This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Beginner’s Guide: Always charge to the hotel room to maximize point earn

If you’re an expert in points and miles then you probably know some of these tricks, but there are a lot of beginners out there who are just getting their feet wet. The beginner series is designed to help out those who are new to the space and looking to hone their travel skills – they’re also meant to be helpful reminders to all the travel experts. In this brief post we explain how charging everything you spend at a hotel, resort, or partner property can earn you loads more points.

When you charge to the hotel room, you can earn hotel and credit card points.

Hotel programs give you points not only the price of the room, but for qualified purchases put on the room. So when you grab a coffee at the cafe downstairs…don’t throw a couple singles down – put it on the room. Dinner? Throw it on the room. This way you’re earning as many hotel points as possible, and then when you pay to check out, you’ll earn points on your credit card as well. Make sure that you’re charging hotel stays on the card you have that has a hotel category bonus.

A Great Vegas Example with Hyatt that you may not know about…

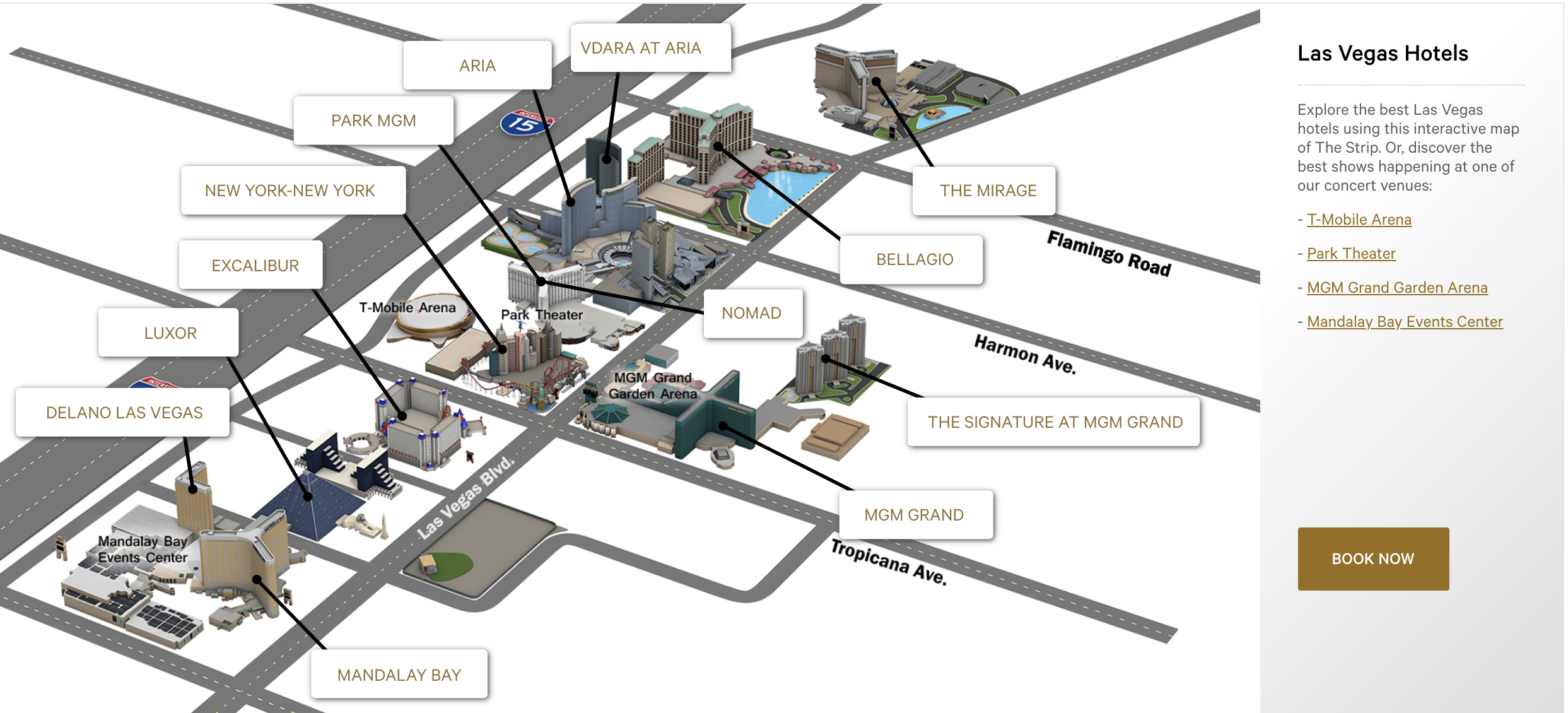

Hyatt and MGM have an agreement whereby you can earn status and points at their resorts, but did you know that you can charge at any hotel within the group to your mother hotel room…it provides a HUGE opportunity to earn points. Here’s a look at all of the MGM Resorts in Las Vegas ( check the list I provide down below for the participating properties ).

You’re staying at the MGM Grand

If you’re staying at MGM GRAND and go to dinner at BELLAGIO, you can charge that dinner to your MGM Grand hotel room. That’s fantastic. Or if you pop bottles and make it rain…think of all the points you can earn on your Dom P. Hitting up brunch to eat your body weight in mimosas and pancakes? CHARGE IT TO THE ROOM! Just remember that incidental purchases are limited limited to $5k on each stay for WOH points.

Eligible Incidental Spend:

Can I earn World of Hyatt points on M life Rewards-Eligible Incidental Spend even if my stay is ineligible?

- Yes, you may charge your M life Rewards-Eligible Incidental Spend to your room folio and earn World of Hyatt points, on up to $5,000 of M life Rewards-Eligible Incidental Spend even if your stay does not qualify as an M life Rewards-Eligible Night.

What is eligible spend?

- Mlife Rewards-Eligible Room Spend is room rate spend on M life Rewards-Eligible Nights.

- M life Rewards-Eligible Incidental Spend means any incidental charges charged directly to the member’s room/guest folio during a stay at a participating M life Rewards destination. Casino charges, taxes, gratuities, and charges at any retail location within an M life Rewards destination are not M life Rewards-Eligible Incidental Spend. Members may receive World of Hyatt points on M life Rewards-Eligible Incidental Spend, regardless of whether their stay at the participating M life Rewards destination satisfies the definition of an M life Rewards-Eligible Night.

Here’s a list of MGM properties that are partnered with World of Hyatt.

- Bellagio®

- ARIA™

- Vdara™

- MGM Grand®

- The Signature at MGM Grand®

- Mandalay Bay®

- Delano Las Vegas

- Park MGM™

- NoMad Las Vegas®

- The Mirage®

- Monte Carlo™

- New York New York™

- Luxor®

- Excalibur®

When you check out…Throw your best travel rewards card down.

All of that eligible spend will earn you your Hyatt points, but when you pay the bill, you’ll earn credit card points. I end up putting a lot of my business travel spend on my Chase Ink Business Preferred because it earns be 3x points on every dollar I spend.

Beware..

You’ll also see exactly how much you’ve spent at once…which means you may need some st john’s wort nearby to boost your spirits. Or a shot of Don Julio…pick your poison.

Stacking VIP programs…

If you’re unfamiliar with hotel VIP programs I’d strongly suggest you read our comprehensive article on all hotel VIP programs. Not only will you be treated like a VIP, you’ll be paying the normal rack rate but have a ton of added benefits. Most include room upgrades, breakfast, and even a resort credit.

A list of all the Secret VIP Hotel programs you should be using

A few of the hotels up above are part of the Amex FHR program, but I want to note that Amex Prepaid hotels aren’t yielding WOH elite nights or points and may not qualify for other hotel programs either since they are prepaid. Only the purchases made to the hotel property are counting. So, if you make one of these Amex FHR reservations, and you want to earn WOH points and elite nights which I’d highly suggest, don’t prepay and instead book a room that you pay in full at check out. If you’d be

Here’s the difference in points you’d earn

It would look something like this:

$1000 eligible hotel purchases

- Pay with Amex Green – get 3x or 3000 Amex Points

- Credit to World of Hyatt – get 5x or 5000 Wold of Hyatt points

I hope this helps!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Learn More

Learn More

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.