We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Holy Schmoly Guacamole. Bilt Rewards will be the only program to have Alaska Airlines as a 1:1 transfer partner…that’s a massive deal. Alaska miles are some of the most valuable in the industry and they recently became a full fledged member of One World meaning you can redeem on American Airlines, British Airways, Japan Airlines, Cathay Pacific, Qantas, the list goes on and on. ( I am a Bilt Investor and Senior Advisor btw ).

But they didn’t stop there.

Use an Alaska Airlines credit card to pay rent in the Bilt App and earn 3x Alaska Miles ( with a 3% fee ) Now live.

As part of the partnership, later this year, if you have an Alaska Airlines credit card you can pay your rent with it, up to $50k a year, and earn 3x Alaska miles. WOW, WOW, WOW. Paying rent with a credit card and incurring no transaction fees was unprecedented, but now integrating other credit cards into the app to earn their points on rent? That’s a double game changer. It’s like the movie Inception, they changed the game inside a game changer.

- Alaska Airlines is now a partner of Bilt Rewards

Later this year, Starting today, May 15th, load your Alaska Airlines credit card onto the Bilt App and earn 3x on Rent, up to $50k- Note that a 3% fee will be charged, so you’re effectively buying Alaska Miles at a penny a piece ( i’d value them around 1.5c, maybe bit more )

How does using the Alaska card count toward Bilt status?

- Long story, short, it doesn’t count

- Just like rent paid via Bilt – the spend doesn’t count towards the spend requirement of status

- And because you’re choosing to Alaska Miles vs Bilt Rewards you don’t earn any points toward status either

Bilt Rewards Transfer Partners

- Note that American will be dropped in June

Alaska Airlines Award Charts

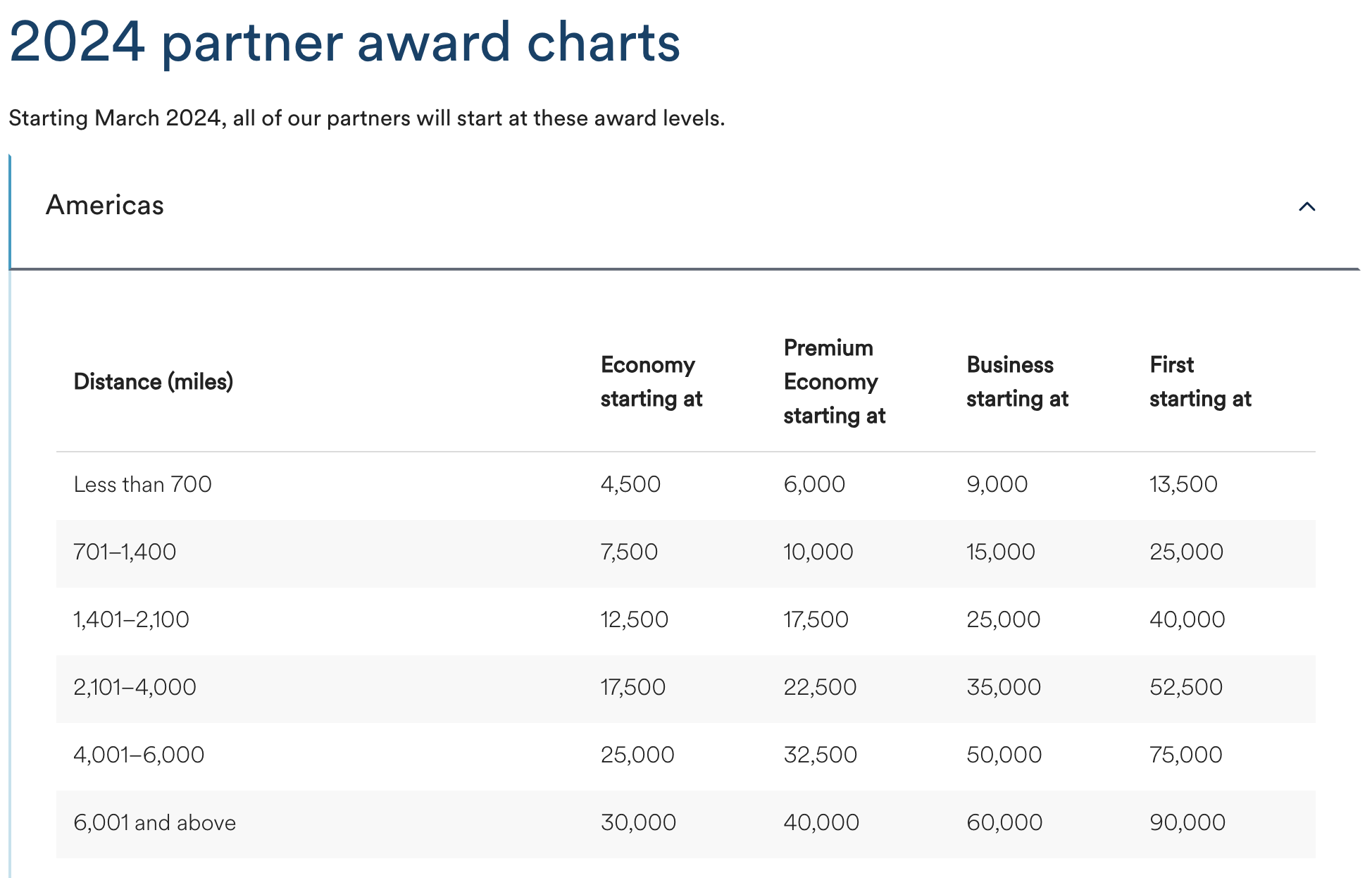

Americas

Flights here in the Americas aren’t really that attractively prices unless you’re popping down to South America where you can hop in business class for 35k to 60k. That’s a darn good deal.

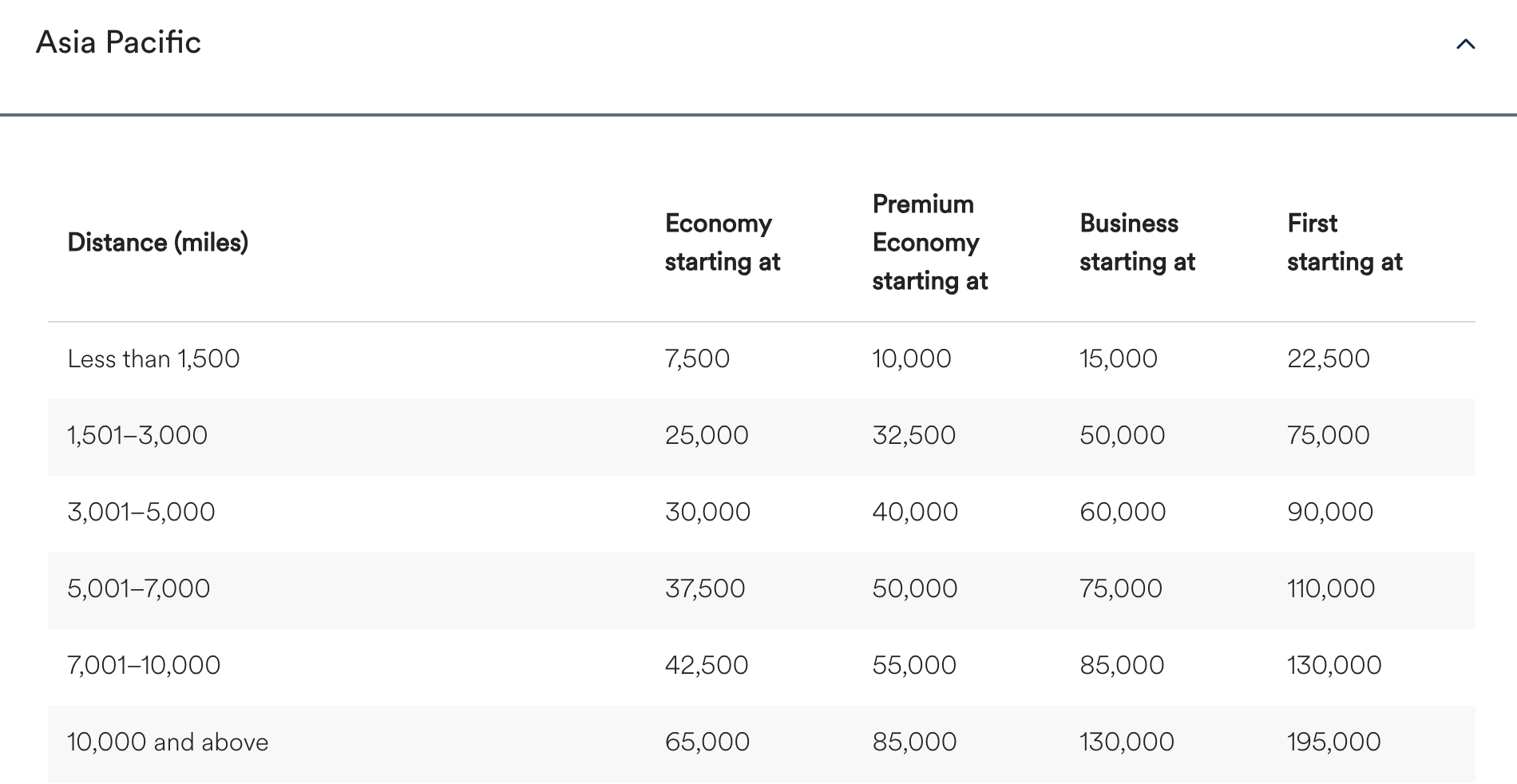

Asia Pacific

Asia Pacific

- Business Class

- to Japan is 75k

- Taipei/Hong Kong/SE Asia 85k

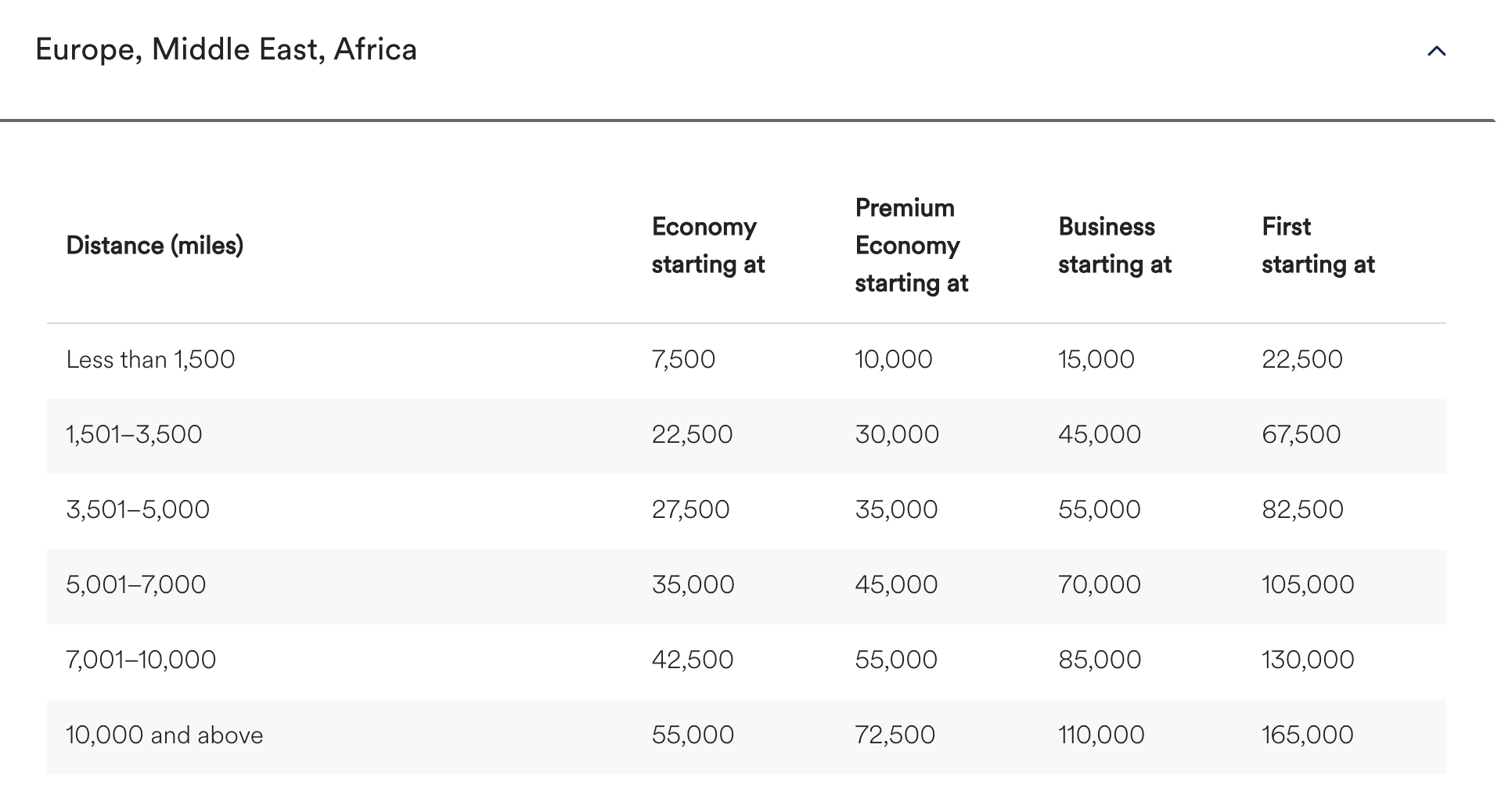

Europe/ME/Africa

Europe/ME/Africa

- Business Class to most of Europe is 55k to 70k depending on routing and if you’re flying from East Coast or West Coast

- First Class from Dallas, ORD, East Coast is 82.500 ( which is a pretty darn good deal )

Overall

Overall

If I had to choose between having American Airlines or Alaska…I’d take Alaska all day every day. They still publish an award chart and their partners are outstanding. Well done Bilt.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.