This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

What Factors determine your credit score?

Each Monday Miles has decided to drop a tip, hint, tutorial, trick that maybe you’ve missed or haven’t heard before. If you’re an expert in this field, some of these may be things you already know, but there are a lot of beginners out there who are just getting their feet wet. This week the Monkey Miles Monday Memo: What factors determine your credit score?

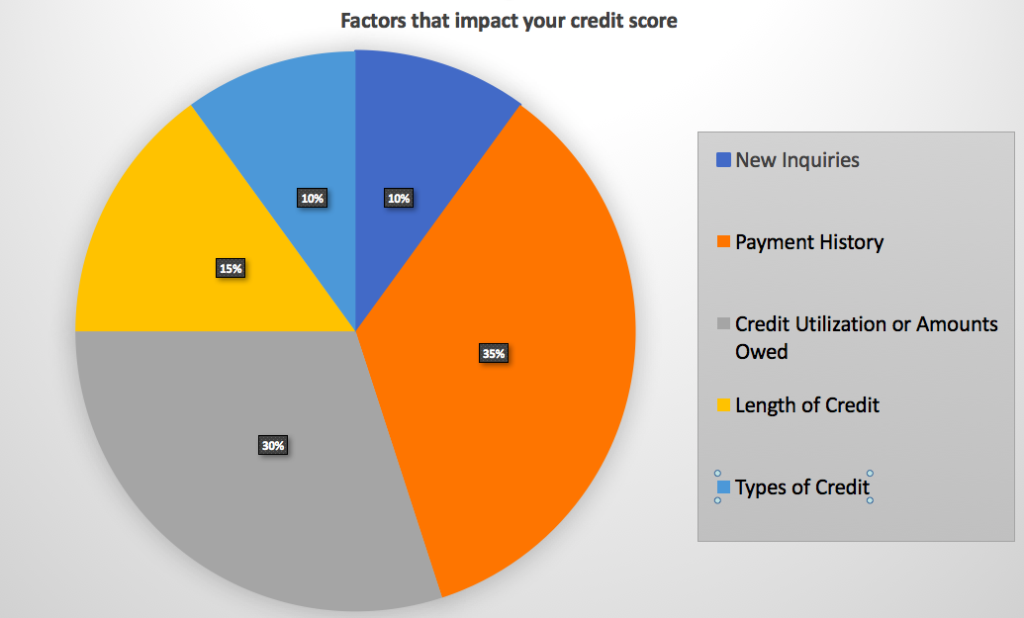

5 Factors determine your credit score

- New Inquiries

- Payment History

- Utilization

- Length of Credit ( average age of card accounts)

- Types of Credit

These different factors affect your credit score in different ways

New Inquiries have little impact

These are hard inquiries where they pull your score from an agency. Depending on where you live, a different agency provides your report. My experience has been that a new inquiry drops your score about 3-5 points. My score typically pops back within 3 months. They drop off your report after 2 years.

Payment History and Utilization are big time factors

Simply put this means:

- Have you paid your bills on time?

- How much of all the credit available to you do you use?

As you can see from the table above these two factors account for roughly 2/3 of your score. THAT IS MASSIVE. It makes sense though when you think about it. Credit card Issuers want to know that you’re going to pay your bills, and keep an eye on the amount of your credit you’re using. If you’re racking up debt, the odds increase that you won’t be able to pay it off even if you’re paying those bills on time. If you’re wondering how utilization affects your credit in just one month…check out my story. Hint…it was dramatic.

Types of Credit has little impact

Have you had a car loan? Apartment Lease? Auto Lease? Home Loan? Credit cards? The more and different types of credit that has been extended to you and paid off, the better your score will be. Makes sense, right? Lenders want to see proof that you’re a reliable borrower.

Length of Credit has medium impact

How long have you been a borrower? Add up all of your account ages and divide by the number of accounts. That’s your average length of credit. This is the biggest reason you should keep a couple no fee cards open. This will help you ‘average age’ or your ‘length of credit.’ JSYK Accounts that have been cancelled stay on your history for 10 years.

FYI…I use CreditKarma to keep an eye on mine. As you can see from the Featured Image…Miles LOOOOOOVES his cards. He’s earned Millions this way 😉

*Keep your credit healthy and don’t overextend yourself. Points are interesting, but not worth the interest.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.