This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

In November, we saw the program add Marriott, and now Avianca has been added as Bilt Rewards 15th transfer partner! My oh my, the program just continues to get better and better and better. You can earn points on rent, we’ve gotten multiple 100% transfer bonuses for Rent Day, a dining program that you can stack with other programs, no annual fee, the list goes on and on. I signed on to Bilt Rewards as a senior advisor and investor over 2 years ago now and I have to say, they’ve blown any expectations I’ve had out of the water. I look forward to what 2024 holds, have heard some insider rumbles of what’s to come, and I think y’all are going to be VERY happy with what’s in stow.

Unfamiliar with Avianca’s Lifemiles program…you’re probably not alone

Avianca can provide excellent access points to Star Alliance award inventory. You can also use them on AeroMexico and Iberia. I do want to point out that the online booking system can sometimes be clunky, and customer service is hit or miss.

Should you transfer?

Totally depends – it can be a resounding yes when you’re accessing business or first class awards, or short haul economy in the USA, but at other times, you may want to look at other partners.

Avianca point sales

You can see what the latest one is here, but if you don’t have enough Bilt Rewards in your account to make a full Avianca LifeMiles redemption, you can often buy LifeMiles with a very good bonus. Sometimes there is even a transfer bonus between Avianca LifeMiles accounts, meaning you may be able to transfer 10000 Bilt Rewards to get 10,000 LifeMiles, then pay a transfer fee to move another LifeMiles account, and get 25,000 LifeMiles, etc depending on the bonus. You could then book from that account.This opens up ways to expand the use of your Bilt Rewards that you may not be aware of.

Note that United, Aeroplan, and Avianca LifeMiles are all partners of Bilt Rewards, but Avianca prices business class from the US to Europe on United at the lowest amount of miles: 63k ( 70k for Aeroplan and 80k for United ).

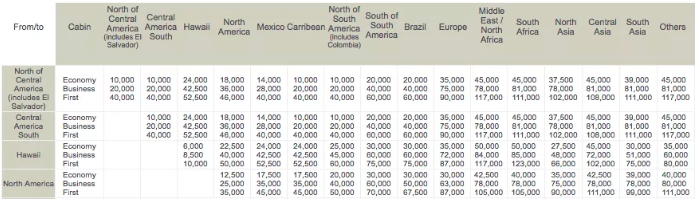

Here’s a look at Avianca’s award chart

This chart is unpublished now, but seems to still be accurate.

Sweet Spots include:

- US to Europe in Business Class for 63k

- US to Europe in First Class for 87k

- US to North Asia in Biz for 75k

- US to North Asia in First for 90k

- US to South America in Business or 50k

- US domestic economy for 7500

Mixed Cabin trips are where its at!

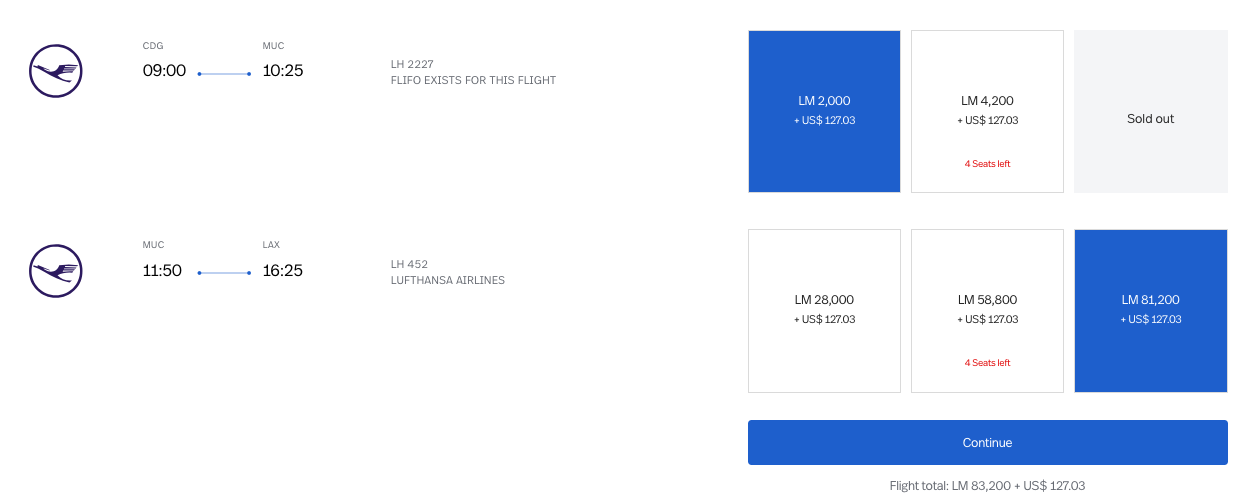

As I noted above, one of the sweet spots is booking First Class between Europe and the US for 87k miles. However, Avianca gives its loyalists a break when their entire itinerary isn’t in the same cabin. Here’s a look at an itinerary from Paris via Munich to Los Angeles in Lufthansa First Class. Since the first leg is in economy the price is knocked down to just 83,200.

Overall

Bilt Rewards continues to provide value to their customers offering more options for redemption!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.