This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

$10000 initiation fee and $5000 annually, Authorized Users are another $2500. The Black Card is for those who have some cash to spare. That…or you have a business that processes a lot via Amex and you have decided that the 2 cent redemption rate Amex Business Black Card holders get on premium flights outweighs the annual fee. Either way…it used to be that you needed to wait to get an invitation and those came if you spent more than $250k to $500k.

A few things to know about Black Cards – American Express Centurion Cards

-

Personal Centurion: 20% points back when used for premium flights or selected airline

- 1.25c per point

-

Business Centurion: 50% points back premium flights or selected airline

- 2c per point

-

IHG Platinum Elite

-

Hilton Honors Diamond

-

Marriott Bonvoy Gold

- Earn 1.5X Membership Rewards points per dollar on purchases over $5,000

- (Up to 1 million additional points per calendar year)

- Delta SkyMiles Platinum Medallion status,

- Hertz Platinum

- Avis President’s Club

Why a Black Card could actually make financial sense to you…

You’d need to be able to out-redeem the Amex Business Platinum + your initiation and annual fee, which is $15000 less the business platinum which is $595 and become $695 next year. Let’s use $695…so you’d need $14305 in added value. In the first year that would be roughly 3.2 Million in spend at 1x. After that it would be significantly less – roughly 957k. Those would be breakeven and the residuals bennies from Hilton Diamond, Delta Plat, etc would outweigh the fees. That really isn’t that much for business spend…

- 3.2 Million Amex points

- $64k in value with Biz Black

- $49,600 with Biz Plat

- 957k Amex Points

- $19,140

- $14,835

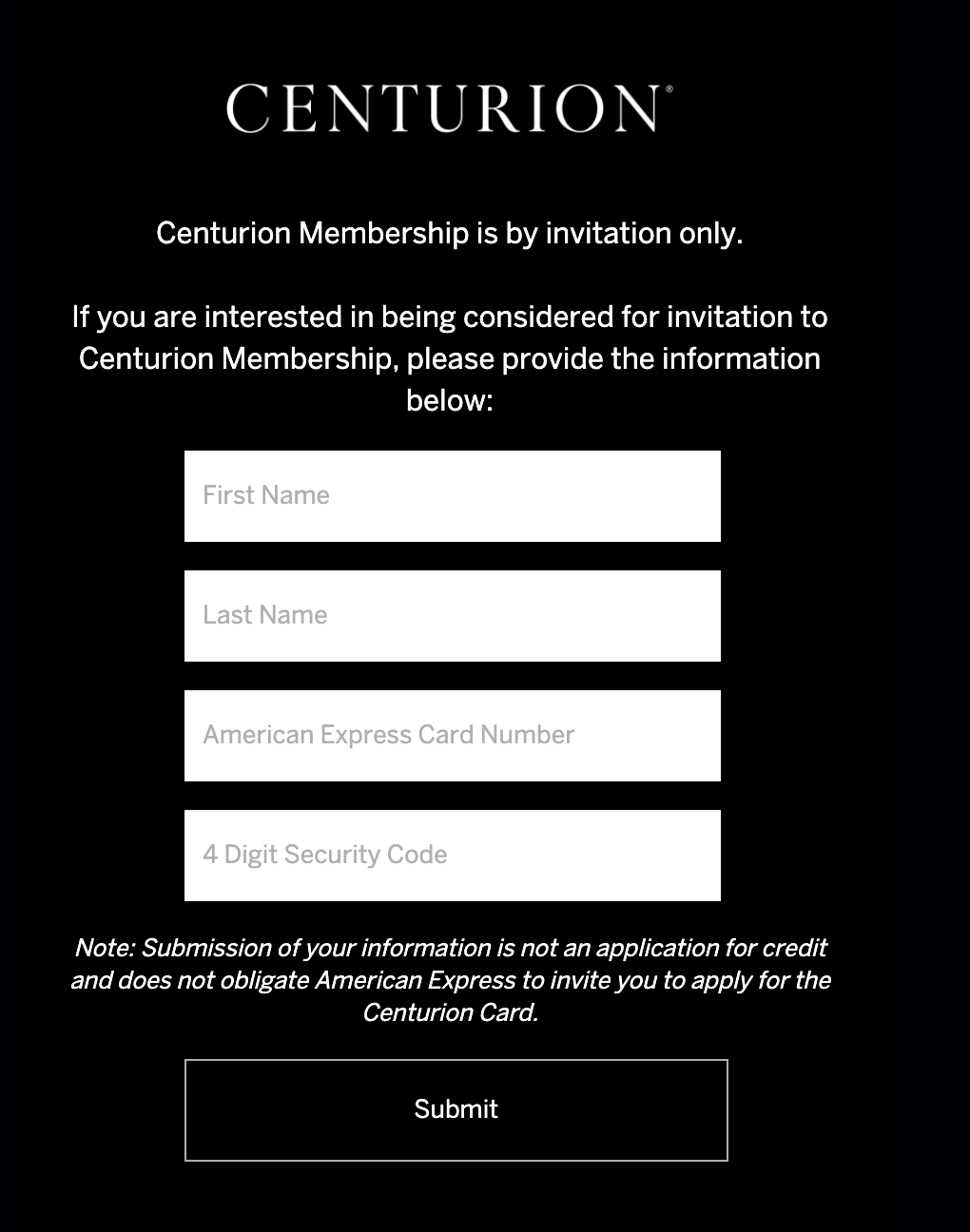

Sound Good? You can go here to request an invitation:

No guarantees…

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.