This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Here’s a hint: Freedom is offering 5x points this quarter.

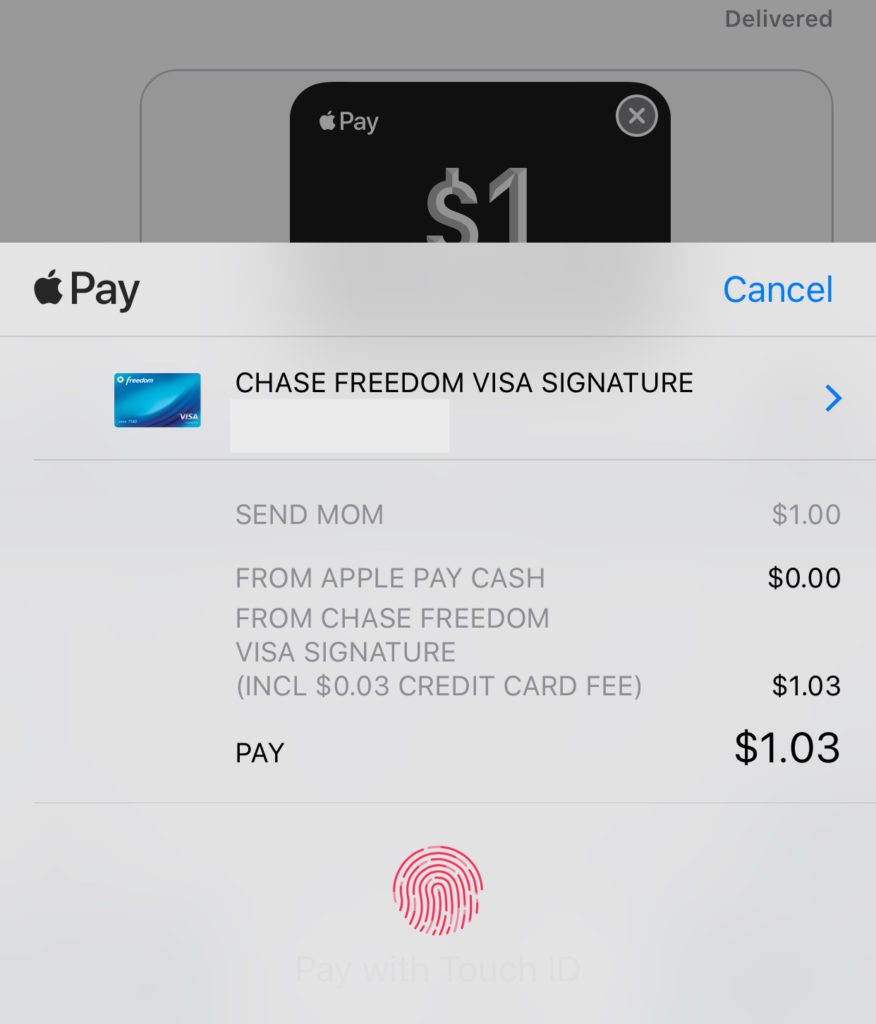

I bet some of you have already utilized this little trick, but I thought I’d highlight as we are about halfway through the 1st quarter. Chase Freedom will give you 5x points when you use Apple Pay to purchase any good or service. Did you know that you can actually pay your friends with Apple Pay? You’ll get hit with a 3% fee to do so, but you can charge it to your credit credit card if it’s registered to Apple Pay. This is a great way to pay your room-mate for rent, or if a group goes out to dinner to pay your part of the bill. Obviously, if you can hit the $1500 max per quarter with traditional payments and avoid the 3% fee it’s better, but this opens up another avenue to profitably maximize the quarterly bonus.

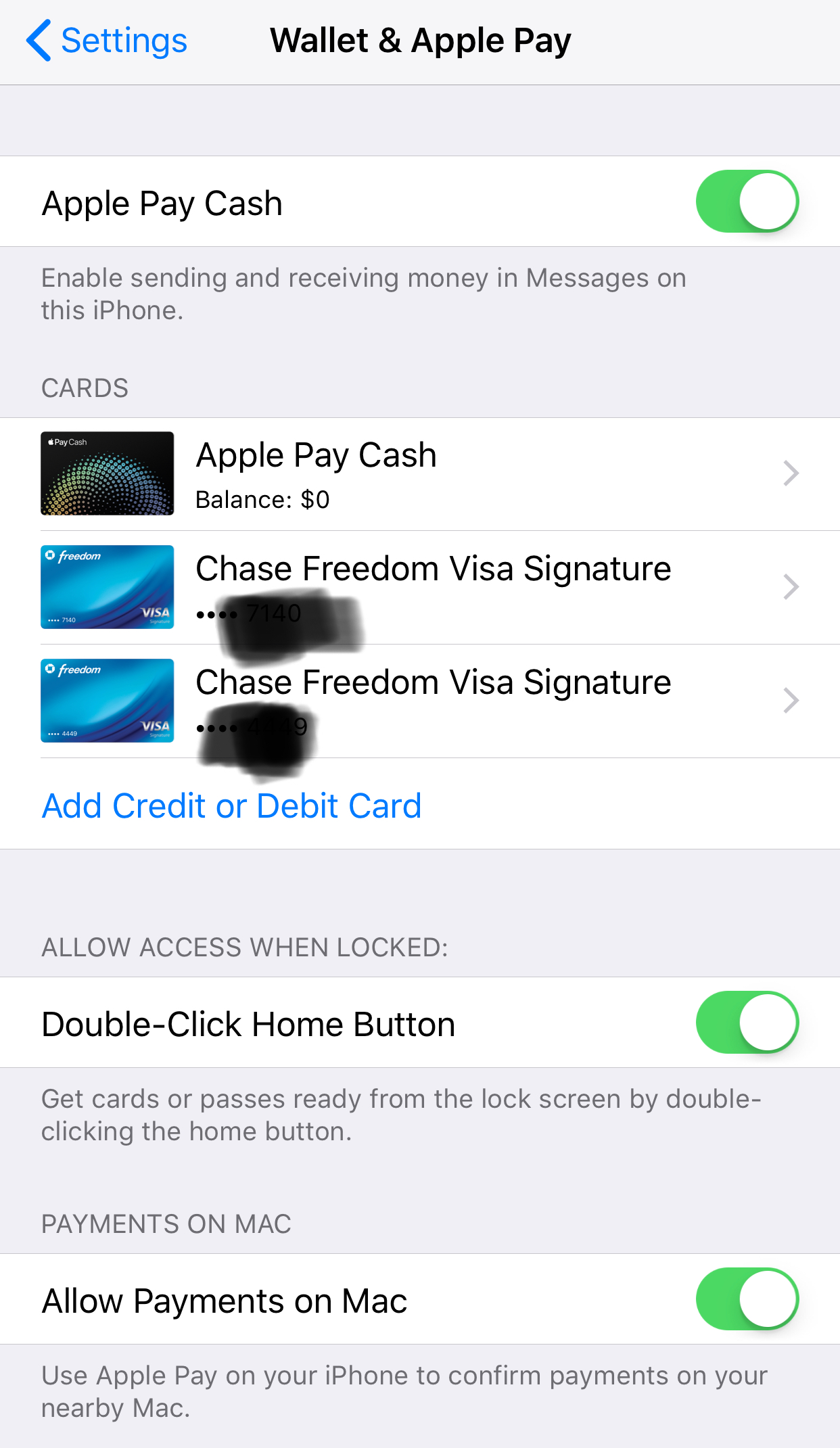

Make sure your Apple Pay Cash is turned on.

You can access it via “Settings” —-> “Wallet & Apple Pay.” You’ll see the cards you have registered.

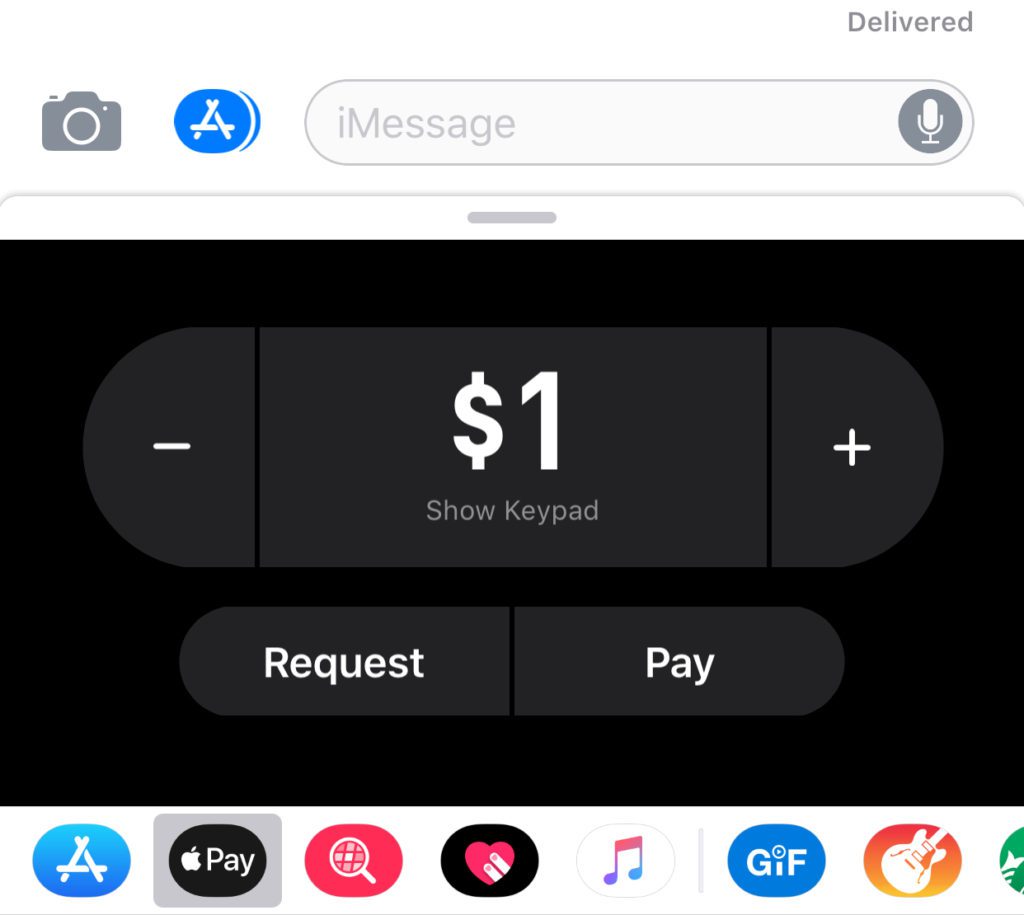

When you want to pay someone, just select Apple Pay at the bottom of an iMessage, and follow the instructions.

As you can see, you’re given the option to pick one of your accounts. Then, you’ll see the 3% fee added on.

I have 2 Freedoms, which gives me the opportunity to earn 15k this quarter. Combine that with the 15k I earned at Walmart in Q4, 2017 – I’m well on my way to flying like this again. Just 65k on Singapore Airlines.

Swiss Business Class Throne Seat.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.