This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

American Express Pay Over Time

Time after time, American Express Pay over Time has been one of the easiest ways to accrue Amex points. Simply add the feature to your card, and get some easy points. A new round of offers have hit accounts at 30k points. Personally, I’ve never gotten more than 20k targeted on any of mine, so this is massive, but there is a bit of confusion because the email says 30k, but when I populate the portal to do it…it says 20k. I’ll let you know what they end up honoring, but head’s up that 30k offers are out there!

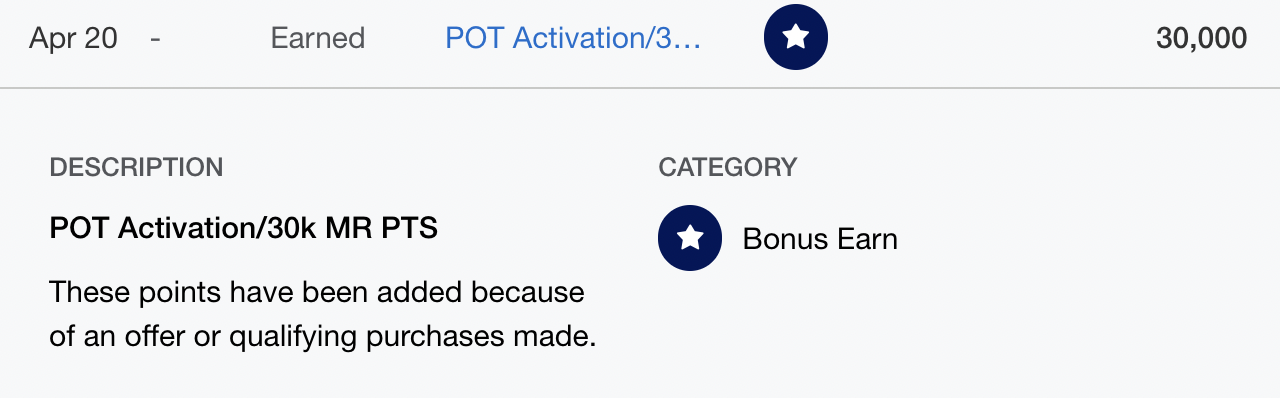

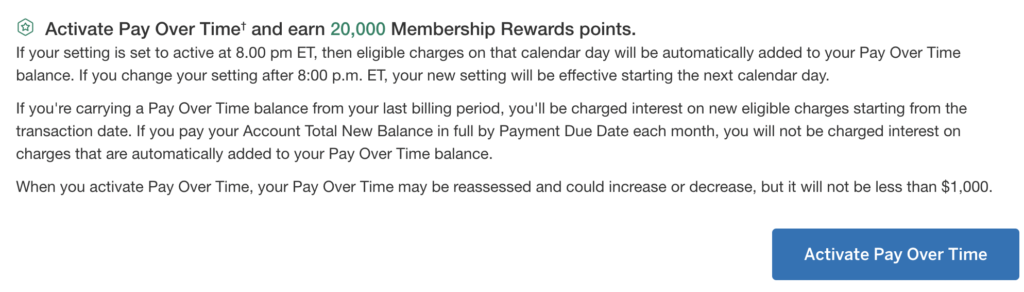

Update – The portal continued to populate the 20k offer, and I ended up just accepting. A couple days later, it awarded me 30k just like the email had said. So that’s good news!

What is American Express Pay Over Time?

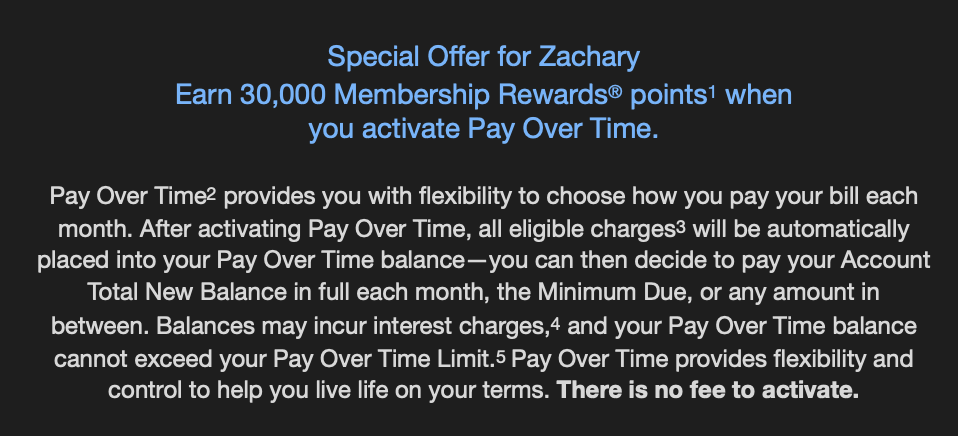

You’ll find these offers associated with Amex charge cards because, by default, a charge card requires you to pay off the balance in full each, and every, month. What the Amex Pay Over Time feature allows, after accepting, is the ability to pay certain transactions, over $100, over time with interest.

Usually, you’ll get targeted for Pay Over Time without a bonus, but if you wait long enough, an offer with points will arrive.

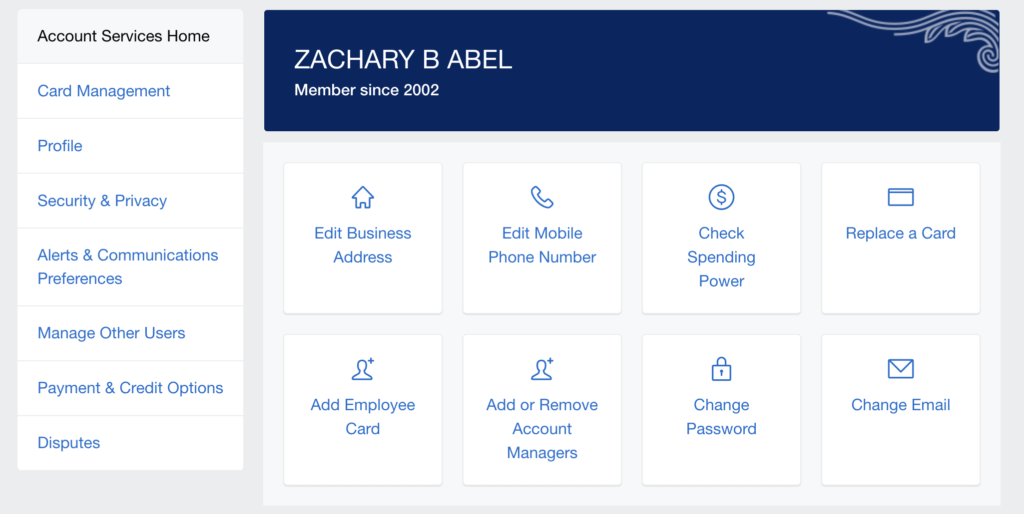

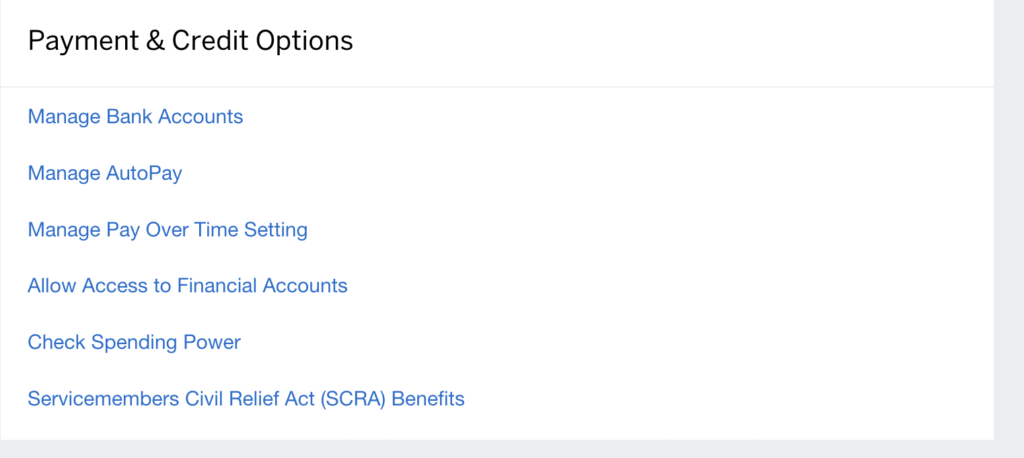

How Can I check if my account is signed up?

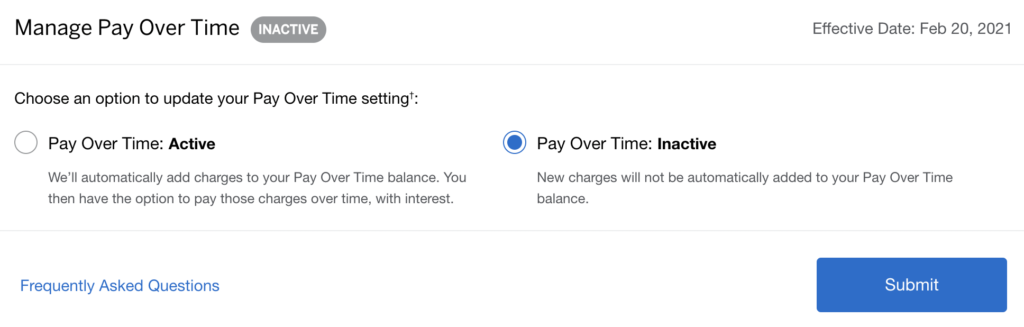

Go to account services, manage pay over time, and then you can make it inactive. Often times, you’ll get retargeted.

Ways to get an American Express Pay Over Time Offer.

The first is in your account in Amex Offers. It’ll look something like this:

Go here to see if your account is targeted, but mine was emailed to me and isn’t showing up in my account.

Additionally, you may receive an email that looks like this:

You’ll get a notification on terms:

This is where my offer went from 30k to 20k. It also gave me an error message to try again later. I’ll keep giving it a go online before I call in just to see if it evolves.

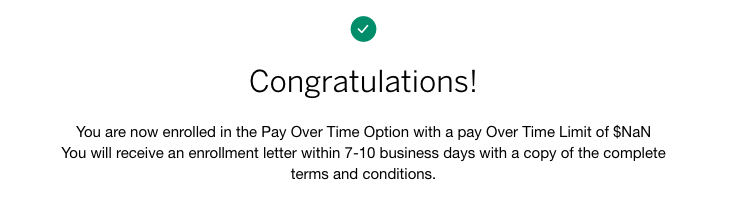

After enrolling…Wham bam

This is what you’ll see once you activate

How quickly do the bonus points populate?

In the past it was added the next day

Analysis

As discussed, these will only be offered on charge cards which means you’re already accustomed to paying off your cards in full every month ( which you should 100% being doing on every card you have ), and this feature would allow you to pay them over time but pay interest – something I ardently advise against. Enjoy the extra 10k, pay your bills on time, and don’t run up debt. It’s really a generous offer that Amex continues to provide on a regular basis. Have you been targeted?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.