This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

AARP 5 year membership for $55, but get up to $100 back.

For a limited time you can join AARP for $11 a year on a 5 year plan. This is an absolutely stellar deal if you join AARP via Rakuten – I save $10 a month on my AT&T plan, tons on British Airways tickets, and anyone can join as long as you’re over 18.

But, as you know I LOVE a good shopping portal, and you can save even more if you start your order via Rakuten. Heck, you could spend $55 on an AARP membership, get $50 back via Rakuten when you purchase a 5 year membership, and $50 when you join Rakuten.

If you want to stop reading…The order needs to go like this:

- Sign up for Rakuten with my referral to get $50 back after you spend $50

- Use Rakuten to sign up for AARP to get $50 back on 5 year plan.

- Link to Bilt if you want to earn Bilt Points

- Bilt is free to join and that link will also facilitate you joining Bilt if you aren’t a member

- Make sure your Rakuten and Bilt emails are the same

First off…you don’t have to be over 50 to join AARP

Let’s get this misnomer out of the way. I joined when I was 34 and it’s literally on their site.

The Black Friday AARP Membership for $11 a year for 5 years = $55

Currently AARP has a Black Friday Sale running, and during that sale, you can join AARP for $11 a year if you sign up for 5 years. That, in and of itself, is a wonderful deal since the normal rate is $20 a year, and first year deals often drop it to $15. Sometimes you’ll find 5 year deals for $70, so this is a savings on top of that.

- You can also add another member free of charge.

Rakuten got in on the mix, and just increased the offer – up to $50, 5000 Amex or Bilt Points

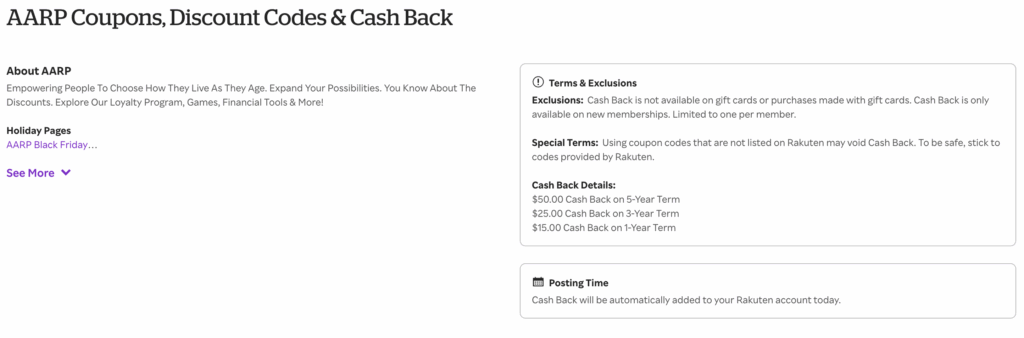

If you use Rakuten, and start your AARP order on their site, they will give you $34 cashback, or 3400 Amex/Bilt points, if you sign up for a 5 year plan.

You can see here that the Rakuten portal gives you a different cash-back/Amex points option on each term of membership you purchase. It needs to be the 5 year plan to trigger the full $50 back, and you need to spend $50 to get the $50.

Rakuten allows you to earn Amex or Bilt points – you just select how you want to be paid under your account settings. Effectively, once you’ve signed up for Rakuten, you can select either Cashback as a form of payment, American Express Membership Rewards, . I also choose Amex points since I value these at roughly 2 cents a point meaning I’m earning double the cashback in the form of Amex points. For every 1x of cashback you see listed on Rakuten you can convert that to mean 1 Amex Points.

Rakuten New Members get $50 after spending $50 = get paid $84 to join AARP

- Sign up for Rakuten with my referral to get $50 back after you spend $50

- Use Rakuten to sign up for AARP to get $50 back on 5 year plan.

- Link to Bilt if you want to earn Bilt Points

- Bilt is free to join and that link will also facilitate you joining Bilt if you aren’t a member

- Make sure your Rakuten and Bilt emails are the same

If you already have a Rakuten account you’d get this membership for $21 for 5 years ( $55-$34). If you don’t have a Rakuten account, you can use my link to sign up and get $50 back when you spend $50.

Note, some people, for some reason, aren’t able to code their accounts to earn Amex points on the first purchase. Others are able to do this, and I’m not really sure why…but keep that in mind since you may be bound to earning cashback.

How do I link my account to Bilt?

Link your Bilt account to Rakuten here

Then account settings where you’ll find this:

If you don’t have a Rakuten account, you’ll need to select either PayPal or Big Fat Check to get going. You may need to sign out and back in for the Bilt account to actually populate. If it doesn’t go here for Help which has a chat function to see why your Bilt isn’t populating.

What do I get with an AARP membership?

Let’s break it down because I have EASILY saved a ton of money over the nearly 10 years I’ve been a member.

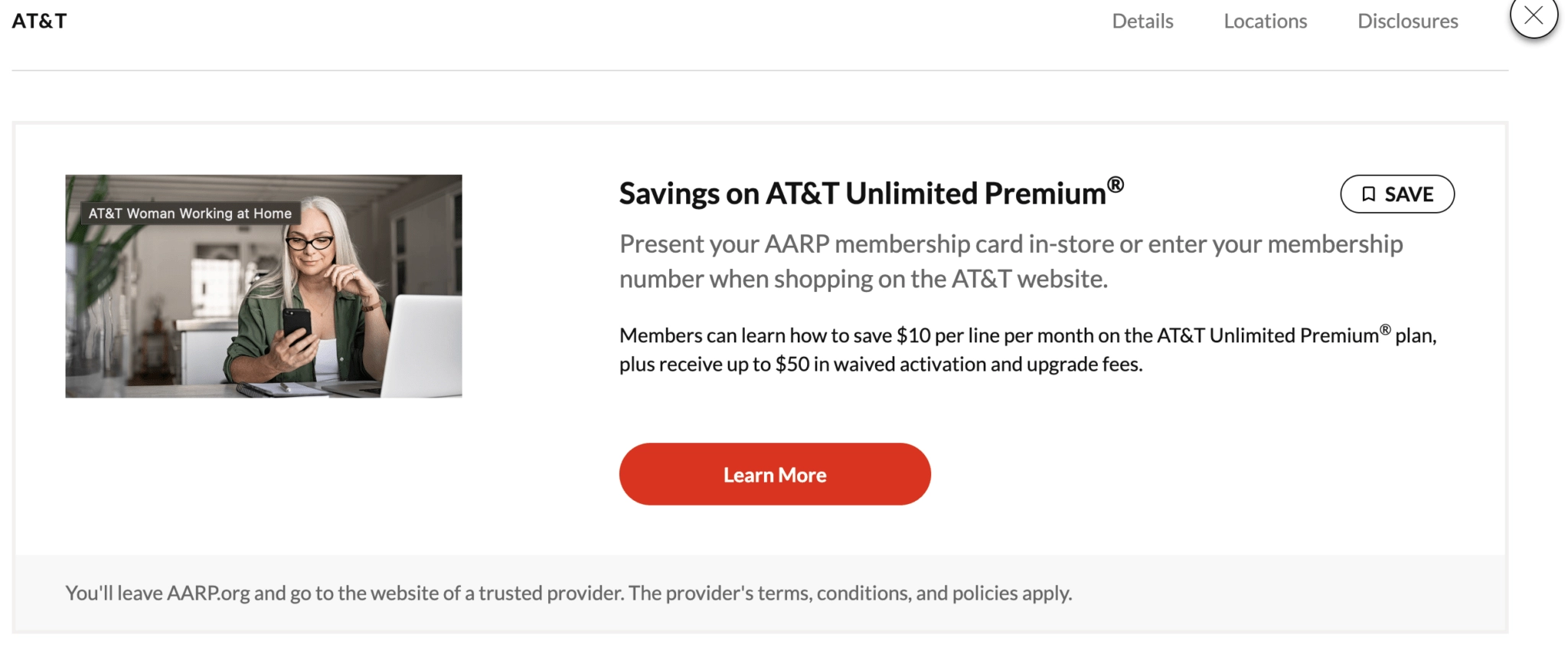

Personally I’ve saved the most on my AT&T bill – $10 per line, per month!

- Save $10 per line, per month with Unlimited Premium Plan

- A bunch of other waived fees

You can also save on Consumer Cellular, but I don’t have personal experience with this.

Purchasing British Airways flights

- Years ago this benefit was $400 on Business Class originating in the US and I saved thousands on tickets for my family. It’s still a great deal at $200

One Way Car Rentals

One Way Car Rentals

Don’t go to Expedia AARP Portal, you need to click directly on the Car Rental agency and you’ll find some really great deals. I rent cars one way quite often and AARP has some very competitive, often cheapest, deals on one way car rentals. Check AutoSlash as well, but these are very good.

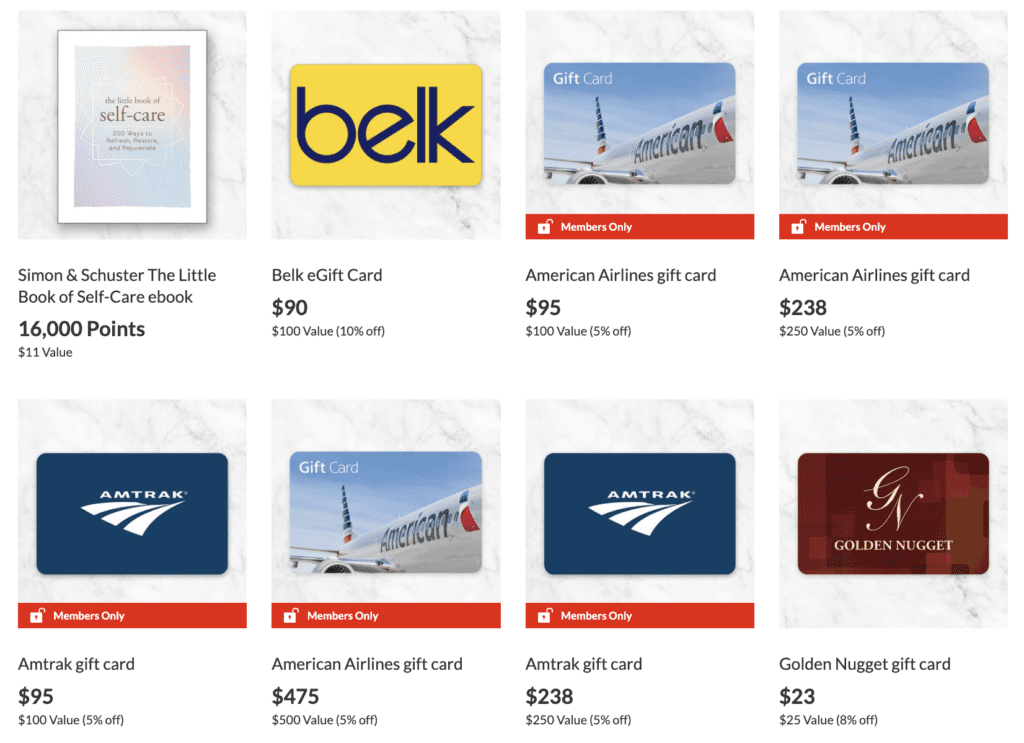

Buy Discounted Gift Cards

Buy Discounted Gift Cards

You don’t have to be a member of AARP to buy discounted gift cards, but members get access to even more cards with bigger discounts. For instance, you can currently buy cruise and airlines gift cards at a discount.

Gas Discounts

You can link your AARP membership with your Exxon/Mobile Rewards+ and earn an additional penny back in rewards per dollar spent.

Overall

It’s a complete no brainer to join AARP if you would use any of their benefits and ESPECIALLY if you have an AT&T phone line that saves $10 a month. That is just silly when membership is $11 a year with this promo.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.