This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Amex to Hilton transfer bonus

Usually I’m not a fan transferring American Express Membership Rewards to any hotel program, but transfer bonuses, at the very minimum, warrant a discussion. Currently, there is a 25% transfer bonus given when you turn an American Express Membership Reward into a Hilton Honor point. This isn’t necessarily a bad deal, but the best ever is 50%. Unless you’re desperate to redeem your Amex points at an uber high end Hilton property, this deal probably doesn’t make sense. Remember, throughout the year Hilton will sell their points for 1/2 a penny.

In order to dissect the deal and determine I’m going to break down the underlying valuation of each currency.

Amex to Hilton 25% transfer bonus runs until 09/23/25

What is a Hilton Honor point worth?

Hilton Honors are given a fixed price if you redeem them on anything other than standard rooms. That is pegged at roughly $0.004 per point.

However…I don’t advise you redeem if you can’t land a room at a higher valuation than that. For instance, many hotels will release standard rooms for a point redemption when the points needed for the redemption give you a valuation in excess of $0.004. I did this a couple years ago for a New Year’s at the Waldorf Hilton in London. I redeemed 320k points (80k/night with a 5th night free ) when rates average $600 a night. We got $3000 in value for 320k points ( which we purchased for $1600 – read below ).

Throughout the year, Hilton will sell their points for roughly 1/2 cent. If you can buy it for that much during a sale then I’d say that’s a good benchmark. You can also combine Hilton Honors points from multiple accounts so you can almost always purchase enough points for a redemption you have in mind.

What is an American Express Membership Reward point worth?

If you carry any American Express card that earns Membership Rewards you have the option of redeeming for a cent per point. That’s on hotels, flights, etc.

If you carry an American Express Business Platinum card then you have the option to redeem those points within Amex Travel on your selected airline or premium flight with a 35% refund ( that’s roughly 1.55 cents per point ). I think that’s a fair valuation, although for my intents and purposes I throw a higher valuation on it at 2 cents. Why?

I tend to transfer points into programs and redeem for last minute flights at a valuation in excess of 2 cents.

When does it make sense to transfer points?

If Hilton points are typically worth 1/2 cent then you could extract 1.34c in value via this transfer, can potentially much more if you’re strategic.

Let’s take an extreme example and you can apply the principle to a redemption you may have in mind.

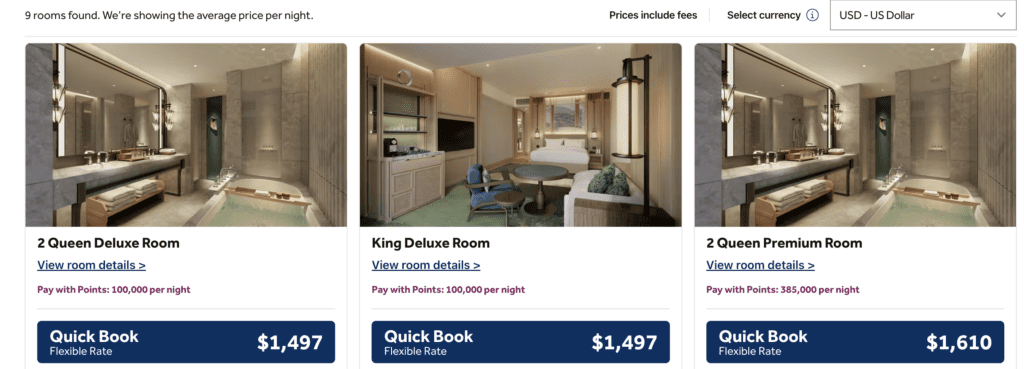

Waldorf Astoria Osaka

This is one of the most expensive properties in Hilton’s portfolio and goes for a 100k points per night. With this current transfer bonus, 40k Amex. Remember…If you carry an Amex Platinum then you are Hilton Gold, and if you are Hilton Gold, you get a 5th night free on point redemptions.

Here’s a look at rates…sky high and make sure you factor In taxes and fees – $1500/night base room

That means that you could stay for 5 nights with 184k Amex points which would be 480k Hilton honors.

- 40k Amex = 100k Hilton

- 5 x 150k = 500k

- 5th night free ( 100k )

- Total = 400k

160k for at least $7500 of value is almost 5 cents per point!

Is that valuation really fair?

Well…you could also buy 480k Hilton points for $2400. That’s a big if, and if you did…then you’re getting $2400 of value for your points or roughly 1.5c. That’s less than I’d peg an Amex point to be worth.

Stacking with an Amex Hilton Aspire

If you carry Amex’s premium Hilton card the Aspire, you are given top tier Hilton status…diamond + a free night + $400 annual Hilton Resort credit ( divided into 2 semi annual credits of $200 ). Diamonds get free breakfast which I would imagine is roughly $35-40 per person per day.

If you found the availability…you could book a free weekend night via your Aspire, then use the points accrued from your other Amex card to transfer to Hilton and stay 6 nights for 160k Amex Points. 6 x$70 in breakfast credits and another $200 in resort credit means an additional $620 in Hilton credits for a whopping ( 6 x $1300 + $670 ) $8500 in value. Of course you’d need the Aspire.

Recap

Is it worth it? It very well could be if you’re looking to redeem at some fantastic resorts that ordinarily cost a fortune. The example I used is taking it to the extreme – although maybe not as extreme as Bora Bora or the Maldives because Cabo is very easy to get to and requires none of the crazy resort transportation costs.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.