This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Amex isn’t kid-ding around, limits Centurion Lounge access

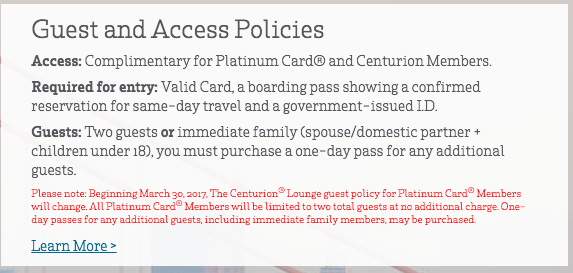

Just in case you missed the news that was circling around the blog-o-sphere last week: Amex has reduced the number of guests you can bring into the lounge with you. What’s the big deal? It used to be that you could bring in your immediate family without limitation. Now? Sorry kiddos…the limit for guests is now 2, regardless if you’re related or not. Immediate family means 3 people now. Amex isn’t kid-ing around with Centurion Lounge Access and you better have your seat assignment!

Points with a Crew pointed out the newly advertised policy on their website: 2 guests OR immediate family.

I’m not married and have no children, but I can see how this would be a pretty big devaluation to those who travel with more than 3 total people, and it’s a real zinger when it comes with the news that the annual fee is going up by $100! So less perks and more fees? You’d better make use of those Uber credits 😉

There is always the strategy of paying $175 for 3 authorized users. Each of those users would have access + 2 guests, so there is at least a possible way around the restrictions and limit the cost to $175.

Also…you better have your boarding pass with assigned seat. The unaccompanied flyer reported this:

As a matter of fact, any lounge that isn’t affiliated with a particular airline won’t allow you into their lounge unless you have a seat assignment or boarding pass from another flight with a seat assignment. He explained to me that many agents don’t enforce this rule. However, he did say that the American Express Centurion Lounge in Miami is the one exception in which this rule is enforced 24/7

In case you’re wondering where cardholders have access…Here are the Centurion Lounges in America and Internaional Amex lounges worldwide.

Is it too soon to start using the family room/kid’s club as an impromptu wine tasting room? 😉

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.