This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Think inflation is something you’re just dealing with at the grocery store or pump? Think again. Delta has completely overhauled the way you will earn status with the airline going forward and it’s all about those greenbacks. A lot of greenbacks.

Delta has followed American Airlines down the path of revenue only, dollars spent, requirement for status. In a lot of ways, this makes sense. Airlines make more money off their loyalty programs than people actually flying, so they want to incentive and reward those who spend more, not fly more. And…Delta is requiring that you spend A LOT if you want to be rewarded with status in their airline. The way they calculate spend is called MQD or Medallion Qualifying Dollar.

That spend can come from multiple sources: flights, hotels, car rentals, and of course their credit cards.

Speaking of which, lounge access is being slashed across all the Delta Amex cards as well as for the Amex Platinum and Amex Business Platinum.

Let’s check it out!

Table of Contents

What are the Status Tier Requirements?

The have blown the ceiling off the MQDs required for Platinum and Diamond Medallion status. You’ll now need to earn a whopping 35k MQD to achieve Diamond. Wow!

For 2025:

| Silver Medallion | 6,000 MQD |

| Gold Medallion | 12,000 MQD |

| Platinum Medallion | 18,000 MQD |

| Diamond Medallion | 35,000MQD |

For a frame of reference, here is what it was for 2024

| Silver Medallion | 3,000 MQD |

| Gold Medallion | 8,000 MQD |

| Platinum Medallion | 12,000 MQD |

| Diamond Medallion | 20,000MQD |

And 2023

| Silver Medallion | 6,000 MQD |

| Gold Medallion | 6,000 MQD |

| Platinum Medallion | 9,000 MQD |

| Diamond Medallion | 15,000MQD |

How can I earn Delta MQDs now?

- Flights = 1 MQD per $1 base fare dollar spent ( no taxes and fees )

- Delta Vacations = 1 MQD per $1 spent ( no taxes and fees )

- Cars, Hotels, etc = 1 MQD per $1 spent

How will Delta American Express Cards earn MQDs?

The MQD waivers are gone. It used to be that the Delta SkyMiles® Platinum American Express Card or the Delta SkyMiles® Reserve American Express Card would give you a MQD waiver, up to Platinum status, when you spent $25k a year on the card, and if you spent $250k, you’d get a Diamond waiver. Those are gone and you’ll earn MQD at the following rates.

Delta credit cards will earn MQDs at the following rates:

| $10 USD spent on Delta Amex Reserve Credit Cards | 1 MQD |

| $20 USD spent on Delta Platinum Amex credit cards | 1 MQD |

Starting 2/1/25 the access rules for Credit Cards that come with Delta SkyClub access are changing

Currently there are a few cards that come with access to Delta SkyClubs

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- The Platinum Card® from American Express

- The Business Platinum® from American Express

Amex Platinum and Amex Business Platinum – 6x

Starting on Feb 1st, 2025 lounge access will be limited to 6 times per year

Delta SkyMiles® Reserve and Business Reserve- 10x

Starting on Feb 1st, 2025 lounge access will be limited to 10 times per year

Delta SkyMiles® Platinum + Business Platinum – 0x

Starting on Feb 1st, 2025, you will know longer be able to pay for access

What happens to rollover MQMs?

If you’re sitting on rollover MQMS, which I’m sure a lot of your are, you will have the option to convert them into either MQDs or Delta SkyMiles

| 20 MQMs | 1 MQD |

| 2 MQMs | 1 Delta SkyMile |

However, you can’t just convert at whim. You need to convert in 25% increments. For instance, if you had 100k rollover MQMS you’d need to decide how you want to split them up.

- 50,000 MQM to SkyMiles = 25000Skymiles

- 50,000 MQM to MQD = 2500 MQD

or

- 25,000 MQM to Skymiles = 12,500 Skymiles

- 75,000 MQM to MQD = 3750 MQD

and so on and so forth.

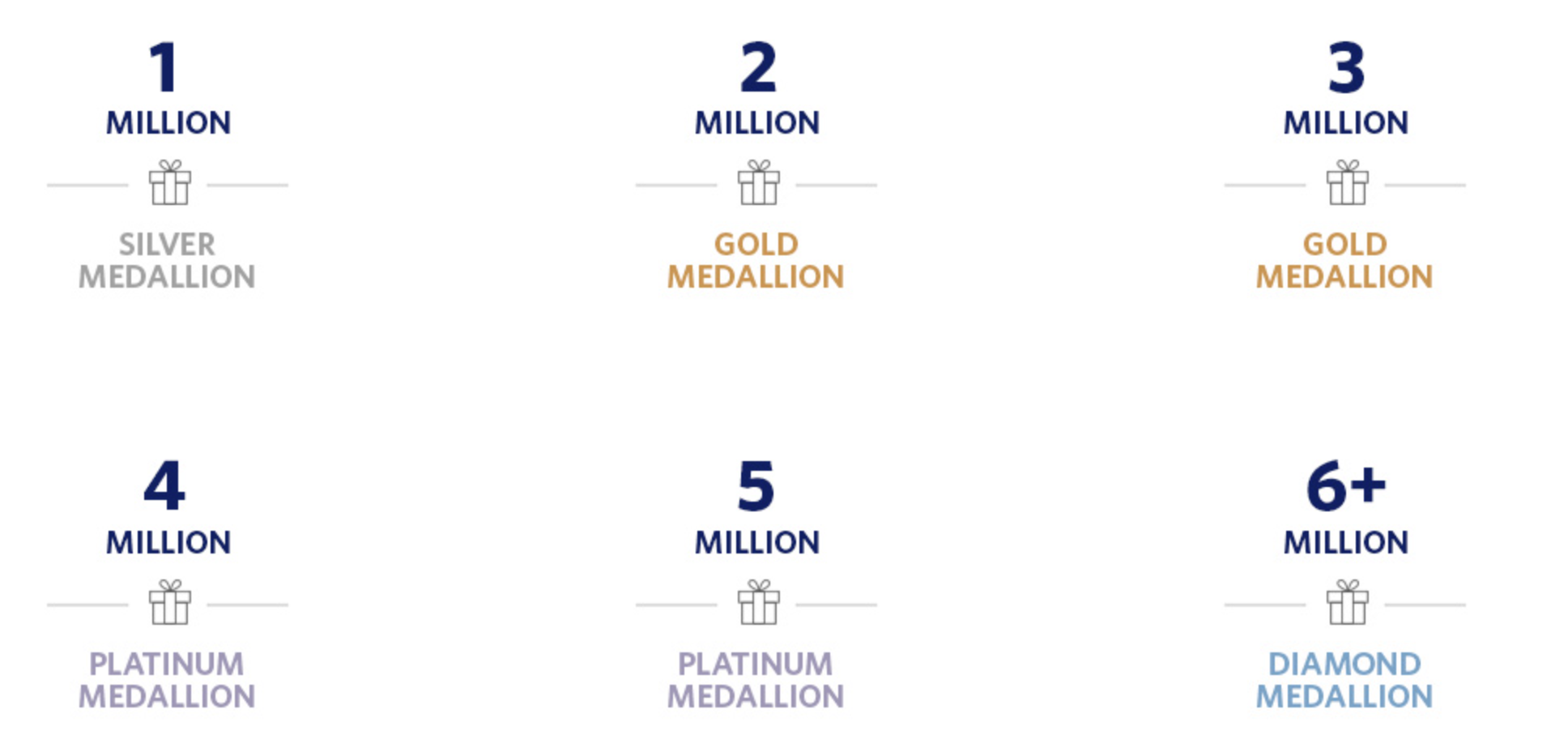

Million Miler Changes

Delta extends lifetime benefits to their “Million Miler” members. This will now be based on how many “butt in seat” miles you fly. So, whatever your number is currently, will be converted into “Miles Flown” and going forward you will earn another Million Miler mile based on the number of miles you actually fly. In the past, MQMs were counted. Todd O has flown 14 Million Miles so he is a lifetime Diamond Medallion regardless of how they are counted, but wow…6 million flown miles are now needed!

Overall

This is a seismic shift and honestly, status just isn’t worth chasing when it comes to US based airlines. I’ll likely credit my Delta flights to Virgin Atlantic or FlyingBlue.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.