This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Using Hyatt points to upgrade from a base room to a suite is arguably one of the highest value redemptions you can make. Often times the price differential is 100s of dollars, but it only costs 6k points to upgrade a standard room to a standard suite and 9k points to a premium suite. While it’s been something that I’ve done frequently in the past, I wasn’t aware that the option is now available online, at the time of booking. This is an amazing perk – have I missed this at some point?

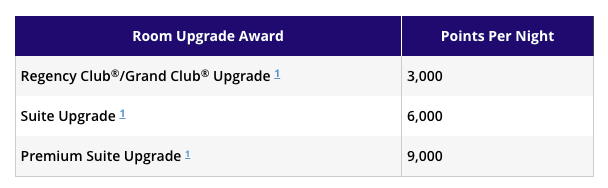

Here’s the official chart from World of Hyatt that breaks down the upgrade award rates

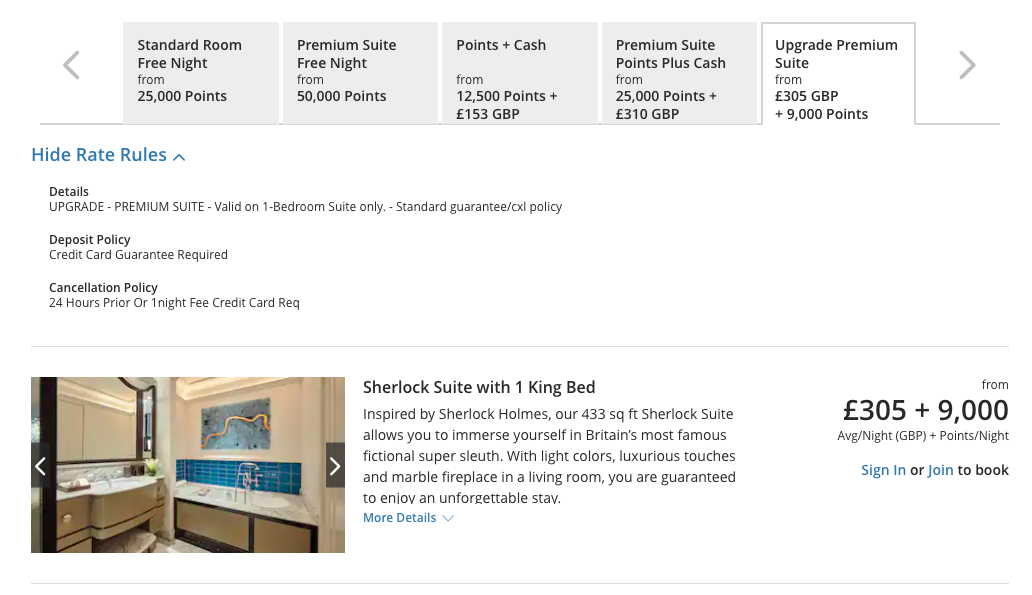

An example in London with a premium suite

An example in London with a premium suite

I had been looking at using points to stay at The Great Scotland Yard hotel which is a part of the Unbound Collection and is currently a part of the 25% back promo when using points, points + cash, etc.

The base room is:

However, when you look at View Points you can see that booking the base room and then upgrading into a Premium Suite is the rack rate + 9000 points. Pretty amazing, especially considering I”d get 2250 of those points back as well.

However, when you look at View Points you can see that booking the base room and then upgrading into a Premium Suite is the rack rate + 9000 points. Pretty amazing, especially considering I”d get 2250 of those points back as well.

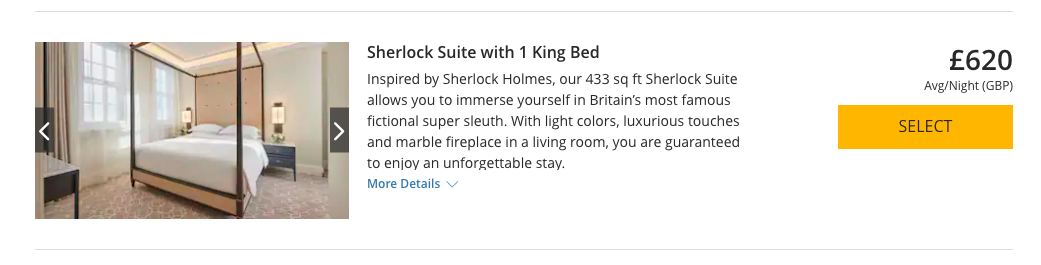

That premium suite is a Sherlock Suite that is over 300 pounds more per night. At 9000 points, that’s 33 cents per point.

That premium suite is a Sherlock Suite that is over 300 pounds more per night. At 9000 points, that’s 33 cents per point.

The Park Hyatt New York

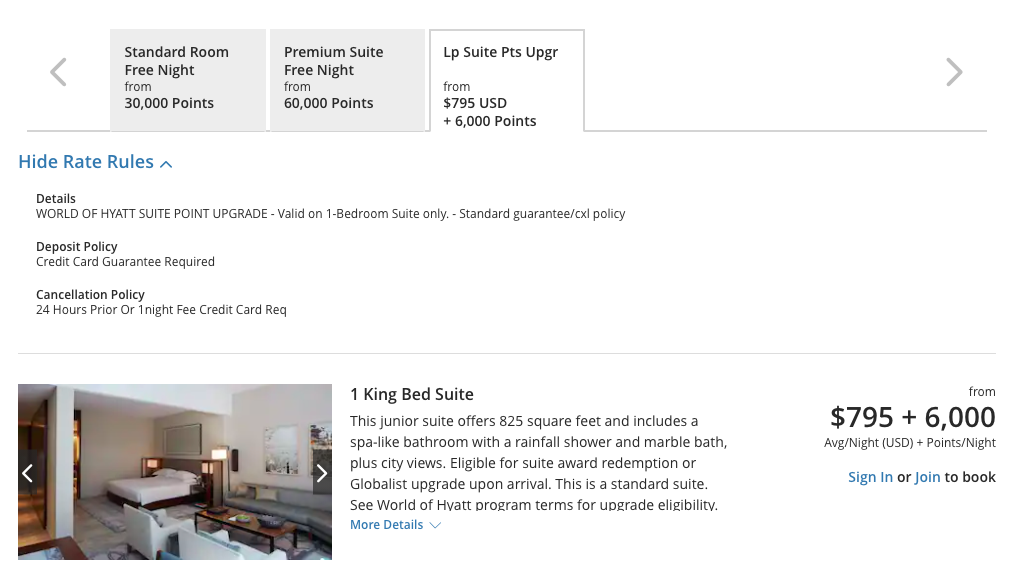

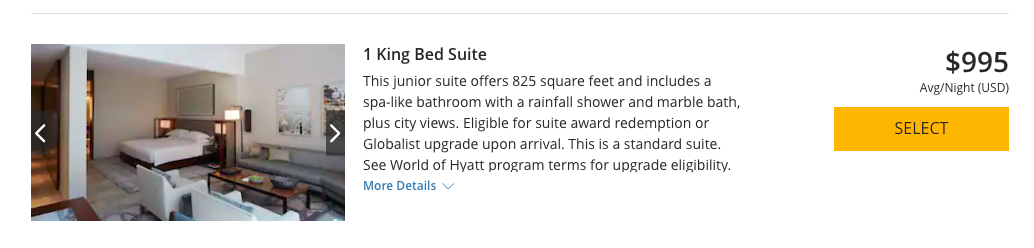

I did another search to see if standard suites were available with a points upgrade at the time of booking. I stumbled upon the Park Hyatt New York. Obviously these rates are insanely high, but they illustrate the point.

Then with points, you can upgrade to a standard suite

Which would usually cost $995

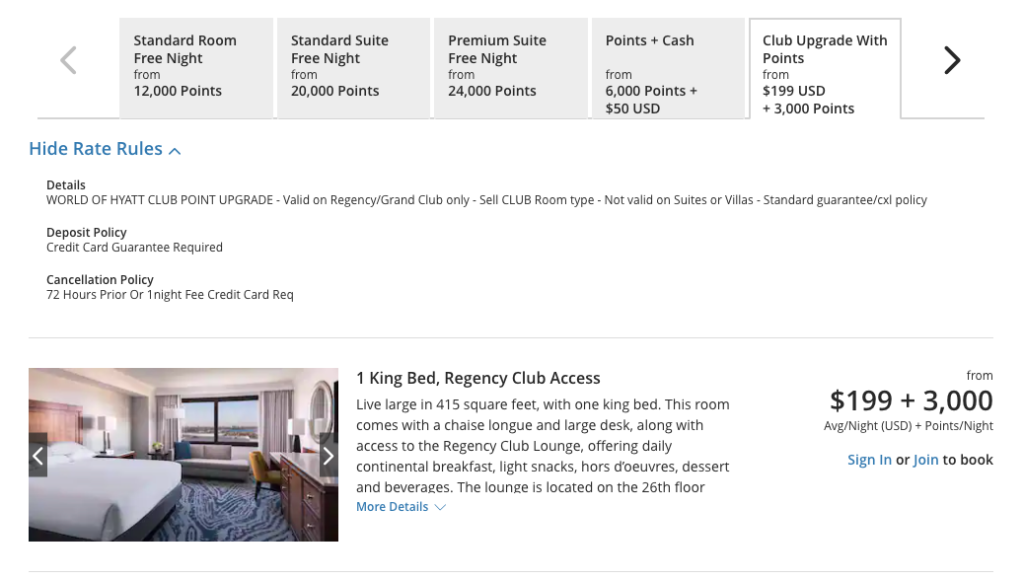

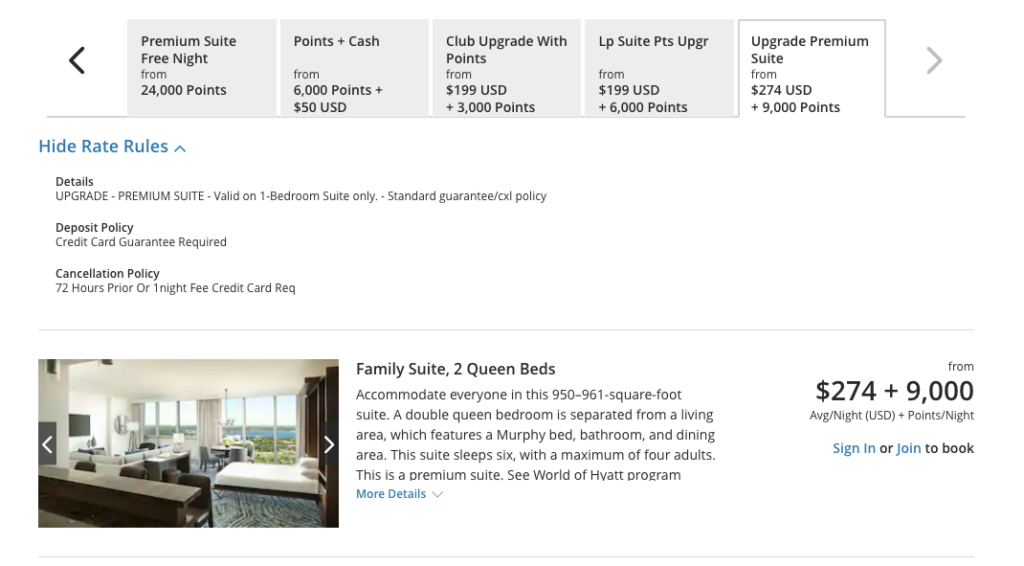

Hyatt Regency Orlando

This hotel always has fun upgrade options and it didn’t disappoint. Club, standard and premium were all available. There were so many options I had to click the arrow to see them all

Overall

This is a great addition to the Hyatt website and illustrates just how valuable these points can be when used for the right redemptions.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.