This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Which Credit Bureau will be used to pull your credit report?

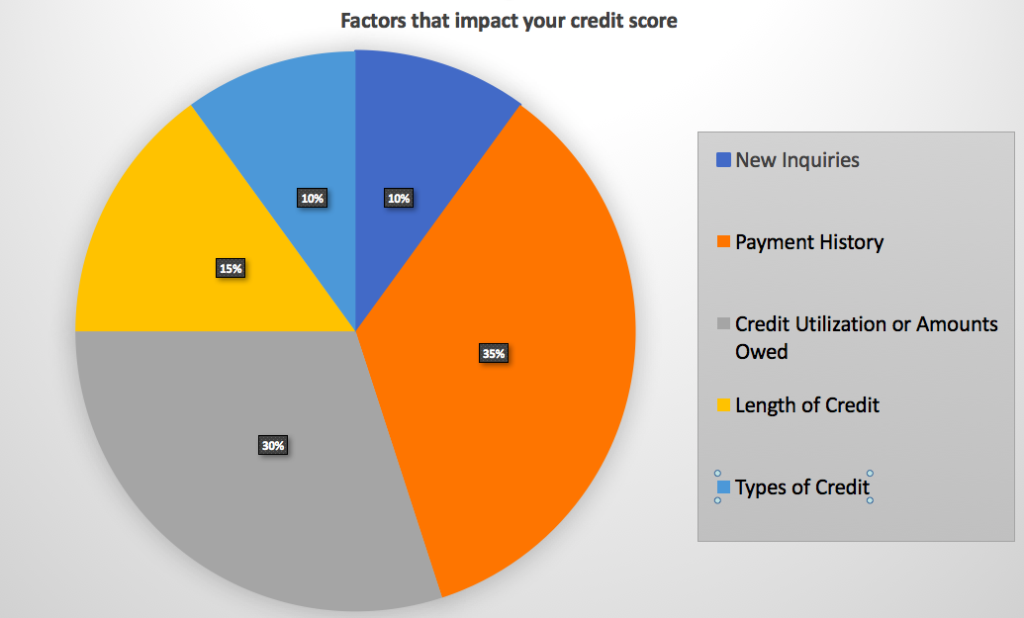

I recently wrote a Monkey Miles Monday Memo that illustrated the 5 factors that impact your credit score. You will have a different score from each of the 3 major credit bureaus: Transunion, Equifax, and Experian. You may wonder why each credit bureau has a different score for you? That’s a great question. While each bureau will have it’s own specific metrics, one of the biggest factors is how often a report is pulled – this impacts your “recent inquiries” number. This pull is referred to as a “hard pull.” and each hard pull drops your score. This is why people will try and combine inquiries or apply more than once on a day: an app-o-rama if you will 😉 When you apply for a credit card, loan, lease, etc the lender will pull a report from one of those 3 bureaus, but which one? I use a resource page that is full of anecdotal, wiki-style, information to see just which bureau will be used to generate a report. How to find which credit bureau will be used to pull your credit report.

A quick reminder: the 5 factors

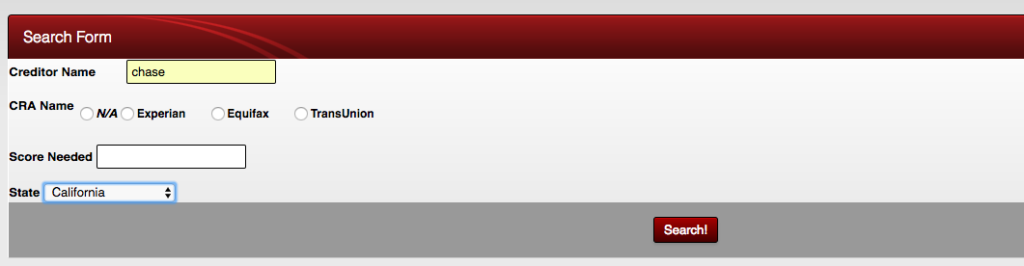

I use Creditboards “pull database “

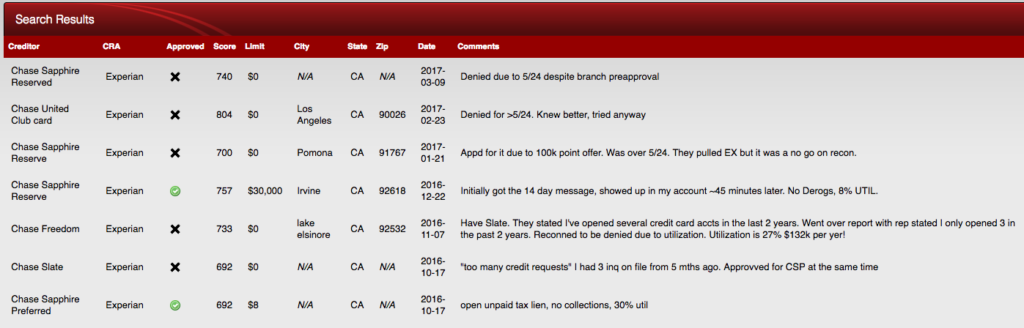

I recently applied for the Chase Sapphire Reserve, in branch, despite being at 6/24. You can read about my entire experience, but I got denied. My report was pulled from Experian. I knew this would be the case because I searched creditboards ahead of time and saw these results.

Credit boards search engine

What you’ll see are the results for my specific state and the creditor

- Creditor

- Zip

- Date

- approved or denied

- limit

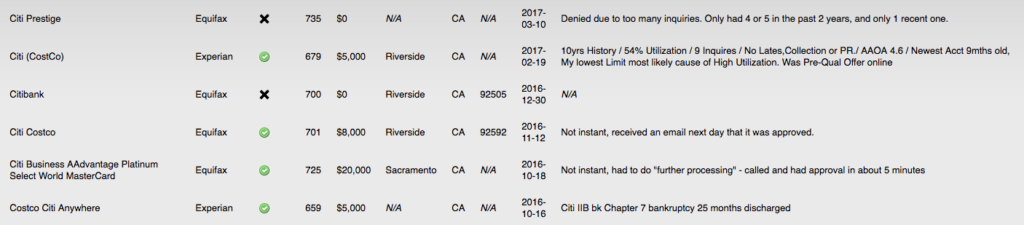

Here’s a look at Citi:

slightly different results and looks to vary between city/zip code

Hope this helps!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.