This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Buy IHG points with 100% bonus is more than just the normal promo

Getting a 100% bonus when buying IHG points is a great deal – it effectively equates to just 1/2 a cent a point – and that creates a great way to shore up your account, but it also generates discounted access via purchased points compared to just paying for the room outright. In the past, they’ve always limited purchases to 60k. IHG just sweetened the deal

They increased the pre-bonus max to 100k

Why does this matter? Let’s walk through some examples, including how to get top tier properties for $250 a night or less. Like the feature pic of the Intercontinental Hong Kong and it’s insane breakfast spread.

It means you can excise the value of buying points for stays vs paying outright more times per year.

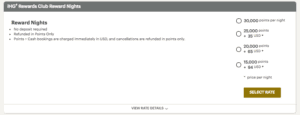

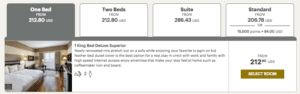

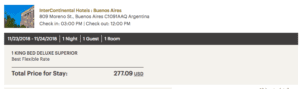

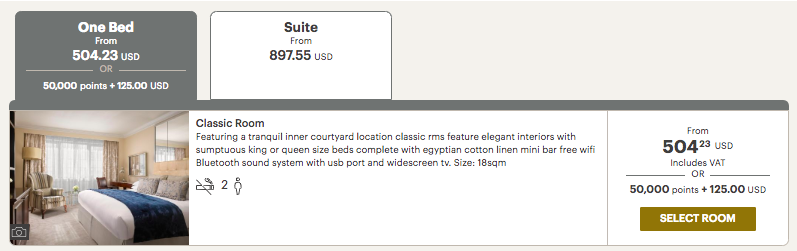

I’ll use the Intercontinental Buenos Aires as an example. Here’s a look at what it would cost you to stay there on a random weekend in November vs using points. $277 ( all in ) vs 30k points per night. It also, just so happens that the minimum purchase is 30k = exactly what this hotel costs.

With this 100% offer you could actually just buy points to stay for $150 a night ( a $127 nightly value), but it gets better.

You can buy points and stack with credit card perks/Ambassador and lower your nightly rate even further

- The old, now grandfathered, IHG Rewards Select – offers 10% back on award stays

- 3k a night here

- The new IHG Rewards Club Premier offers buy 3 get the 4th free.

- worth 30k points here

- Ambassador renewal offers of 10% back ( up to 100k points ) on Intercontinental stays.

- 3k a night here

This would mean you’d effectively be paying 24k a night for 3 nights, or 72k points ( $360 with this offer ) to stay 4 nights vs over $1000 paying outright. Huge value.

Increasing the purchase cap from 60k to 100k = 2 more nights at 40k hotels = increased value in credit card annual night certificates.

80k additional points ( 40k + 100% bonus ), or 200k in total, means you can buy 5 nights per year at hotels that require 40k points for an award night. This number just so happens to exactly correlate to the maximum value of either annual night certificates issued by both IHG Rewards Club Premier and the now grandfathered IHG Rewards Select ( post any hotel certs expiration ).

Why does this increase the value of credit card annual night certificates?

Most people aren’t looking to go and spend just one night at a property, but rather a weekend, or even a longer trip. The ability to buy another night at that property for a maximum price of $200 means you’re more likely to use the annual night certificate at a property you’d like to visit rather than burn it to just “get some value out of it.”

Effectively buy 4 nights at top tier properties for $1000.

- Need 10k+ points in account

- Need the IHG Rewards Club Premier card

- Hotel has 4 nights award availability

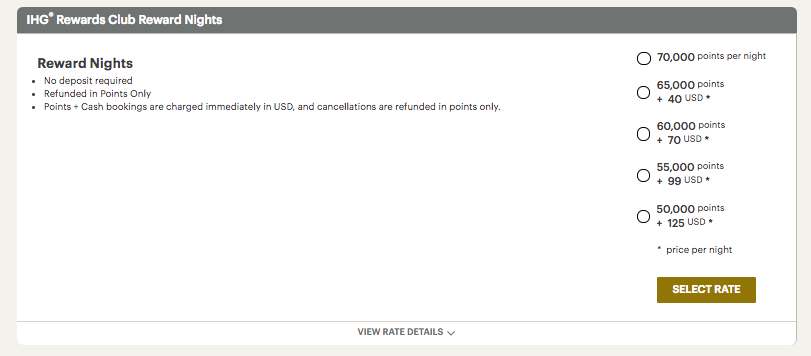

Since IHG prices their most exclusive properties at 70k a night, and the IHG Rewards Club Premier gives you a 4th night free on award stays —> this means you can stay 4 nights for just 210k points. If you don’t have the 10k, you transfer them in from Chase…

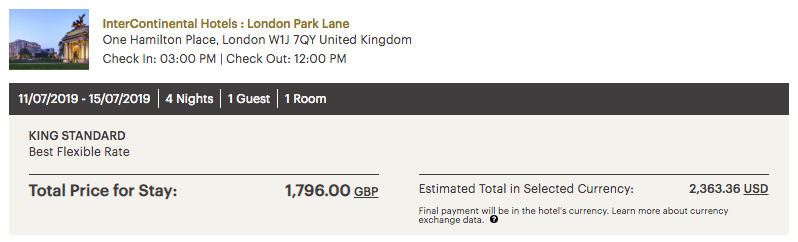

Here’s an example of the Intercontinental Park Lane – with this deal you’d spend $1000 vs $2300+

The Intercontinental Park Lane is in an incredible location overlooking Hyde Park, and cash rates are always pricey.

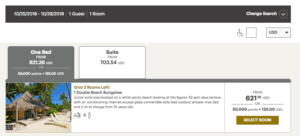

Or how about the Intercontinental Moana Bora Bora – late October – $1k vs $3k+

Who doesn’t want to go to paradise. At $250 a night…this is downright doable. Honeymoon anyone?

This would put you in a standard beach bungalow – you could use all that saved cash to upgrade yourself to an overwater villa at check-in 🙂

Things get better from here: if you have any of the aforementioned credit cards/Ambassador 10% rebates – you’d be receiving 42k points back after your stay.

Yes, that means you’d spend a net 168k points or $840 out of pocket, $210 a night.

I’d never suggest speculatively buying points, but this is a great deal. It should also be noted that the 100% bonus kicks in on purchases over 30k

Promo ends October 31. You can buy here. Appreciate the support!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.