We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

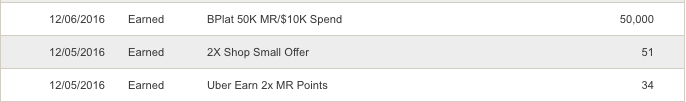

I received my 50k bonus points for the Amex Business Platinum Upgrade

Ordinarily this wouldn’t really warrant a post because it would be standard practice to receive bonus points if offered them for an upgrade. However, my sitch was a bit different. I already had an Amex Business Platinum when I received an offer to upgrade my Amex Business Gold. This meant I would be maintaining 2 Business Platinums for the same business. This seemed to be in conflict with Amex’s policies and I just didn’t know what this would mean in relation to their “once in a lifetime” bonus clause. My original post got some feedback that other people were in the same sitch and would appreciate it if I’d keep them abreast of my bonus situation. I got them! BYAHHHHHHHHHH So if you were/are in a similar situation as I – Everything looks GREAT!

The text to my original post:

Upgrade to Amex Business Platinum and get 50k bonus points

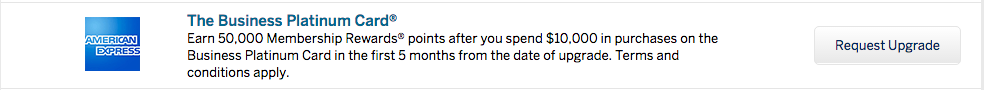

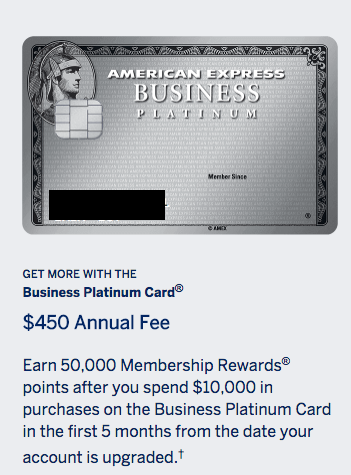

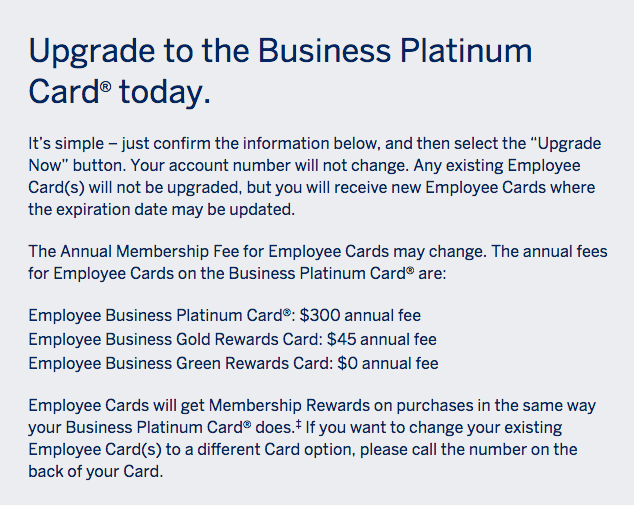

Well isn’t this just DANDY! I logged into my Amex account this morning and was met with a great upgrade offer: Upgrade to Amex Business Platinum and get 50k bonus points. I’d recently written an article that said that Amex needed to respond to the Chase Sapphire Reserve with Vigor. I’d say that this is a good start! I received 75k bonus points when I signed up for the Amex Business Gold card roughly 2 years ago. I also received a 15k retention bonus. This would make my total bonus 140k. That’s is insane! I have until October 5th to make a decision, but this is very tempting and requires some investigation into the terms and conditions. In fact, the min spend of 10k over 5 months isn’t even that crazy!

I already have an Amex business Platinum card. For the same business.

Currently, I have both the Gold and Platinum versions of the Amex business card. I wasn’t aware you could maintain two accounts of the same product for the same business. Now, I could apply for the same product for a different business, or a different product for the same business, but I didn’t think I could concurrently hold the same product for the same business. If I decided to go forward I’ll have to clarify this, or cancel my other card before upgrading my Gold to Platinum. The other question is how does this relate to the Once in a Lifetime clause?

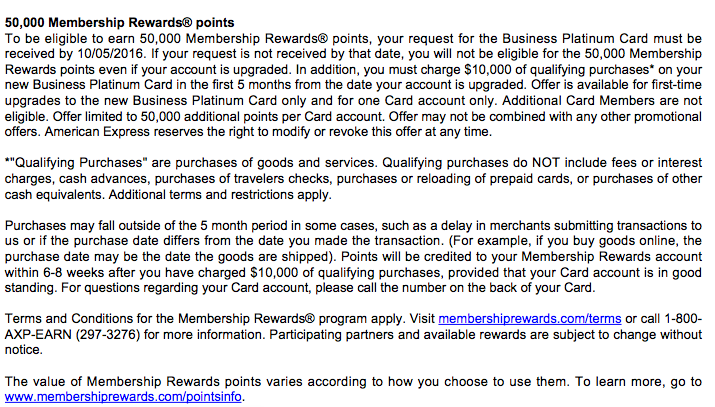

Looking at the terms of the card it appears I can receive points even if I’ve had the product

I don’t see anything listed in the terms that excludes prior or current holders of the Business Platinum Card from earning the bonus points. This is amazing!

I would assume this would qualify for Once in a Lifetime if you’ve never had the product

American Express still has a clause on their sign up bonus terms that states terms limiting a sign up bonus to once in a cardholder’s lifetime.

In my situation, since I already have a Biz Plat, my main concern is whether I qualify for the bonus points at all, or if the Once in a Lifetime clause will negate my eligibility. The other thing to consider is if you are presented with this offer and have not had an Business Platinum card before then this would effectively be your sign up bonus. After upgrading you will have had the card and records will reflect this fact and negate your potential of signing up for higher bonuses due to Once in a Lifetime. I received a 100k sign up bonus for my business platinum card, so there are higher bonuses to be had. My mom received 150k!

What is the true cost of the upgrade?

Currently I have no additional employee cards and I pay an annual fee of $175. I earn 3x points on Travel and 2x points on gas, advertising, computer purchases, and shipping. Primarily I buy gas and flights with the card, but I don’t earn anywhere close to enough in my bonus categories to offset 50k points to upgrade. The fee difference is $450 vs $175 or $275.

But what do I get for $275?

- 50,000 bonus points = valued at just $0.015 per point that’s worth a $750

- $200 annual airline fee reimbursement – I’d qualify twice for this – that’s $400

- The airline reimbursement is per calendar year vs the cardmember year of which the annual fee is based.

- If you buy AA gift cards you actually get reimbursed as of when this article is published

- Global Entry fee reimbursement – worth $100

- I already have so it’s moot.

- Priority Pass Select membership – worth ~ $400

- I have a Citi Prestige so this is moot.

- Delta Sky Club lounge access – when flying on Delta

- Centurion Lounge access – network expanding and very worthwhile

- Access to Fine Hotels and Resorts

- Amazing benefits such as free breakfast, resort credits, room upgrades, early check in, late check out, etc

- Lately I’ve been using Virtuoso and Citi buy 3get1 but this is still of some value.

- Over 20 transfer partners: like Singapore Air, Air Canada, Air France, British Airways

- I love the transfers to Sing and Air Canada

- SPG gold status

- Hilton Honors gold status

- Boingo free wi-fi at more than 1,000,000 hotspots around the globe

- The Hotel selection

- slightly different that Fine Hotels and Resorts, but provides great benefits, credits, and upgrades

- Return protection on goods a store won’t take back, you get reimbursement up to $1000/year $300/item

- 10 Free GOGO in flight WIFI passes. Per Year

- Valued at just $10/piece this is another $200

I’d be most excited for 50k, 20 GOGO passes, $400 AA fee credit, and Centurion lounge access

That right there is worth:

- 50k: $750

- 20 GOGO: $200

- Airline fee credit: $400

- Centurion Lounge access…who knows

At the very least I’m getting $1350 in return plus Centurion lounge access for an extra $275. Not a bad deal at all. If they don’t give me the 50k bonus points I’m getting a fresh 10 GOGO and a new $200 airline fee credit. That’s worth over $400 right there. It’s a net positive to me regardless I’d say. The whole question is whether the 10k in 5 months is tenable. I’ll be having a deep think on this one and making a decision by October 5th for sure!

Make sure you check your Amex offers when you log into your account. There’s always something in there that has value to me. And who knows, you may get an outstanding upgrade offer like me!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.