This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

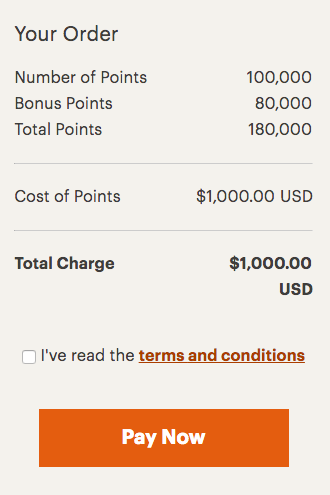

IHG is running another promotion whereby you can purchase IHG points with an 80% bonus. They’ve also increased the amount you can buy in a year to 100k, meaning you could get 180k bonus points for $1000. If you have signed up and carry the brand spankin’ new IHG Premier card from Chase you also qualify for a 20% discount on purchased points…meaning that 180k would set you back $800. That’s a phenom deal, especially when you consider that the card comes with a 4th night free when you book with points. Let’s take a look at this deal.

The max has increased to 100k points.

The current promo that effectively values IHG points at $0.0055 per point. Or $0.0044 if you carry the IHG Premier

If you max out the deal…

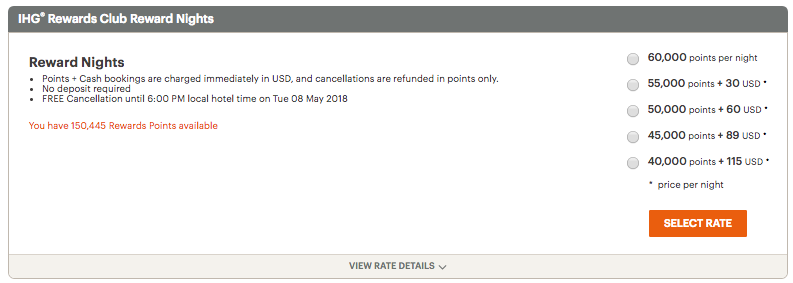

I just completed a stay at the Intercontinental Sydney. A great redemption at 60k points a night.

If you carry the IHG Premier, you could purchase 180k points for $800 and redeem them for a 4 night stay overlooking the Sydney Opera House. 4 nights in a great hotel in the heart of Sydney for $200 a night is a great deal.

If you’re interested…you can buy here

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.