This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

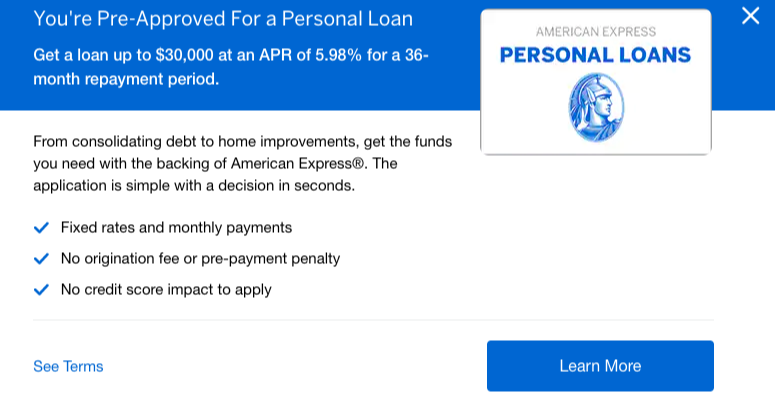

First off, I’m not a financial advisor, and am in no way advising anyone take out a personal loan. This isn’t something I have an affiliate partnership with either. But, I’ve seen this pop up on my account and a couple others I manage, and figured it could be helpful especially given the times. While I repeat, I’m not advocating anyone take out a personal loan, a reality many are facing is lost income and financial uncertainty. An APR of 5.98% is certainly far more advantageous to credit card interest rates, and if you have run up debt, this could also be a way to consolidate debt and pay it off.

When doing a cursory glance at personal loan APRs it seems they were higher in 2019 – between 9-10%. I did find several offers via bankrate for personal loans on a top tier credit score, $30k, and 36 months around this same APR.

AMERICAN EXPRESS® PERSONAL LOANS TERMS AND CONDITIONS

Last Modified: February 14, 2020

General

American Express Personal Loans are personal loans issued by American Express National Bank. Personal Loans are not Card

products. Unlike American Express Cards, they do not include any Card benefits, rewards programs or insurance. For example, you do not get Membership Rewards® points or Reward Dollars from American Express with your Personal Loan.

Any information American Express collects from you shall be governed by our Privacy Statement (americanexpress.com/privacy).

Eligibility, Use and Verification

You can only apply if you receive an offer to apply and continue to meet the eligibility requirements. You must be 18 years or older, a U.S. citizen or resident of the U.S. or its territories, and have an active American Express Card. You must also have an American Express online account to view your Loan Documents. If you do not, you can create one at americanexpress.com/register. When you apply for a Personal Loan, you are representing that all information in your application is true, correct, and accurate. If you have previously applied for a Personal Loan, you are not eligible for a Personal Loan until at least 60 days after the decision on your most recent loan application and only if you receive a new offer to apply.

Personal Loans may not be used for post-secondary education expenses, real estate, business, securities, vehicle purchases (other than as down payment for a vehicle), or any purpose prohibited by law or not otherwise permitted by these terms and conditions or your Loan Agreement.

We reserve the right to verify any information you provide to us or that we have on file for you, including your identity and any bank or credit card account information. However, we may also rely on the accuracy, authenticity and completeness of any information that you provide to us. We reserve the right to refuse to make any payment to any of your designated accounts if your request

does not meet these terms and conditions or the terms of your Loan Agreement,

or violates applicable law.

Patriot Act Notice.

Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account or applies for a loan, including your name, address, date of birth and other information that will allow us to verify your identity. We may also ask you to provide identifying documents.

Your Pre-Approved Loan Amount and APR

Your pre-approved loan amount and annual percentage rate (APR) are based on your creditworthiness and other factors at the time of pre-approval. Your actual APR may vary based on the amount you borrow and the repayment period you select, but it will not exceed your pre-approved maximum APR.

After you receive your pre-approved offer, you must submit an application to find out if you are approved for a Personal Loan. We may not approve your application if there has been any material change to your financial condition or creditworthiness, as a result of our fraud review or for other reasons under applicable law.

Credit Card Payment Option

You may be eligible for the Credit Card Payment Option. If you are eligible for and select this option, American Express will pay down balances directly on up to four personal credit cards issued by eligible US banks (including in the US territories) in the amounts that you designate in your application. You must request a minimum loan amount of $1,000 for each credit card you select, with a total requested loan amount for all credit cards of at least $3,500. American Express Cards are not eligible for debt consolidation. After you sign your Loan Agreement, we will send a loan payment directly to each of the credit cards you designated in your application. You will not receive any loan payments directly. In certain cases, your credit card bank may not be able to process the loan payment from us—for example, if the credit card information you provided is not correct or your credit card bank rejects the payment. If this happens, we will reduce the total amount of your loan by the amount of the failed payment and you will not owe any interest on the failed payment.

Direct Deposit Option

You may be eligible for the Direct Deposit Option. If you select this option, the funds will be deposited directly into your bank

account. You may be prompted to add the routing and account numbers of your bank account. Your bank account must be in your name and may be verified upon submission. Your requested loan amount must be at least $3,500. If you are required to add a bank

account, you will have three (3) days from the date you sign your loan agreement to add a bank account; otherwise, you will not receive your loan funds. In some cases, we may need to verify your account by asking you for personal information. If you are unable or unwilling to satisfy these conditions or we are otherwise unable to verify your bank account, we will not be able to send any loan funds to you and your loan agreement will be void and unenforceable. In addition, you may not apply again for at least 60 after the decision on your most recent loan application and only if you receive a new offer to apply.

Fund Disbursement

American Express will typically send your loan funds within three to five business days after you sign your loan agreement to the bank or credit card account(s) you designated in your application. If you are required to add a bank account to receive your loan funds, we will typically send your loan funds to that bank account within three to five business days after we verify your account. If we cannot verify your bank account, we will not be able to send your loan funds to you and will cancel your loan.

Please note that your bank or credit card issuer may take additional time to post your loan funds to your account(s). If any loan funds do not post to your bank or credit card account(s) within two weeks, please contact your bank or credit card issuer. We are not liable for any loss or injury resulting from any failure or delay in issuing your loan funds.

Your Loan Agreement

If we approve your loan application, we will present you with your actual loan terms. These terms will include your APR, total interest

charges, amount financed, total payments and repayment schedule (including your monthly payment amount). We will also present you with your Loan Agreement and other required disclosures.

You will have three (3) days from when you are approved to review your loan terms and electronically sign your Loan Agreement. If you do not electronically sign your Loan Agreement within these three days, we will withdraw our approval and you will not be able to obtain your loan. In addition, you may not apply for another loan for at least 60 days after the decision on your most recent loan

application and only if you receive a new offer to apply.

Credit Reports

By applying, you agree that we may obtain credit reports and other information about you from other sources, including consumer reporting agencies and our affiliates. You agree that we will use such information for any purposes, subject to applicable law. Upon request, we will tell you if we have received a consumer report and the name and address of the agency that provided it. You authorize us and our affiliates and subsidiaries to share information we have about you at any time for marketing and administrative purposes, subject to applicable law.

Consent to Electronic Communications

To apply for a Personal Loan, you must agree to receive communications and other documents in electronic form pursuant to the Consent Statement. If you do not agree to the Consent Statement, you will not be able to apply for your loan.

Notice to California Residents: A married applicant may apply for a separate account.

Notice to Ohio Residents: The Ohio laws against discrimination require that all creditors make credit equally available to all credit worthy customers, and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio civil rights commission administers compliance with this law.

Notice to Married Wisconsin Residents: No provision of any marital property agreement, unilateral agreement, or court decree under Wisconsin’s Marital Property Act will adversely affect a creditor’s interest unless, prior to the time credit is granted, the creditor is furnished a copy of that agreement or decree or is given complete information about the agreement or decree.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.