This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

This hasn’t been AA’s week.

Rumor 1 – AA Executive Platinum devaluation

As noted by Matthew at Live and Let’s Fly rumors started to circulate that AA may be contemplating limiting System Wide Upgrades redemption to just the account holder, and anyone flying with them. That’s a big hit to AA’s “top tier” Executive Platinum status. I’m no longer Executive Platinum, but when I was one of the great perks was the ability to upgrade someone who wasn’t traveling with you, and let them enjoy the amazing comforts of the next cabin up. If this new limitation was enacted you’d only be able to do it when everyone is on the same itinerary as the status holder.

Currently AA awards its EPs with 4 System Wide Upgrades that allow a confirmed upgrade to the next level of service on any of their flights worldwide ( hence System Wide ), and these can be used on anyone whose itinerary the status holder attaches the certificate to, and has upgrade space available. AA is already on the low side with these certs ( which used to be 8 back in 2016 ), and if you compared them to United, which awards 6 Regional Upgarde certs and 6 Worldwide to their 1ks, it’s crazy to me that they’d devalue even more.

Rumor 2 – AA is losing Etihad to United in March ( maybe Star Alliance? )

I saw this via VFTW earlier this morning and he has an excellent article on it, as well as a link to his prediction this would occur over 6 months ago. If it happens, it’s a MASSIVE win for United and if there is any credence to Rumor 1, this puts United clearly in the top position for US legacy carriers: Best award redemption partners, ability to transfer from Chase, and best benefits for their 1ks in comparison to Delta and AA.

AA has systematically gutted its program since the time of its merger with US Airways in 2015. The biggest to me: Am I missing something glaringly obvious? Lemme know.

- Moving away from a Mileage based program to Revenue

- Gutting the award chart ( from ’16 to ’17 we saw rates in First Class to Asia skyrocket form 67.5k to 110k )

- Instituting a spend requirement for status

- Dropping SWUs for Executive Platinums from 8 to 4

- Heavily marrying segments

What to do? If you wanna do Etihad with AA miles…book now

Worst case this is just a rumor ( but it sounds pretttttttty likely ) and you’ll incur a cancellation fee if you don’t want to take the trip. However, do realize, if it is true and you booked with AA miles, you’ll likely not be able to change your trip dates.

If they join Star Alliance? How to redeem?

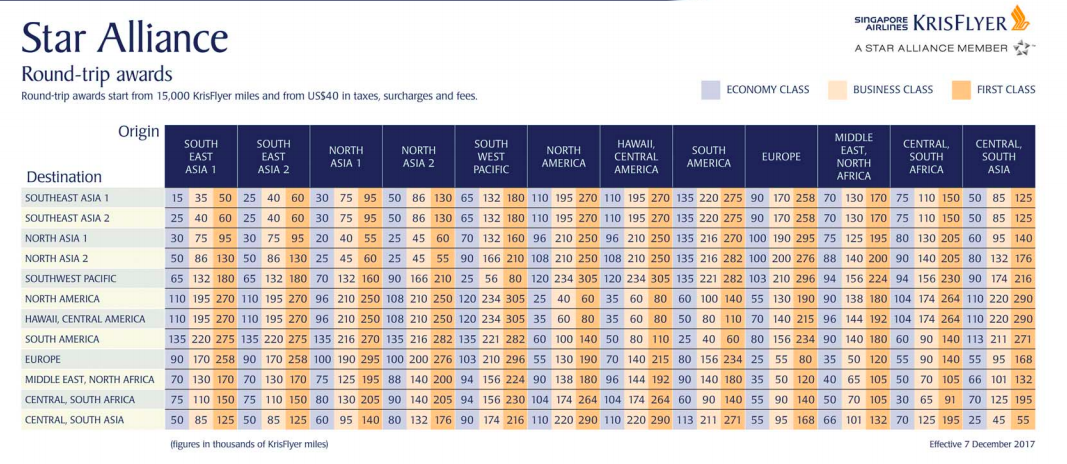

I wrote an article on this back in 2017, and while it isn’t quite the same stunner of a redemption…Singapore Airlines would be the best way to go. 90k ( 75k when I wrote the article ) one way for apartments, and 69k in the business studio. Don’t get too excited, there are many obstacles between the current situation and Etihad becoming a full fledged Star Alliance member, but…stranger things have happened. We can dream can’t we!

- United would be 140k

- Aeroplan 115k

- Avianca 97.5k

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.