This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Buy status with American for 2017

Opened my email and found a ridiculous offer to buy status. I don’t mean ridiculous in a good way, I mean ridiculously expensive and not worth it with this much time left. If you’re interested there are a few different offers floating around to buy status with american for 2017.

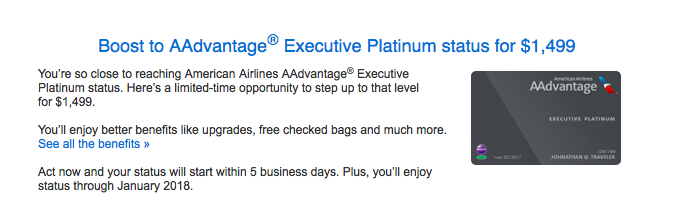

My Offer: Executive Platinum for $1499

Now, I don’t think this is too bad of a deal if it’s December 31st and you’re a lot of EQM away from hitting Executive Platinum, but we have over 6 weeks left. Plenty of mileage run time left if you need those EQM. If you don’t want to mileage run and get this offer…aside from First Class Lounge access internationally, a bevvy of other upgrades opps, you would get 4 System Wide Upgrades. That’s $750 per roundtrip upgrade. Of course…if you’re in paid business and an upgrade is avail you could use these for a First Class upgrade as well.

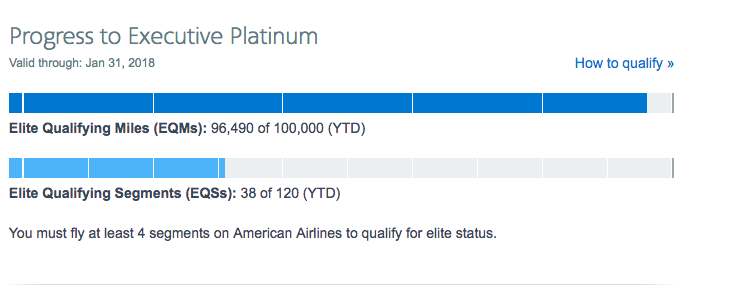

However…I’m roughly 3500 EQM away. Not worth it to me, especially because I’ll hit it over thanksgiving.

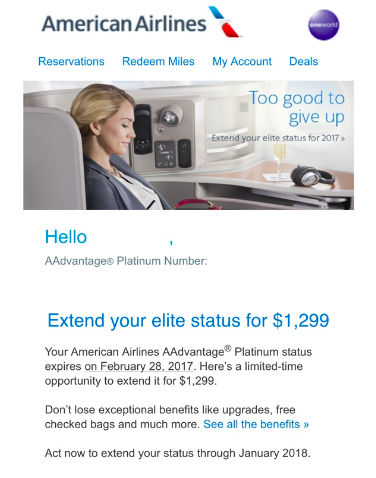

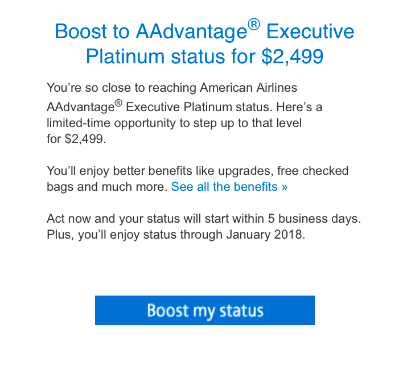

Here’s what someone with roughly 88k EQM received.

Here’s what a buddy of mine with Platinum received to Extend his Platinum Status for 2017. He currently has roughly 25k EQM

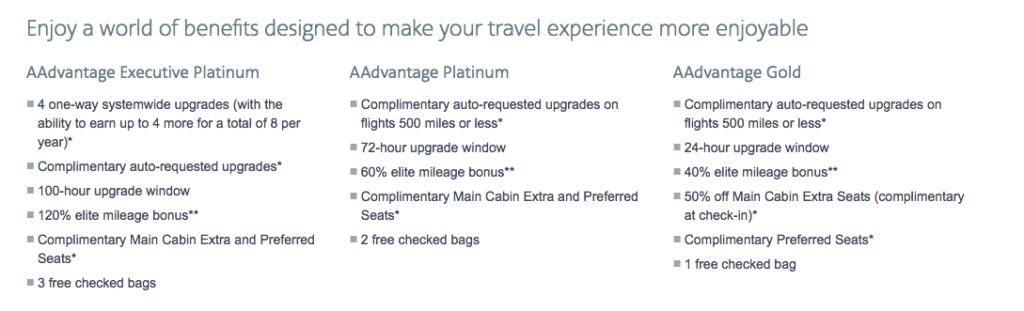

In case you aren’t familiar AA status levels. Here’s an an overview:

In all honesty, I don’t think one of these offers is a great value proposition. I suppose you could make an argument that if you’re significantly short, can’t mileage run, and offered $2500 and knew you’d use the SWUs – it’s not terrible. Here’s my thinking: with 4 SWUs you’re essentially buying roundtrip business class upgrades for $1200 each, and that’s not awful.

BUT, when you look at some of the mileage run opportunities out there to get over the hump organically…not such a great deal. Luckily, I’m really well positioned and don’t need to take any of these into deep consideration.

Please, lemme know if you end up buying status!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.