We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

American Express Platinum has a variety of benefits and perks. One of my favorites is their Fine hotels and resorts program. It offers incredible benefits at a multitude of luxury properties around the world ( free nights, upgrades, breakfast, credits, late check-out). However, one of the main requirements, and rightly so, is that you must pay with an American Express card at check out. It doesn’t need to be your platinum card, but it does need to be branded an Amex. I’ve utilized this program a lot, and the upgrades, free breakfast, and resort credits alone can offset your card’s annual fee.

But there are situations where you may want to pay with a card other than Amex.

Perhaps the only Amex you have is a Business Platinum, but you’re taking a personal trip and can’t charge it to your company’s credit card. Or perhaps you’re hitting a minimum spend requirement and would like to use a big hotel bill to help hit that spend? Or you’d like to make 3x points per dollar on travel with the Chase Sapphire Reserve? The list goes on and on.

You’re in luck! You can ask for a match… even on Amex FHR offers.

Often times, many of the properties participating in Amex’s Fine Hotels and Resorts also participate in Virtuoso or a hotel’s Preferred Program ( Ritz Stars, Hyatt Prive, Peninsula Pen Club, etc). According to Travelsort, you can match benefits between the programs, even on free night FHR offers if the properties participate in both programs. Simply ask your Virtuoso or Preferred Partner rep to reach out to their contact at the hotel and request the match.

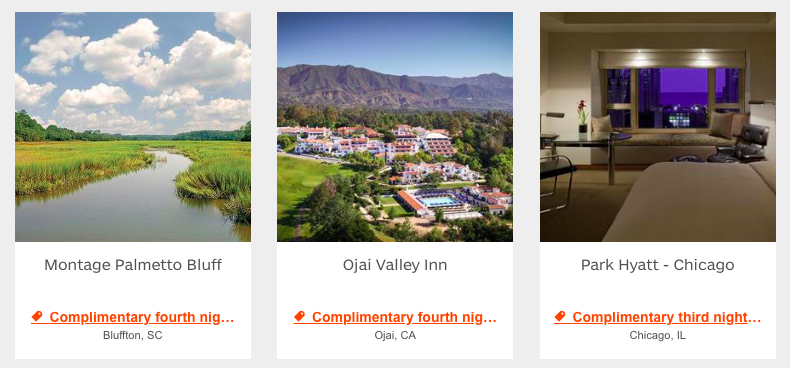

Unfamiliar with Amex’s FHR offers? Participating hotels around the world offer a free 3rd, 4th, or 5th night. For instance…FHR is offering a 3rd night free at the Park Hyatt Chicago, but Virtuoso isn’t.

I doubt this will work at every property or preferred program, but it’s at least worth a shot. Much like requesting an airline status match. What do you have to lose?

Widget not in any sidebars

We work with two incredible Virtuoso Reps that maintain great relationships at luxury properties around the world.

If you’re looking to add an incredible amount of value to any vacation, whether you’re matching to FHR or not, I’d highly recommend reaching out. Most often, Virtuoso rates are competitive with the best available rate the hotel is offering through its website, but you get a bevy of benefits added to your stay.

We received an unbelievable welcome at the Peninsula Beijing utilizing Virtuoso benefits.

Many of the FHR and Virtuoso benefits overlap, but these are the biggest differences in between the two programs:

- Amex will guarantee a 4pm late check out whereas Virtuoso is upon availability

- Virtuoso guarantees a full breakfast, whereas FHR only guarantees continental breakfast.

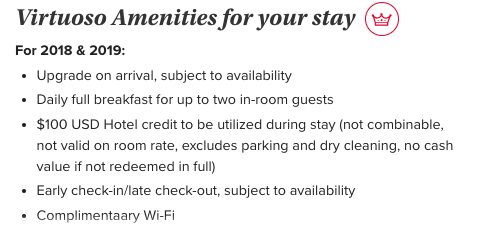

Here’s a look at guaranteed benefits that are included. No commission or additional cost is added to your booking.

Did you know you could ask for a match?

Widget not in any sidebars

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.