This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How points helped me plan a surprise trip

Recently I planned a surprise trip to Austin, Texas for my girlfriend’s birthday. It was a little tricky planning because I wasn’t sure what sort of flexibility she would have and I didn’t want her to have any idea where we were going until we were at the gate. This required finding loyalty programs that would allow me to adjust my plans all the way up til the last minute. The trickiest part was the flights. Most hotels will allow you to cancel up to 24 hours in advance. Had I tried to pay outright for the trip it would have been extremely expensive because of the change fees that would have been imposed. Here’s how points helped me plan a surprise trip, and hopefully help you plan as well.

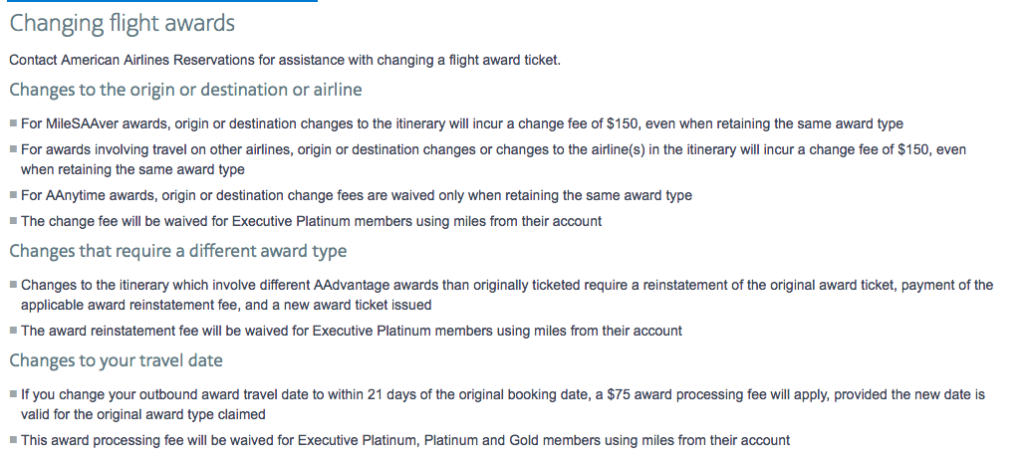

AA allows you to change award tickets without fee – byaw!

This is huge advantage ( no pun intended) in planning a trip like this. As long as saver availability is showing up, your origin and destination stay the same, you can change your tickets. You’ll have to pay any difference in taxes and fees if you end up changing airlines, but for me, I was flying American metal so that wasn’t a concern of mine. The trip got changed a couple of times as her schedule changed. This saved me SOME DOUGH. Every AA change is $200 per ticket and the difference in fare.

My Barclay Aviator saved me 7500 miles per ticket and 10% back.

Traditionally two saver tickets would cost 12,500 each way per person…or 50k total. However, if you carry one of the premium branded AA cards from Barclay or Citi you qualify for discount award tickets: up to 7500 roundtrip. In addition to this discount, the card gives you a 10% rebate on points used. This means I actually paid 31,500 for both flights with great flexibility

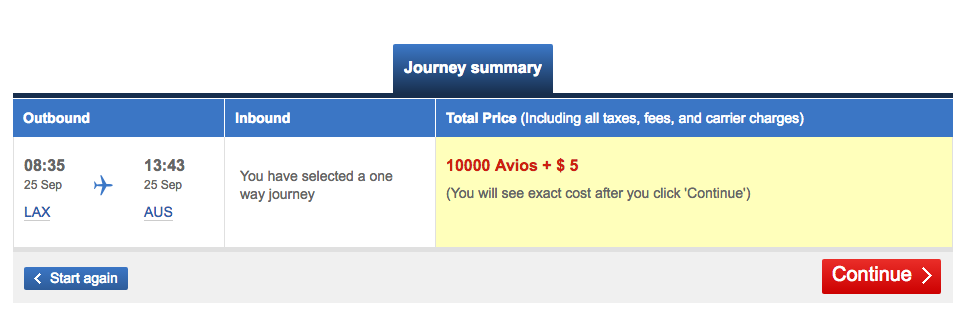

Avios are a great backup.

Not only are American Aadvantage tickets very flexible, but you can book and cancel Avios tickets up to 24 hours in advance and only pay the lesser of the initial booking fee or the “change and service fee = $55 and $25, respectively.” For AA tickets booked online, it’s $5.60. This means you can change these tickets and only lose the $5.60 not the $80 it would cost you over the phone. YUGE YUGE YUGE

These tickets are booked with a distance based chart and would have cost 20k r/t from LAX to AUS. I recommend using Wandering Aramean’s Avios calculator. I have a much larger cache of AA than Avios, and it cost me fewer miles, so I chose to use AA vs Avios.

*Don’t forget that you can transfer Chase Ultimate Rewards and Amex MR into BA’s loyalty program.

I used Hyatt cash + points and my IHG credit card free night cert

I wanted to stay at the Driskill and thought it would be a really cool experience. It’s the oldest hotel in Austin, luxurious, and part of the Unbound Collection, of which I haven’t tried yet. I have a review in process, and IT WAS A CRAZY NIGHT…one might even say paranormal – but it proved to be a great use of points and cash. 10,000 points and $125.

and then also the Intercontinental Austin – which was free cause of my IHG Chase card

The hotels are centrally located, literally across the street from one another, and I thought would provide a fun way to hop the city for a couple nights. Because of the IHG credit card it cost me nothing.

By using points, keeping the right credit cards, and knowing the system, I flew two people to Austin, stayed in fabulous hotels, and the upfront cost was $136 + points.

There is more to the story because we left the Driskill in the middle of the night and ultimately stayed in 3 hotels in two nights, but that’s for another post.( We went to the JW Marriott which was amazing ) Yes…there was some weird stuff happening at the Driskill, but I would still recommend the hotel to anyone going through Austin.

The point is that you can do really fun and cool things for the ones you love and do it for an incredible price

The tickets to Austin were over $500 a ticket when they were finalized and the hotels were nearly $300 a night. Easily saved over a grand.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.