We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

When I fired up the AA app this morning I found a new promotion available in the promotion tab. I’m Hyatt Globalist, and a few days ago a trial status became available for AA elites to try out Hyatt Explorist status. Now, AA accounts have been targeted for a trial AA elite status period for those who keep Hyatt status. It looks like Globalists have been targeted first, but keep an eye out as I have a feeling more will be targeted.

I started the year with Hyatt Explorist Status and no status with American. I don’t chase elite status with any airline, I choose the cheapest fares, and even purchase Spirit Elite status because the benefits off a couple flights outweighed the cost of the status. I will literally fly anything in the Continental US and only value business class on international travel, and the occasional transcontinental flight of 5+ hours or more…and usually not even then.

I wound up landing Hyatt Globalist status because of the lucrative Bilt Rewards promo earlier in the year whereby any Bilt Rewards member could get 3 months of Hyatt explorist with an opportunity to keep Globalist through 2/25 if they stayed 20 nights in 90 days. I fulfilled that challenge, and it has ended up netting my AA Platinum Pro as well because of the AA/Hyatt parnership.

If you’re unaware of this partnership, make sure you link your accounts. You’ll earn AA miles when you stay at Hyatt properties ( in addition to World of Hyatt points ), and Hyatt points when you fly AA ( in addition to AAdavantage miles ).

Let’s take a look at this promotion for trial AA status.

AAdvantage Instant Status pass for Hyatt Elites

- Register by October 12, 2023

- Get Status for 4 months

- Keep status for another 4 months by fulfilling the following requirements in 120 days

- Gold – 13,000 Loyalty Points

- Platinum – 25,000 Loyalty Points

- Platinum Pro – 42,000 Loyalty Points

- Executive Platinum – 67,000 Loyalty Points

The secret Loyalty Point weapon – AAdvantage Hotels

Aadvantage Hotels earns you AA Loyalty Points on bookings and they can be absolutely massive. In addition to the base rate, AA Elites and AA Credit Card holders earn even more

- Capped at 15k LP

- 5x bonus for AA credit card holders

- 5x bonus for AA Elites

- If you do a “check out” boost – those will only earn you AA miles, not Loyalty Points ( not worth it imo ).

Since I’ve been given a trial AA status, and I keep a Barclay Aviator Red Business Card, I’ll get a 10x boost on any hotel booking. This could be advantageous in the next 4 months if I’m looking to stay at a hotel that isn’t associated with any brands I have status with since I’d not only earn AA miles, but AA Loyalty Points that could secure status.

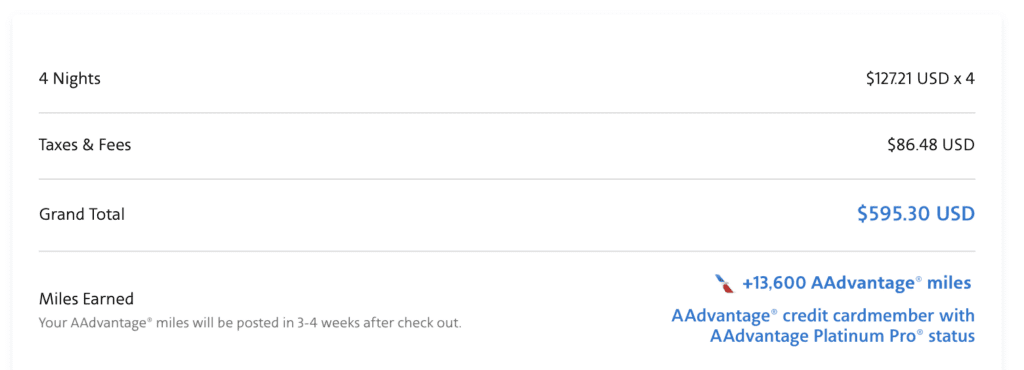

This is just a quick example, but for about $600 I could earn 13,600 AA mile and 13,600 Loyalty Points with a 4 night stay. Let’s say those AA miles are worth 1.5c – I’d be getting about $200 back in the form of AA miles, and securing Gold status for another 4 months. I won’t be doing this, but that’s about $400 net for an additional 4 months of Gold status.

Overall

I went ahead and registered. There is the possibility I will be use the Aadvantage Hotels trick on an upcoming trip to pick up a few extra AA miles, and who knows, maybe I hit Gold. Otherwise, I’ll have the status for 4 months and lose it. Something gained, nothing lost. Amazingly, I’ve done this in the past, and they just keep targeting me. That was my concern last year, when the same thing happened, and lo and behold, I’m targeted again – ruling out being precluded from the promo for past participation.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.