This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

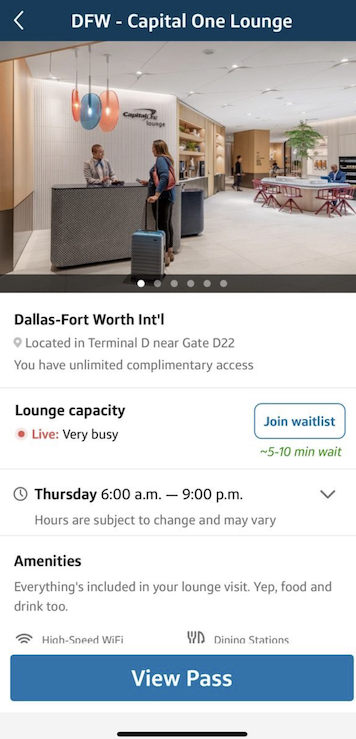

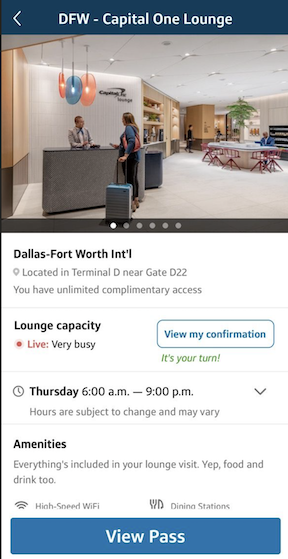

Capital One has now added a feature to their mobile app for Venture X and Venture X Business cardholders that will tell them if a lounge is at capacity, and if so, allow them to add their name to a waitlist. Most eligible cardholders will be able to use this feature now, and all eligible cardholders will have access in the next few weeks.

Here’s a look at the feature

Capital One Lounges

I’ve visited all three Capital One Lounges and they are amazing…though starting to get crowded so hopefully this and the restrictions on access will help.

- Denver

- Washington DC Dulles

- Dallas DFW

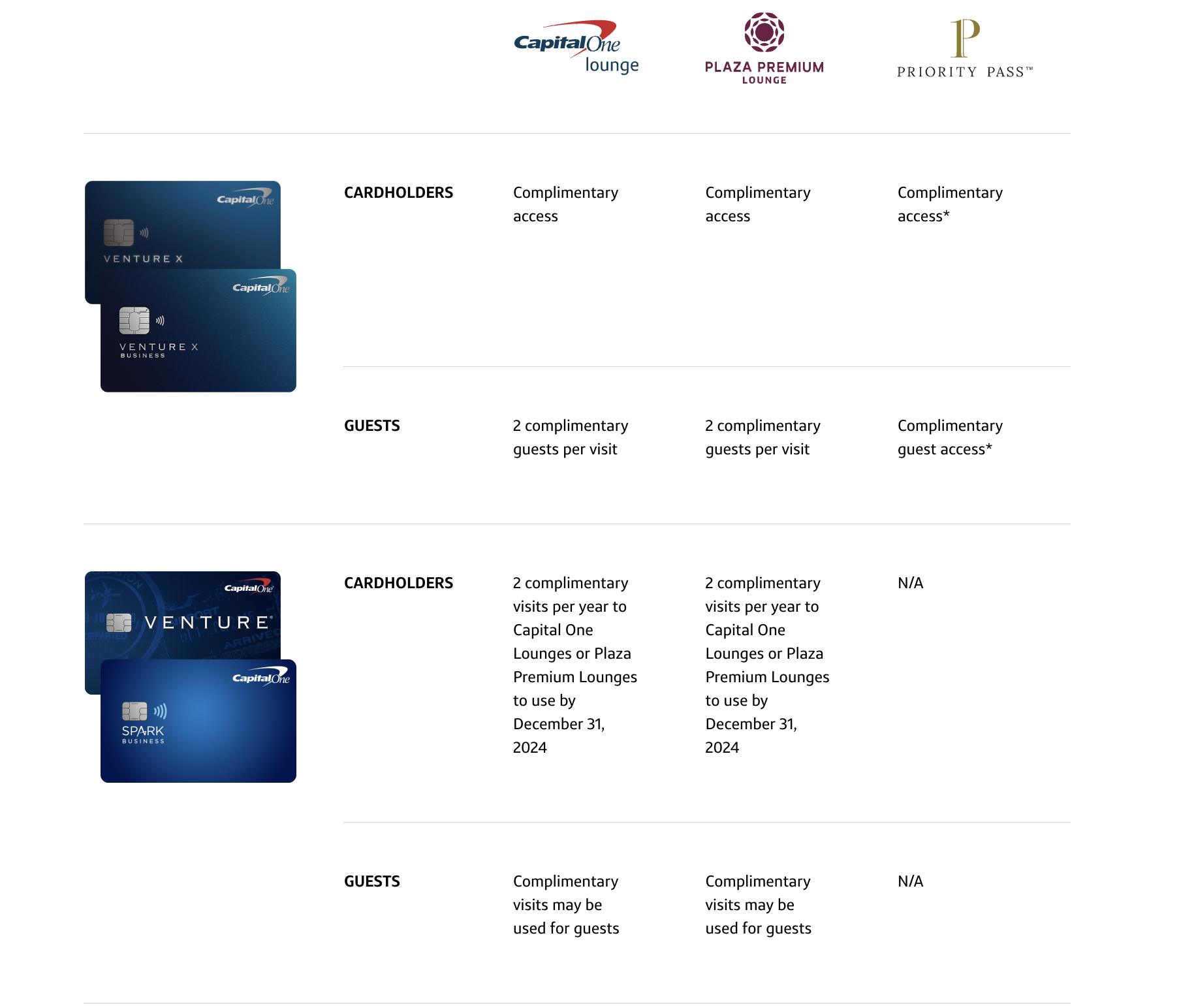

Capital One Lounge Access

Just remember per the terms: “Effective January 1, 2025, Venture and Spark Miles cardholders will no longer receive complimentary lounge access. You will have 2 complimentary visits to Capital One Lounges or Plaza Premium Lounges to use by December 31, 2024. Venture and Spark Miles cardholders can access Capital One Lounges at a special rate of $45 for themselves and their guests.”

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.