We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Several weeks ago, Delta surprised the world with an absolute gutshot of a devaluation to their program. The response was nasty. Comments on my Instagram, TikTok, etc did not sugar the pill and once unwaveringly loyal Delta fliers were looking for a new home. Shockingly, Delta understood they took a step too far, and started publicly backtracking, committing to walking back some of the changes. Finally, people were waking up.

Well…Delta has taken steps and revised some of the changes, but all in all, the question remains…why on earth would you be loyal to Delta now? The writing is on the wall, and all they’ve really done is make things marginally less bad.

As you can see in the various altered changes below, status will still be harder to attain ( $28k MQD for Diamond and $5k for Silver ), lounge access will be still be restricted just not as much, they haven’t improved the value of their SkyMiles currency at all, and rollover MQMs have some bit to them. The program is still gutted.

Personally, I think airline loyalty has gotten to the place where it just doesn’t pay to be loyal. Upgrades are fewer and far between because airlines are selling first class seats at a far higher percentage, and when it comes time to redeem the points of most US based carriers, there isn’t much award space for those leisure destinations you want to enjoy on the back of your hard earned work miles. I credit most of my US based travel to foreign carriers that are partners of Amex, Chase, Citi, Bilt, Cap1.

But, let’s take a look at the changes and let me know what you think.

Delta SkyClub Access is a little better for credit card holders

The following credit cards currently all have some sort of Delta SkyClub access, and that was been changed yet again. One big change is that a SkyClub access will be defined as any 24 hour period, not per SkyClub location. Note that the changes for the Delta SkyMiles® Platinum American Express Card and Delta SkyMiles® Reserve Business American Express Card take effect 1/1/24 whereas the changes for the other cards don’t start until 2/1/2025

Once you’ve hit your max for the year, you can buy access for $50, or Medallion members can buy It for $695. If you’re traveling in Basic Economy, you won’t have access with any of the following cards.

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- The Platinum Card® from American Express

- The Business Platinum® from American Express

Amex Platinum and Amex Business Platinum – 6x will now be 10x

Starting on Feb 1st, 2025 lounge access will be limited to 10 times per year, this was changed from 6x

Delta SkyMiles® Reserve and Business Reserve- 10x becomes 15x

Starting on Feb 1st, 2025 lounge access will be limited to 15 times per year, changed from 10x

Delta SkyMiles® Platinum + Business Platinum – 0x

Starting on January 1st, 2024, you will know longer be able to pay for access

Revised Status Tier Requirements – still a massive increase from 2024

As you can see below, Delta has revised the Tier Requirements, lowering the thresholds somewhat, but compared to what you’d need to qualify for status in 2024, seen at the bottom, it’s still a massive increase.

New for 2025

| Silver Medallion | 5,000 MQD |

| Gold Medallion | 10,000 MQD |

| Platinum Medallion | 15,000 MQD |

| Diamond Medallion | 28,000MQD |

Old 2025:

| Silver Medallion | 6,000 MQD |

| Gold Medallion | 12,000 MQD |

| Platinum Medallion | 18,000 MQD |

| Diamond Medallion | 35,000MQD |

For a frame of reference, here is what it was for 2024

| Silver Medallion | 3,000 MQD |

| Gold Medallion | 8,000 MQD |

| Platinum Medallion | 12,000 MQD |

| Diamond Medallion | 20,000MQD |

And 2023

| Silver Medallion | 3,000 MQD |

| Gold Medallion | 6,000 MQD |

| Platinum Medallion | 9,000 MQD |

| Diamond Medallion | 15,000MQD |

MQD Boost added Delta American Express Cards

The following 4 cards will receive a $2500 MQD boost beginning 2/24 but will continue to earn MQDs at the rate given several weeks ago. Meaning, if you want to spend your way to Delta Silver, you’d need to spend $50k on the Reserve and $100k on the Delta Platinum. Wowzers.

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve Business American Express Card

The way that they will earn MQDs will remain the same.

| $10 USD spent on Delta Amex Reserve Credit Cards | 1 MQD |

| $20 USD spent on Delta Platinum Amex credit cards | 1 MQD |

Rollover MQM adjustments – decide by 12/31/24

Here is what was previously announced:

| 20 MQMs | 1 MQD |

| 2 MQMs | 1 Delta SkyMile |

They are adding in a new option for those with massive MQM balances. For every 100k MQMs you can extend your 2024 status for another year.

| Every “100k Rollover MQM” | Extend Medallion status for another year |

New options for Delta Medallion Choice Benefits

Starting 2/1/24 you’ll have the option to select the following Choice benefits when you hit certain Medallion levels. IF you’re unfamiliar when you hit Platinum or Diamond status you can choose a benefit you’d like, so these will be some added options for your selection.

MQD Accelerator

- $2,000 MQDs for Diamond Members

- $1,000 MQDs for Platinum Members.

Delta SkyClub Individual Membership

- You can use 2 Choice Benefit selections and get an Individual Membership

Bonus Miles

These can be put in your account, friend, or donated to charity

- Diamond Medallion Members = 35,000 miles

- Platinum Medallion Members = 30,000 miles.

Delta Flight/Vacation Voucher

- $350 for Diamond Medallion Members

- $300 for Platinum Medallion Members

Private Jet Credit “Wheels Up”

- Wheels Up flight credit for Diamond and Platinum Medallion Members

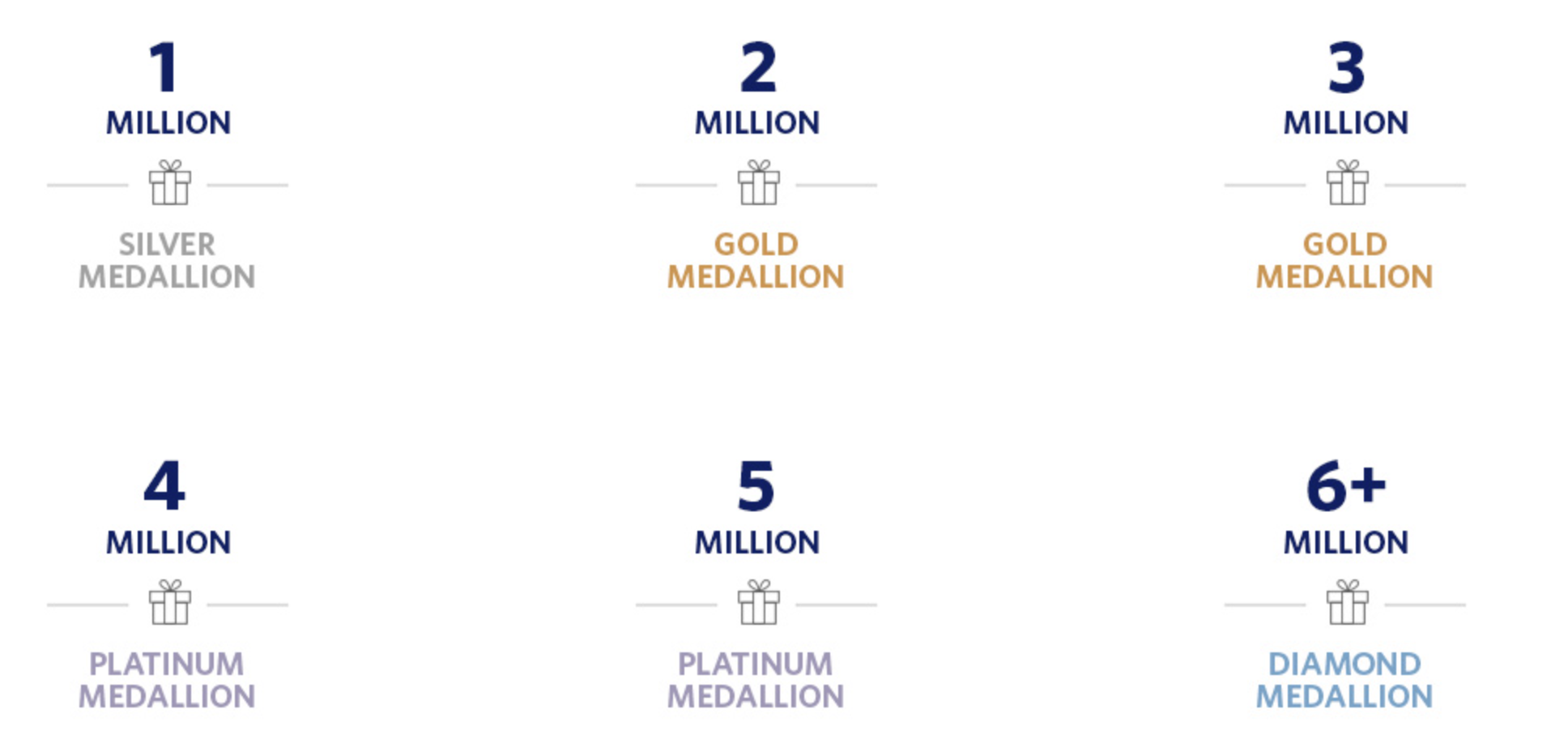

Million Miler Changes – Comped Status, upgrade priority

Delta also revised some of their Million Miler benefits and tiers.

- Only miles actually flown will be counted for Million Miler Status going forward

- Starting 1/1/24

- Upgrade priority will be #3 starting in 2024

- Comped Status

- 1 Million Miler Members will receive Annual Complimentary Gold Status.

- 2 Million Miler Members will receive Annual Complimentary Platinum Status.

- 3 and 4 Million Miler Members will receive Annual Complimentary Diamond Status.

- 5+ Million Miler Members will receive an annual invitation for Delta 360° Membership

As a frame of reference, this is what they had initially announced:

Overall – Delta is still dead to me

Overall – Delta is still dead to me

Why on earth would you still continue to be loyal to Delta. If you’re a 3 or 5 million miler, things got a bit sweeter, but I’ll be shopping cheapest flights on my travel, and when I do fly Delta, I’ll be crediting to either Virgin Atlantic or Air France/KLM Flying Blue.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.