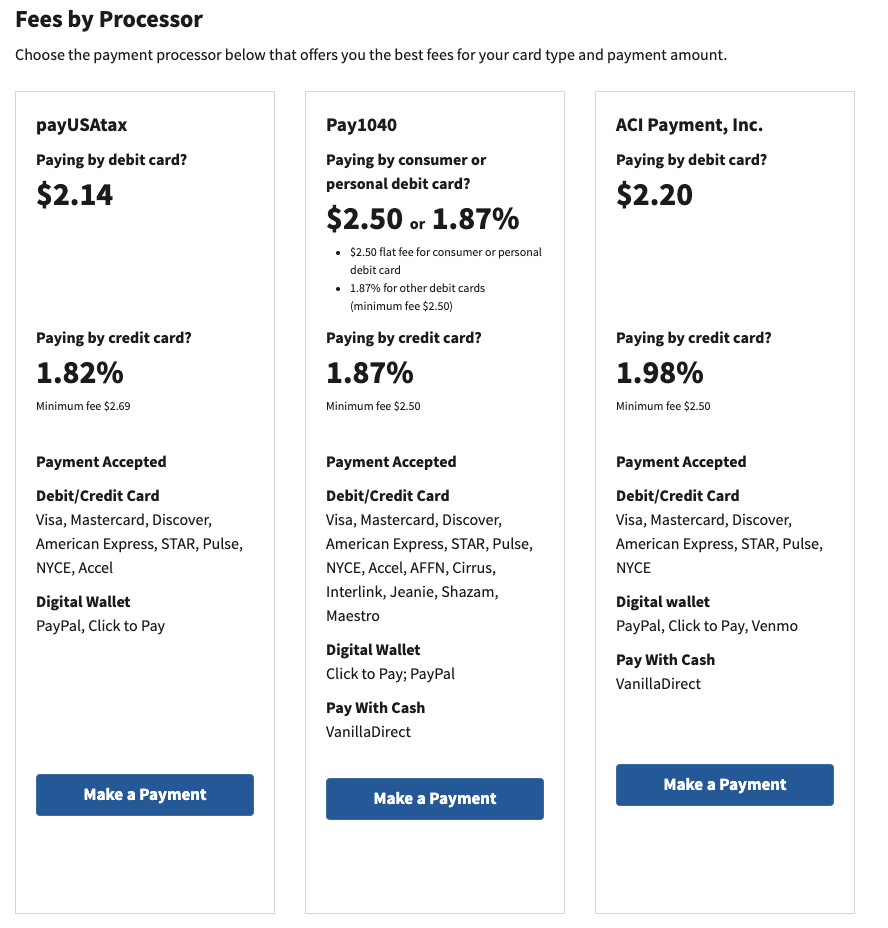

First – here’s a look at the 3 official payment processors: ACI, Pay1040, payUSAtax.

You’ll notice that you can pay your taxes with debit or credit. In fact, Paypal is even possible via PayUsaTax.com .

- Debit Card fees

- $2.14 to 1.87%

- Credit Card fees

- 1.82% to 1.98%

- Digital Wallet Fees – varies

You can see the fees broken down into a table so you know what you’re going to pay:

Which Credit Cards should I use?

There are two instances that make sense

- The standard earn rate on the card outweighs the fees incurred

- Currently the credit card fees sub 2%, so if you’re paying with a 2% cashback card, you’re ahead

- The other instance is where the points you’re earning are worth more than 2 cents a point… the Capital One Venture Rewards or Venture X are great examples of this: you’re getting 2x on the purchase and I’d say the points are worth around 1.7 cents a piece. That’s 3.4% back!

- You’re hitting a minimum spend requirement

- If you’re using a tax payment to hit a big bonus on a new credit card…you’re way ahead

The most popular reason to use a credit card is to hit a minimum spend requirement that unlocks a wave of bonus points. We have a favorite credit cards list that is updated monthly. I would suggest looking there to see how any of those could potentially fit in your travel goal strategy.

Additionally, there are a few other combinations and cards that can make sense even without a bonus which you can read about below. These, in my opinion, are few and far between.

How often can I use this service?

It really comes down to the type of tax payment you’re making, but the general rule of thumb is 6 times a year in each qualifying period. What does that mean?

Each of the 3 payment processors allow:

- You can pay 2x per year on annual taxes,

- You can pay 2x per quarter on estimated taxes.

This is pretty awesome since it creates a situation where you can split payment on a large bill to help you reach minimum spend requirements.

Check out this table on the IRS website that breaks it down into each tax form for exact answers.

An example: You have 1040-ES bill or a $10k quarterly tax bill

You could make a total of 6 payments across the 3 payment processors each quarter.

- Let’s say you need to hit a minimum spend of $6k on an American Express Gold Card, and $4k on a Chase Sapphire Preferred®, and put $4k on an Capital One Venture X to hit the minimum spend.

- You’d spend under $200 on processing fees but you’d earn 90k Amex Points, 60k Chase Points, and 75k Capital One Miles *these are the current offers as of 02/15/24

- 90k Amex

- = $1800 ( $0.02 )

- = $1350 ( $0.015 )

- 60k Chase

- = $1200 ( at $0.02 )

- = $900 ( at $0.015 )

- 75k Cap1

- = $1275 ( at $0.017 )

- = $1125 ( at $0.015 )

- 90k Amex

So on a $10k tax bill, if you added 3 of the best cards to your wallet, you’d get $3375 to $4275 back in the form of points. Not bad on $200 of fees.

Hopefully this allows you to get creative on hitting sign up bonus thresholds 🙂

When you shouldn’t pay your taxes with a credit card.

I want to be very clear that I’m not recommending or advising you to pay your taxes with a credit card, but merely illustrating examples of how and when it could be advantageous to you. I want to stress that you shouldn’t pay your taxes with a credit card if:

- You’re doing it because you don’t have the cash to pay the balance

- You will incur massive amounts of interest from your credit card issuer in addition to the fee charged to process the payment. Find a good tax advisor and negotiate a schedule of payments.

- You don’t intend on paying off the balance in full after charging it

- Again…the finance charges will outweigh any benefit

- There is an argument to be made for cards that offer 12 months interest free, but I’d personally avoid the situation.

- Again…the finance charges will outweigh any benefit

Examples of when it makes sense to pay the payment processing fees

Again…just giving you examples of how this strategy could help you earn enough points to achieve your travel goals.

This isn’t an extensive list, and if you have ideas feel free to leave them in the comment section – this is intended to get the juices flowing.

Lucrative sign up bonuses

-

- You’re going to pay your taxes anyways so the processing fee could buy you a stack of points

- ex: Capital One Venture X

- Spend $4k in 3 months to get a 75k bonus… or roughly 81k points for less than $80 in fees.

- ex: Capital One Venture X

- You’re going to pay your taxes anyways so the processing fee could buy you a stack of points

Cash Back in excess of the processing fee

-

- Yes, if you can earn more than the processing fee in cash back, you can effectively turn paying your taxes into an arbitrage situation.

- Example: You carry both a Chase Sapphire Reserve® and a Chase Freedom Unlimited® and have a $10k tax bill

- You could charge $10k on the Chase Freedom Unlimited earning you 15,000 Ultimate Rewards for a $199 fee; however, you could combine those into your Chase Sapphire Reserve account and redeem them for $225 worth of travel in Chase Travel

- Example: You carry both a Chase Sapphire Reserve® and a Chase Freedom Unlimited® and have a $10k tax bill

- The Citi Double Cash offers 2% back on all charges and the points could be combined with a Citi Thank You Premier for great travel partner redemptions

- Capital One Venture X earns 2x on all purchases…

- Yes, if you can earn more than the processing fee in cash back, you can effectively turn paying your taxes into an arbitrage situation.

Earning Elite Status, elite nights, or free nights.

-

- Several credit card have spend thresholds that give Elite Nights, Elite Miles, etc – here are a few examples where spend can help you reach Elite status

- Credit Card spend earns Loyalty Points with American Airlines now…this could help push you over the top

- Ritz Platinum status after $75k on Chase Ritz Card ( Get Marriott Plat and SPG Plat)

- Hilton cards offer free nights after spending $15k in a year

- Hyatt cards offer free nights after $15k spend, or 2 elite nights after $5k spend.

- The Delta cards boost status based on spend

- Several credit card have spend thresholds that give Elite Nights, Elite Miles, etc – here are a few examples where spend can help you reach Elite status

American Express Business Platinum purchases in excess of $5k

-

- You get a 50% bonus on purchases over $5k when you use your American Express Business Platinum

- When you use your Amex Points in Amex Travel on your selected airline, OR on premium airline tickets you get a 35% refund on your points – this equates to a 1.55 c redemption rates

- $10k tax bill would cost you roughly $199 in fees but earn 15000 Amex Points. These points would be worth $232.50 in Amex Travel if you use them on your selected airline or premium cabin ticket.

American Express Blue Business Plus

- This beauty gets 2x on all purchases up to $50k a year

- I personally value Amex points around 2c so this is a nice arbitrage sitch as I would value it

- If you carry an Amex Business Platinum you could redeem those points as mentioned above in Amex Travel for premium flights or with your preferred airline for 1.55c a piece, or 3.1c per dollar spent on taxes.

PayPal is a category bonus

-

- We have seen periods of time where PayPal has triggered category bonuses on certain cards. Most recently, this was the Chase Freedom Flex(SM) and it earned 5x points or 5% cashback on up to $1500 spend. This is a clear arbitrage situation PayUSATax allows PayPal payments

Capital One Venture X or Capital One Venture Rewards

- Unlimited 2x points and has quickly become one of my go to cards on all non-category spend

- If you value Capital One Miles at just a penny a piece, you’re still getting a return in excess of the credit card processing fee.

So should you pay your Taxes with a credit card?

One of the biggest questions I always get is in regards to hitting minimum spend requirements to get a wave of points. Personally, I think if this is a problem you’re navigating, paying your taxes with a credit is a surefire way to solve it for a fee. With that said, paying your taxes with a credit card isn’t something you should do just because you can earn points on it, and should only be done when the reward is greater than the cost.

Once you’ve paid you should get a receipt from the payment processor, but you can go here to verify the payment was received and documented by the IRS.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.