We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Capital One Transfer bonus: 30% to Virgin Red through 4/30/24

Capital One has brought back their 30% transfer bonus to Virgin Red. If you’re unfamiliar with Virgin Red it’s the umbrella rewards program of the Virgin group, so if you have Virgin Atlantic miles and link your account, you’ll have Virgin Red points. They’re essentially interchangeable, but Virgin Red has a ton more redemptions options since it’s open to cruises, hotels, and even safaris. We have added this to our current list of transfer bonuses. Let’s take a look!

Using Virgin Red to book Virgin Atlantic with miles

Virgin Red and Virgin Atlantic miles are one in the same after you link accounts, but all of the redemption pricing is still in Virgin Atlantic miles.

Virgin Atlantic is a very sleek, sexy, and stylish way to fly. The biggest problem? The surcharges are just outrageous. With that being said, Virgin committed in 2022 to release 2 award seats per flight. So… you can often find award space and if you’re booking last minute flights, it’s still a good deal when comparing to cash rates ( most of the time ).

I’ve flown the A350 many times and it’s a very solid product. My biggest gripe is the lack of storage in the seat, so personally I prefer other carriers, but I still fly it usually once or twice a year since we travel to London quite often. A new seat to keep an eye on is the A330-neo which offers their latest seat configuration and seems like a nice improvement. Avoid the old A330s tho…a quite inferior business class.

The A350-1000 on Virgin Atlantic

Let’s look at the Delta Suite 47k option.

I was fortunate enough to book this deal from London to Atlanta last year – it’s a bit of a unicorn booking so don’t count on finding it consistently.

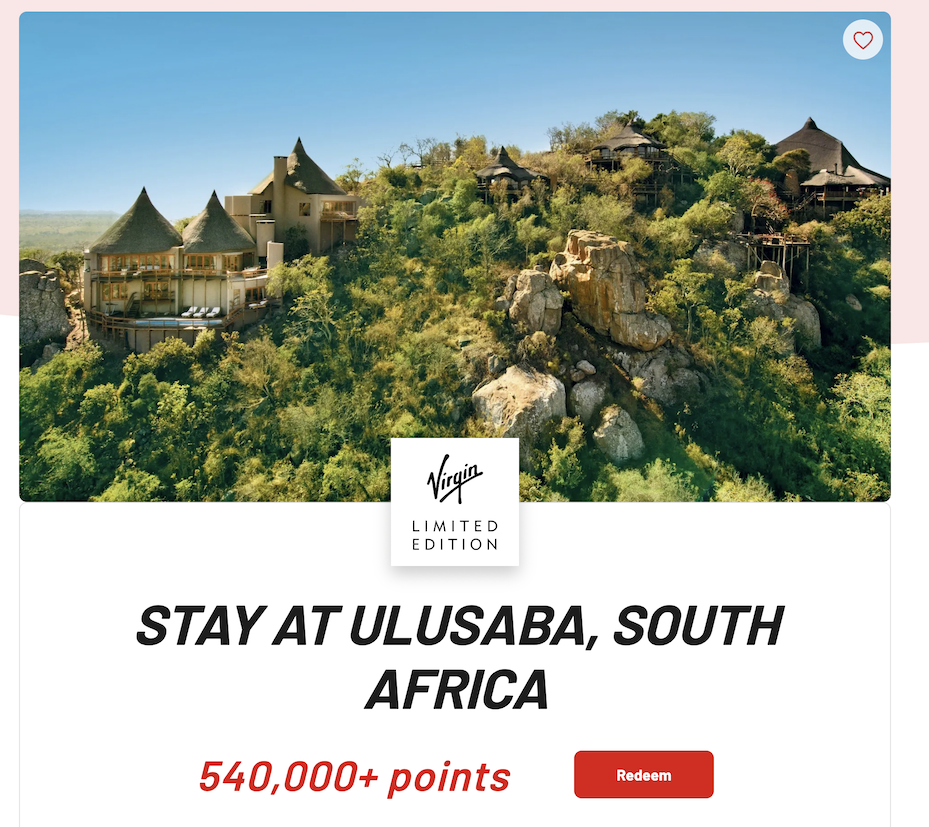

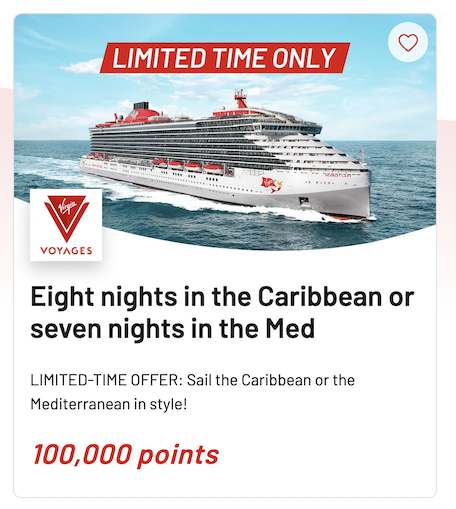

You can also use Virgin Red for cruises, hotels, and safaris

Personally, I think the real value is utilizing them for flights, specifically on partners, but even when paying the surcharges for Virgin Atlantic flights you’re getting pretty good value. One thing I would highlight, in 2023 we’ve seen Virgin Red promote their cruises. There are 7 and 8 nights cruises in the Caribbean or Mediterranean for 100k points for 2 people. That’s 77k Capital One Miles for a week long vacay – I’m sure you’re going to spend some money too on add-ons, etc – but a pretty good deal all around if you ask me.

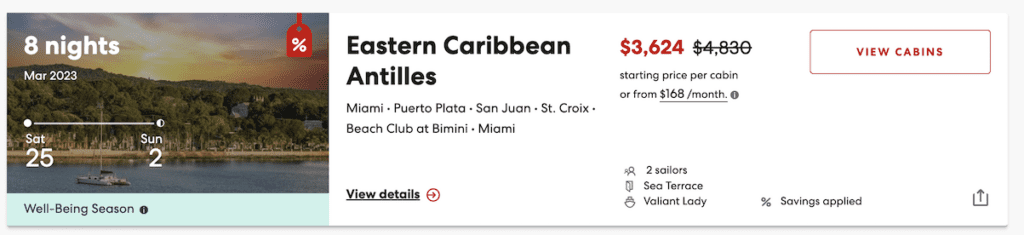

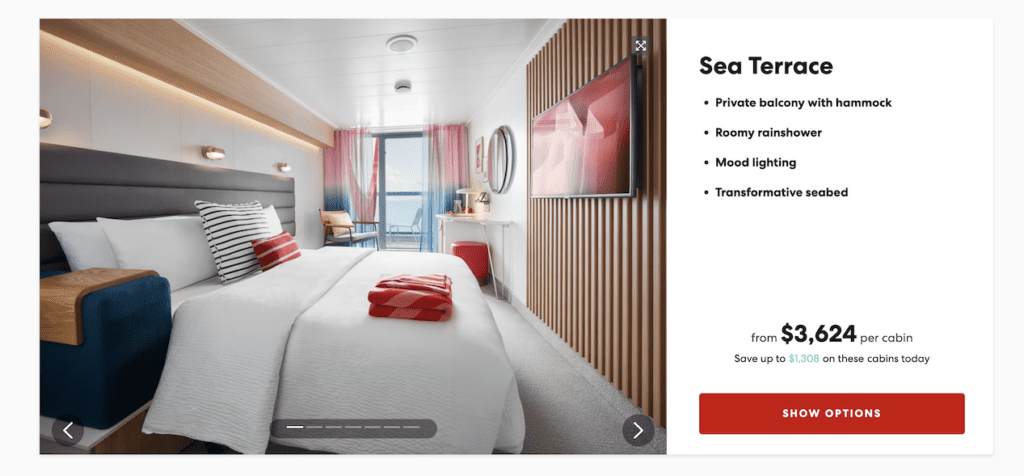

Regarding the cruises the terms say: “As for digs, you’ll be kicking back in The Sea Terrace (or Limited View Sea Terrace, depending on availability).”

I did some perusing and this is the price for a sea terrace for 8 nights in the caribbean, what you could presumably book with Virgin Red

ANA

This is the Virgin Atlantic Award Chart for ANA redemptions.

- Business Class

- Australia / Canada / Western USA:

- 105,000 points round-trip, 52,500 points one-way

- Europe / Central & Eastern USA / Mexico:

- 120,000 points round-trip, 60,000 points one-way

- Australia / Canada / Western USA:

- First Class from US to Japan ranges

- Australia / Canada / Western USA:

- 145,000 points round-trip, 72,500 points one-way

- Europe / Central & Eastern USA / Mexico:

- 170,000 points round-trip, 85,000 points one-way

- Australia / Canada / Western USA:

ANA stunned the world with their new 777-3ooER “The Room” Business Class and you can see why. It’s massive

Not to be outdone…let’s take a gander at “The Suite” – their new First Class offering

Air France/KLM

Yep, you can use Virgin Atlantic miles to fly on Air France. The chart is based on peak/off peak and business class one way from the USA to Europe ranges from 48.500 miles to 97,500 miles. Clearly, you want to find options that are off peak otherwise you could always search on Air France since it’s a transfer partner of Chase as well.

Read our review of Air France business class here

Delta

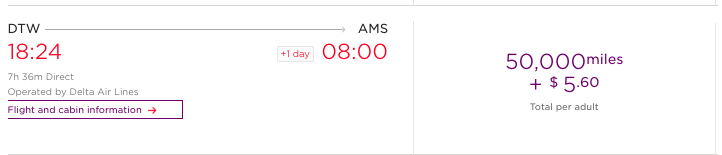

You can use Virgin Atlantic miles to fly on Delta as well, and in particular, to fly business class between the US and Europe for just 50k miles one way. This is significantly cheaper than Delta would charge using their own points, but this rate only applies to flights that aren’t going in/out of the UK.

This is a great redemption theoretically…in practice, finding the award availability for Delta One from the US to Europe is quite difficult, but still possible.

This is a great redemption theoretically…in practice, finding the award availability for Delta One from the US to Europe is quite difficult, but still possible.

Note that surcharges are now quite high on Delta flights booked using Virgin Miles

Virgin Atlantic flights

Don’t forget about using Virgin Atlantic miles on Virgin Atlantic itself…there are quite a few great ways to do this; however, be prepared to pay some taxes and fees.

Upgrading a qualifying fare

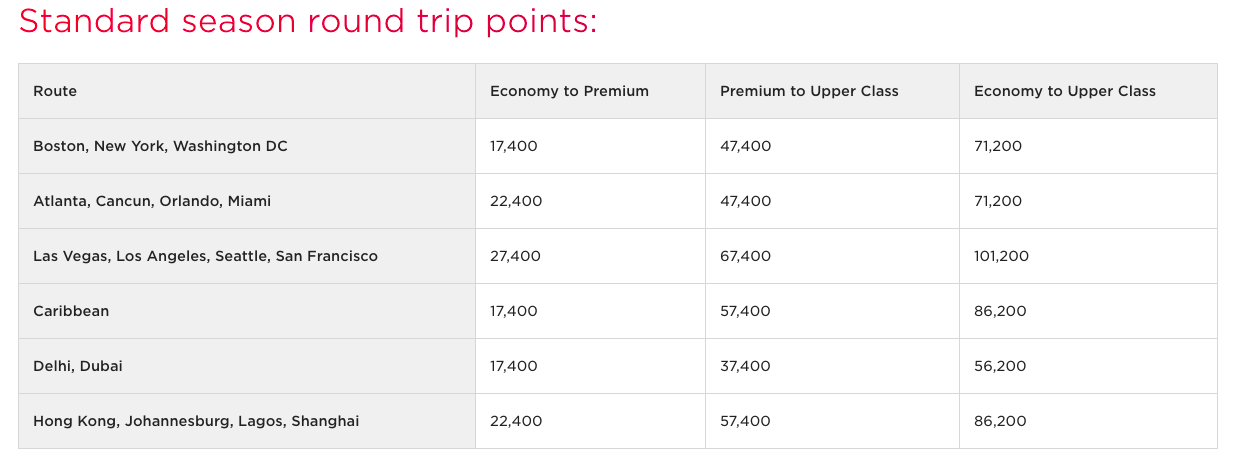

Virgin Atlantic runs promos all the time, and you’ll often find Economy Classic or Delight pricing at $500 to $600 roundtrip from select US airports to the UK. A great use of Virgin miles is to upgrade those tickets to Premium Economy or Upper Class. That is done so using the following table ( add on a few more miles if its peak season )

You could use 71,200 miles to upgrade your roundtrip from Economy to Upper Class ( you’d still earn miles on the base ticket too ).

You could use 71,200 miles to upgrade your roundtrip from Economy to Upper Class ( you’d still earn miles on the base ticket too ).

Upper Class

Upper Class

Watch out for those taxes and fees…but Virgin Atlantic releases a lot of award space on their own flights. Like..a lot. With rates starting around 47,500 miles for a one way upper class flight, it may be worth paying $600+ in taxes and fees to fly Upper.

Overall

A lot of people have added the Capital One Venture X or Capital One Venture Rewards to their wallet over the past couple years when bonuses have ranged between 75k and 100k. There are a lot of interesting redemptions options on Virgin Red that could turn your miles into a very luxurious trip.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.