We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

If you’re a renter, Bilt Rewards makes it super easy for you to pay rent with a credit card – fee free. Yes, you read that right. Ordinarily, you’d have to pay a transaction fee to earn points on your rent. Bilt changed the game when they offered a no annual fee card that allows you to earn points when you rent ( so long as you make 5 other transactions per month ). Heck, they will even mail your landlord a check if your landlord isn’t in the Bilt Alliance, and Bilt works if your landlord accepts Venmo, PayPal, or ACH . I’m a senior advisor with the company and they have been steadily adding more and more benefits and partners ever since I partnered up. June 30th, they announced their new Bilt Rewards Travel Portal which allows you to redeem your Bilt Rewards at 1.25c per point – the same as the Chase Sapphire Preferred.

Bilt Rewards Transfer Partners

Up until June 30th, the only way to redeem points was to transfer.

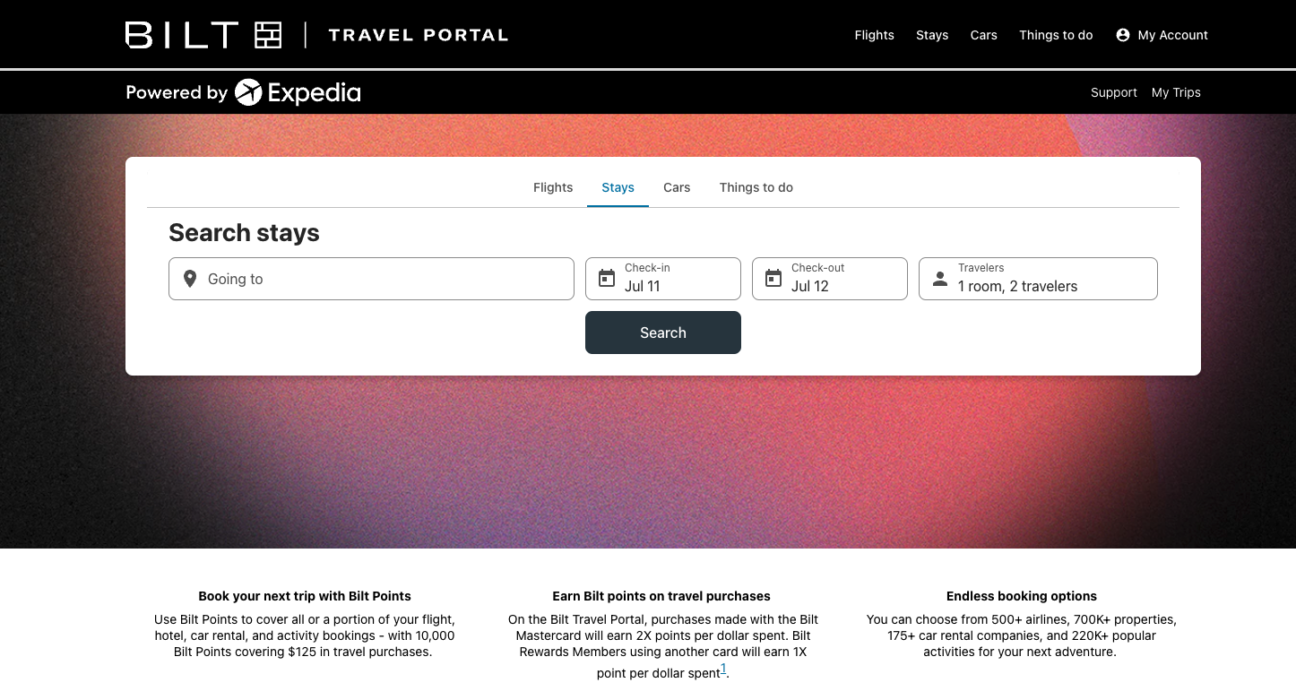

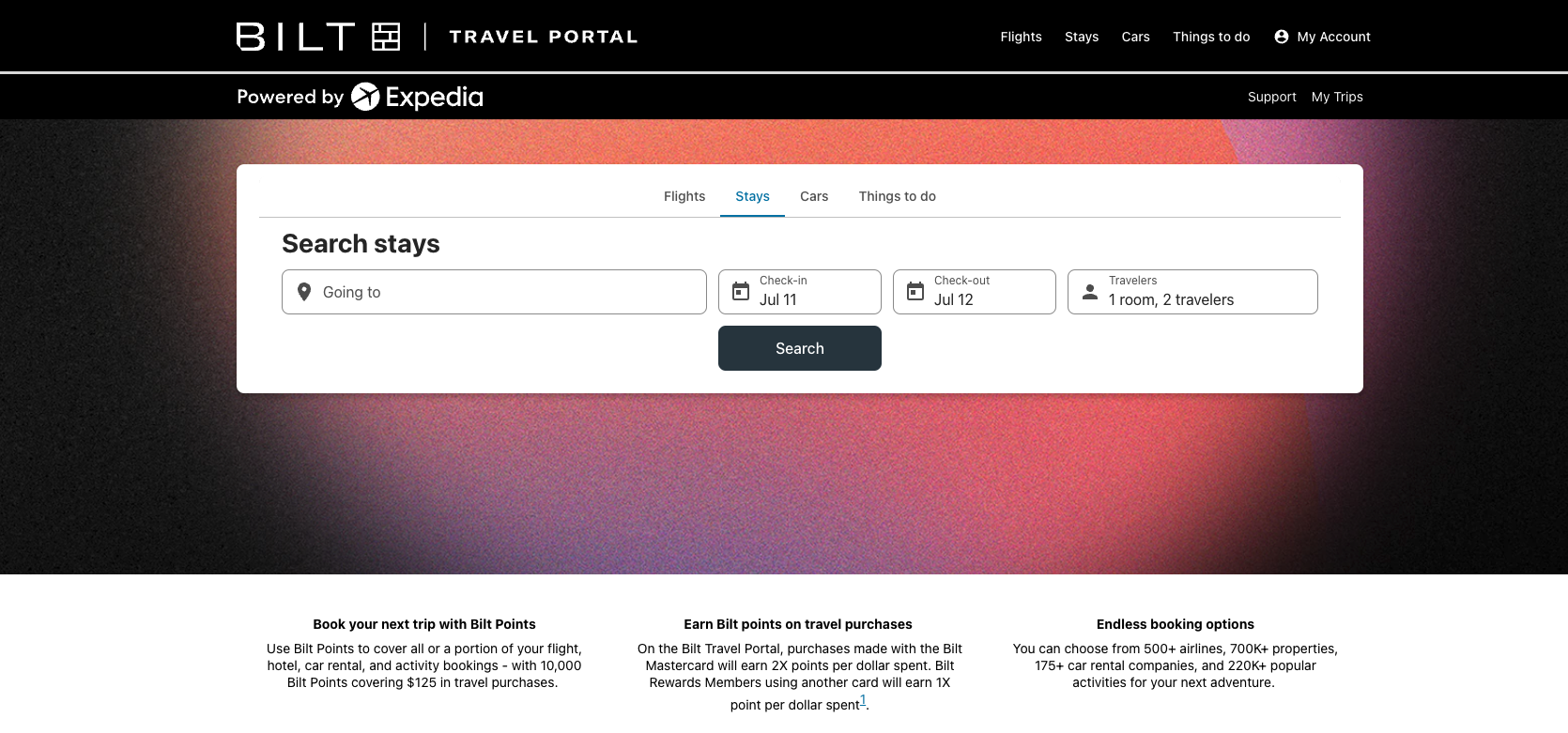

Now you can use the Bilt Rewards Travel Portal – powered by Expedia to redeem and earn points.

The Bilt Rewards Travel Portal is powered by Expedia meaning, if you see a flight, hotel, activity – heck even Disney or Universal tickets for sale on Expedia… you will see them here as well.

Here’s an example of what a search looks like in NYC…

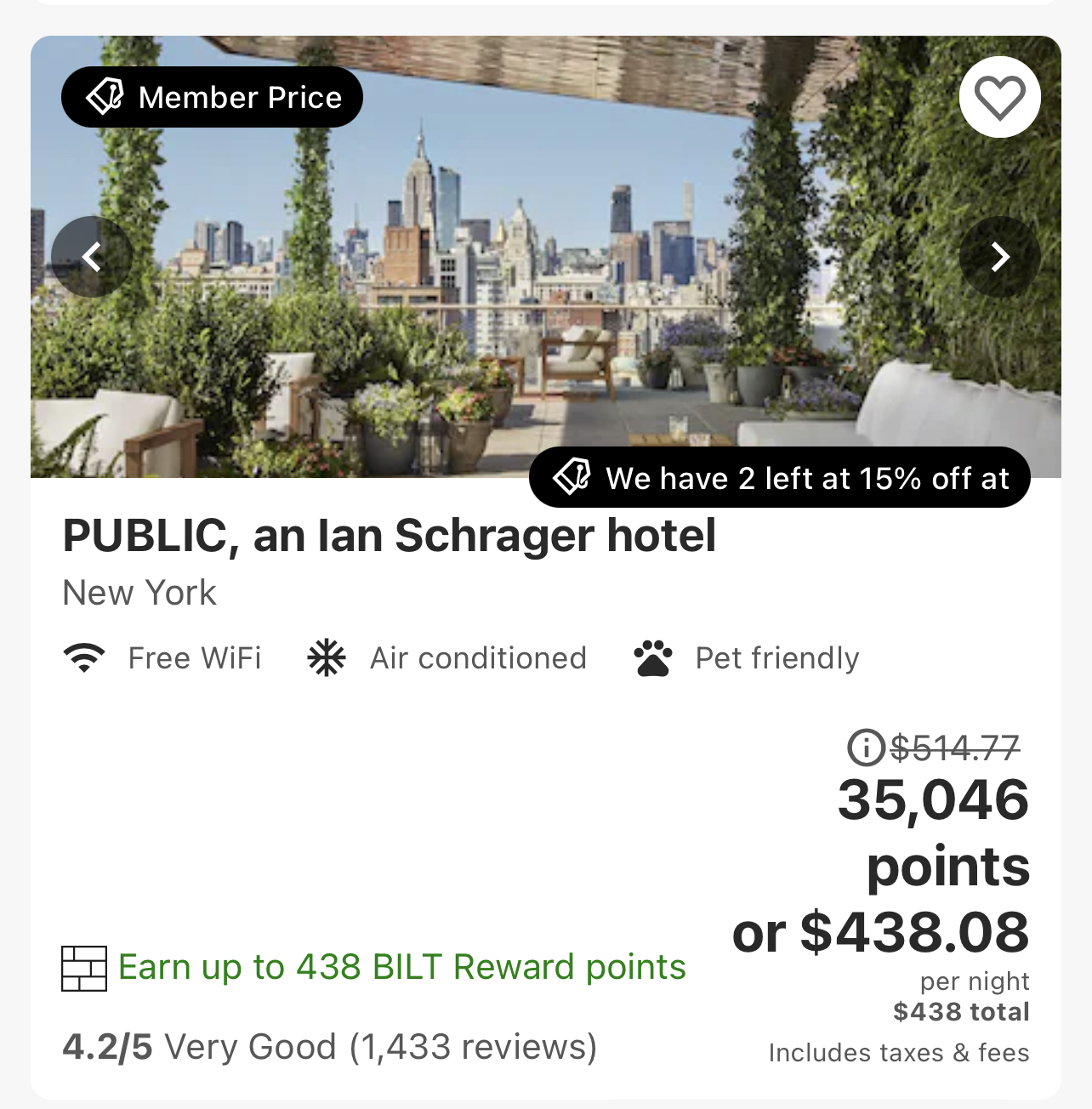

Earning and burning points in the portal

- Bilt Rewards Mastercard members will earn 2x on all transactions in portal

- Bilt Rewards members ( non credit card holders ) earn 1x

You can use your points at a fixed 1.25c valuation on anything you find in the portal

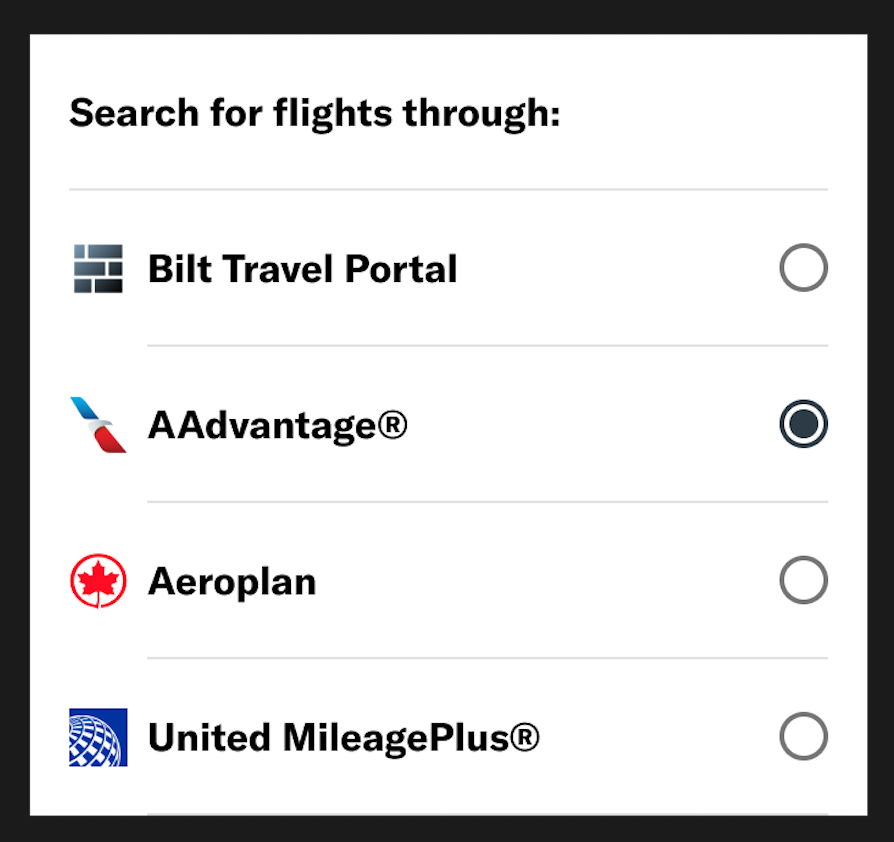

Bilt Travel Comparison Feature

There is a new function that will allow you to compare the Bilt Travel Portal with 3 transfer partners: American, Aeroplan, and United. This way you can choose which is the best use of your points.

Recap

I think the Bilt Rewards Mastercard is a great card for those who want a straight forward seamless way to earn points that can be redeemed at a competitive rate and transferred to partners. Are there other ways to pay rent with a credit card? Sure… you could buy gift cards, money orders, blah blah blah. Most people won’t do this, and Bilt has found an innovative way to capture a massive market segment that currently most people don’t earn points on.

- New Bilt Travel Portal powered by Expedia with 1.25c redemption rate

- Earn at 2x if you have the credit card, 1x as a member

- New Toggle feature introduced for comparisons.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.