We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Starting today, members of American Airlines loyalty program, AAdvanatge, and JetBlue’s TrueBlue will be able to earn miles on any marketed and operated flight on each carrier. This is an improvement over the partnership AA and JetBlue already has where you could earn miles on codeshare flights. This means that loyalty members of American Airlines can earn miles and elite status by flying American, Alaska, or JetBlue. That’s pretty fantastic.

Note that the NYC to London flight that JetBlue will begin operating later this year won’t be eligible.

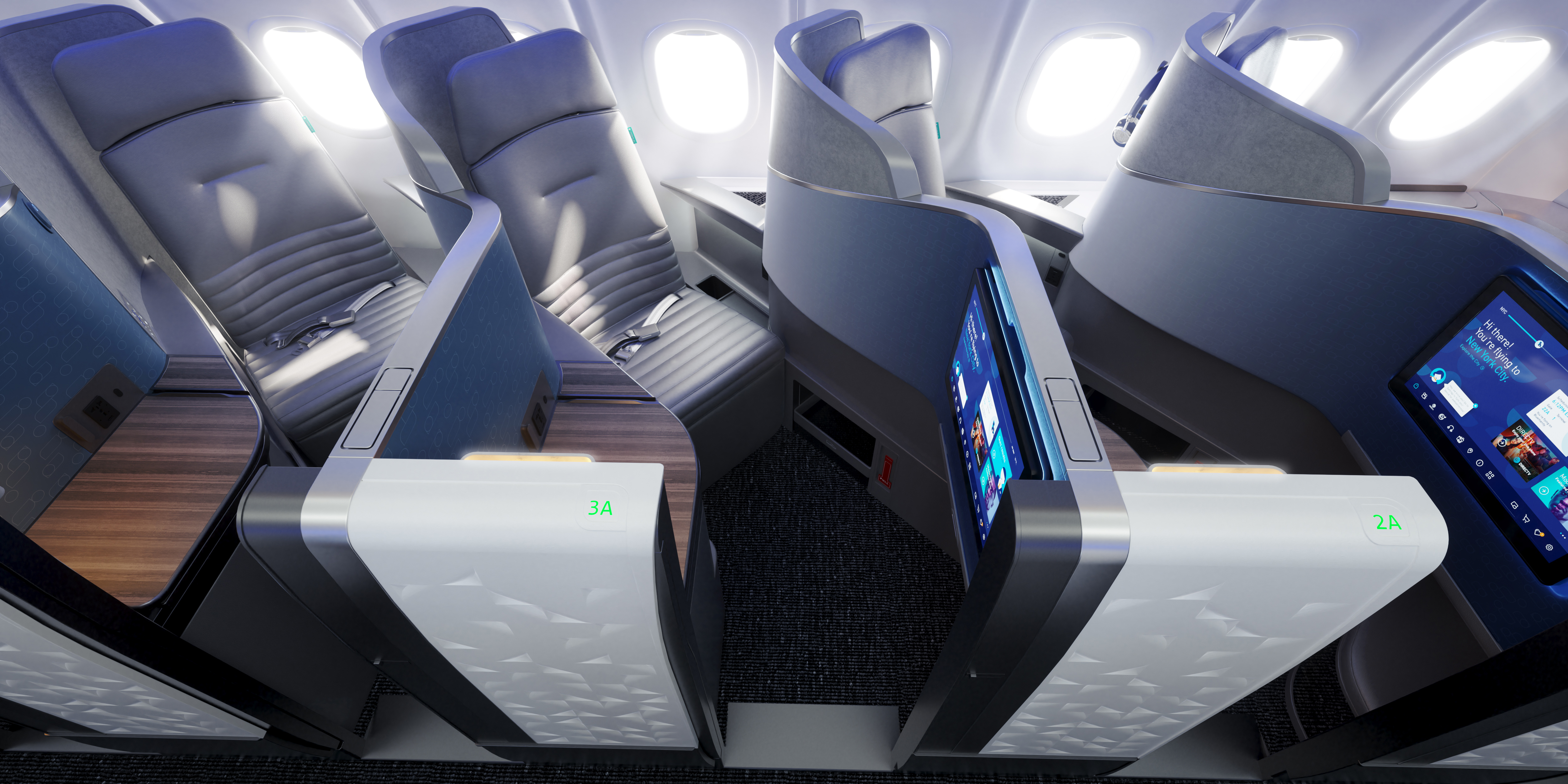

Soon you’ll be able to earn AA miles flying JetBlue Mint

How will I be able to earn miles?

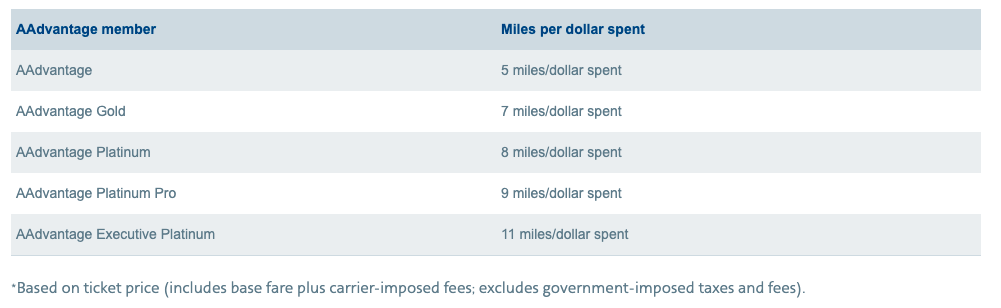

Here is how many miles you’d earn if you credited to AA. You can read more here

Note that these earn rates are on the base fare ticket exclusive of taxes, fees, etc

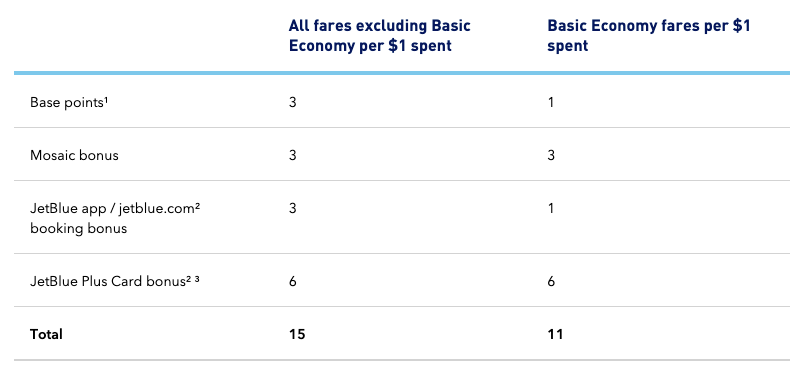

Here’s how many miles you’d earn if you credited to JetBlue.

How about Elite Status Miles and Dollars?

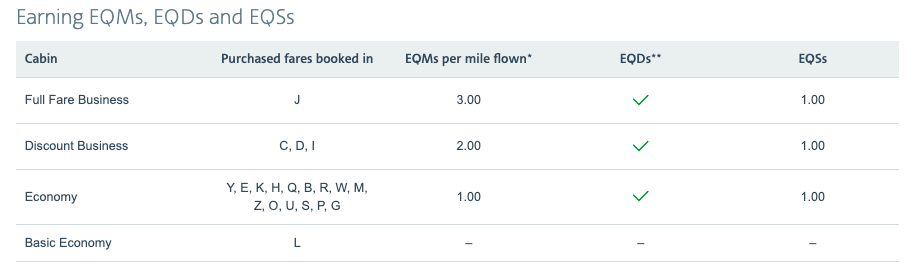

AA has a specific earn rate for each partner…here is JetBlue’s

What does it mean to be marketed and operated by?

This is where an American Airlines flight is sold by American and flown on an American Airline plane. So, if your flight has an AA flight number, and your airplane has an AA logo on it with an AA crew – you could credit it to JetBlue if you want. Same the other way around.

You could choose to earn JetBlue miles flying AA now.

What is a codeshare?

The example up above is a codeshare – a flight that was marketed by AA ( sold on their website or through a 3rd party ) with an AA flight number, but is actually operated by another airline.

If this is an AA flight that you are on, you wouldn’t be able to credit to JetBlue and the same vice versa.

Recap

I’m currently a loyalist of Alaska – I still think as an overall program it provides the best earning/redemption opportunities and the elite benefits on the One World network are quite good. That’s heavily predicated on a fantastic partner award chart and earn bonuses alongside a fixed award chart vs AA’s dynamic pricing.

However…this is a very cool partnership. I think the new JetBlue Mint ( and legacy Mint rows 2/4 ) are probably the best ways to fly in the domestic US, and I would have looked to credit those flights to a foreign carrier.

It makes me wonder if sooner than later we will see each airline allow award redemptions on eachother? This would provide more value to cardholders that can move their miles into JetBlue like Cap1, Citi, and Amex.

Needless to say – I’m very excited about flying JetBlue Mint Suites and Studio later this year and know exactly where I’ll be crediting those flights.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.