This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

5000 point bonus with Citi Thank You Premier

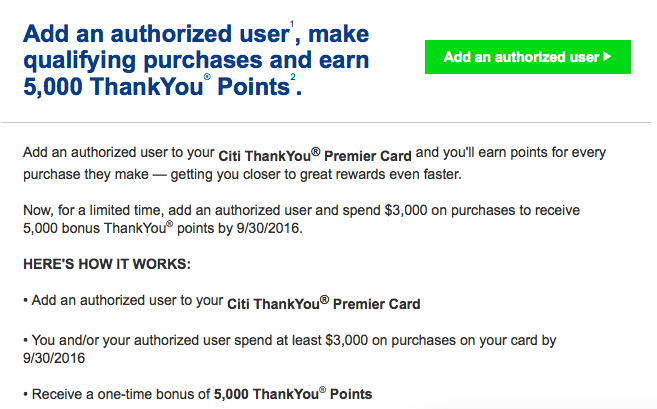

Over the weekend I received a targeted offer for my Citi Thank You Premier card. The offer would grant me 5000 TY points after I added an authorized user and spent more than $3000 combined by September 30th. I’m not exactly eager to sign up for this offer. I’m really on the fence with keeping this card, but haven’t signed up for a Citi Prestige card quite yet, which means I need to transfer my points or lose them. I don’t have THAT many TY left and I’m tempted to transfer all of them out to Singapore for a couple trips I have planned in the next year.

I Do love my Thank You Premier card. Why? Incredible transfer partners = Fly like a BALLER

- Hilton

- Cathay Pacific ( One World )

- Eva ( Star Alliance )

- Etihad ( Non-alliance: American, Air France, Garuda, Korean, etc Full List )

- Air France ( Sky Team )

- Garuda ( Sky Team )

- Malaysia ( One World )

- Qantas ( One World )

- Qatar ( One World )

- Singapore ( Star Alliance )

- Thai ( Star Alliance )

- Virgin Atlantic ( Sky Team )

These Transfer partners are the biggest reason I signed up in the first place.

These partners give great access to the 3 major airline alliances: Star Alliance, Sky Team, and One World. Having the ability to now use a Citi Card that accumulates points that can transfer into these various airlines gives me the ability to top up accounts by transferring Thank You points in addition to Amex Membership Rewards, and Chase Ultimate Rewards. These are 3 of the 4 best flexible currency programs (Award Programs that allow you to transfer into partner programs.) Meaning, my flexible currency account balances can grow faster through sign up bonuses and I can travel on their partner programs more often by transferring smaller amounts from each flexible account. This strategy keeps more points in flexible currencies rather than having to empty out those accounts for an award redemption. Let’s take a look an an example of what I’m referring to.

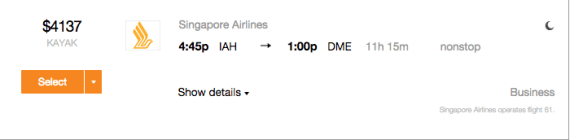

I want to take a trip to Russia later this year…I want to fly Singapore Airlines Business or First. Well…who doesn’t?! I actually wanted to take this trip last year, but things didn’t work out.

Clearly I wouldn’t be paying cash for this trip. But both of these are very attainable with just ONE sign up!

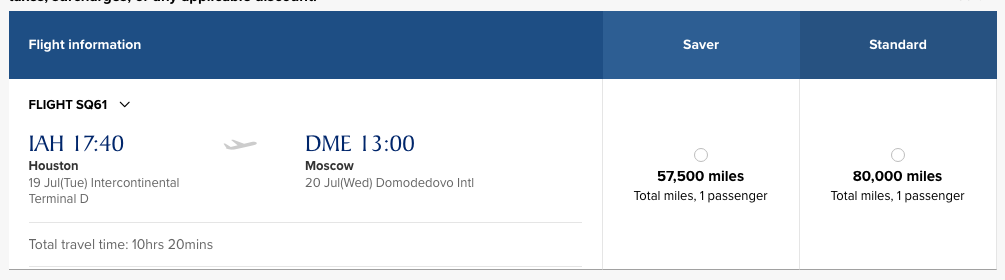

Singapore is a transfer partner of Citi Thank You, Chase Ultimate Rewards, and American Express Membership Rewards. I have balances in all three accounts. Cha-Ching. You can also transfer from SPG…I just don’t have any.

Taking the flight in business (discount 15% for online bookings) is 48,875 points.

And here is what I will be flying! Not. Bad.

The Thank You Premier card has been good to me…but I’d love a big fat Prestige bonus too.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.