This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

3 more days to buy Alaska Air Miles with up to a 50% bonus

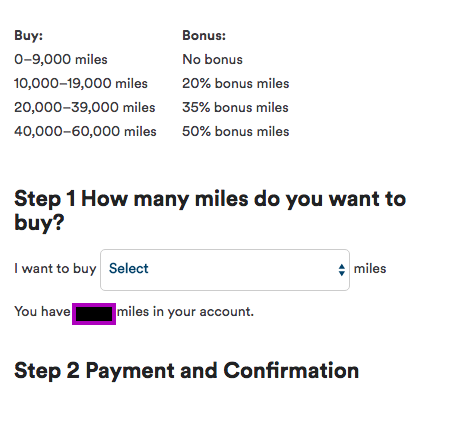

Basically, the sales pitch is it’s a “mystery” how big your bonus will be when you purchase miles. The promotion runs three more days until September 29th, and if you are targeted for 50%, you are getting the best ever Alaska Air promotion. If you’re needing to shore up your balance to make that dream trip a reality, I’d say that this is a great time to do it. However, I wouldn’t advise just buying miles on speculation…you never know what will happen – like a huge Emirates deval. Here’s a look at the promotion where you can buy Alaska Air miles with up to a 50% bonus.

The MYSTERY will sooooooon be revealed!

Here is the email that you will receive. It’s not until you click on the link that you will be prompted to enter your Alaska Air information and…

BAM! We scored 50% BYAW BYAW BYAW

I made great use of this bonus earlier in the promotion to nab some miles to aid the planning of a baller trip early next year.

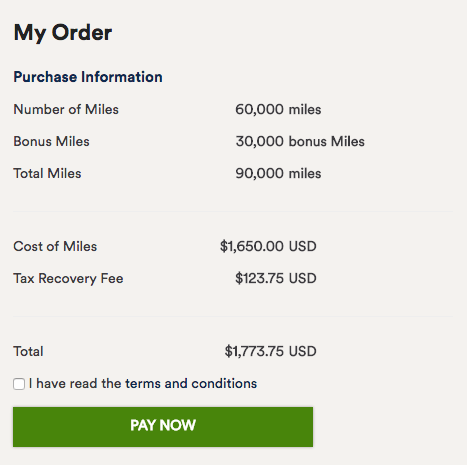

Including taxes the deal comes to 1.97 cents per mile.

However, if you were to use these points on travel on foreign partners you should be able to recoup the taxes at the end of the year. Gary Leff wrote an article on this which you can find here. For me, I’m looking to redeem my miles on foreign carriers, namely Cathay Pacific or Japan Airlines ( once their flights become avail to Alaska ), on business or first class flights to Asia: 50k or 70k, respectively. If we remove taxes from the valuation, we’re looking at just over 1.8 cents per mile. At that valuation, I’m buying a one way business class flight to Asia on Cathay for $900. That is a SICK value.

Removing taxes I’d be paying $900 for a one way flight to Asia on Cathay:

That ain’t shabby folks. You can see my review of Cathay Pacific business class here. It’s a great product featuring reverse herringbone seats that lie flat. They also serve Johnnie Walker Gold…which is a great blended scotch. B-YAW!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.