This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Capital One has introduced a 20% transfer bonus to Qantas. If you’re unfamiliar with Qantas it’s a One World partner airline that is the flag carrier of Australia. It has a great award calendar if you’re looking to book First Class or business class to Australia and don’t want look one day at a time. We have added this to our current list of transfer bonuses. Let’s take a look!

Details:

- 1000 Capital One Miles = 1200 Qantas Points

- Transfer by 8/31/24

How much does it cost to book Business and First Class using Qantas Miles?

The price varies depending on the distance so…

Business Class:

- West Coast of USA: 108,400

- Dallas: 126,500

- NYC: 144,600

First Class

- West Coast of USA: 162,800

- Dallas: 189,800

- NYC: 216,800

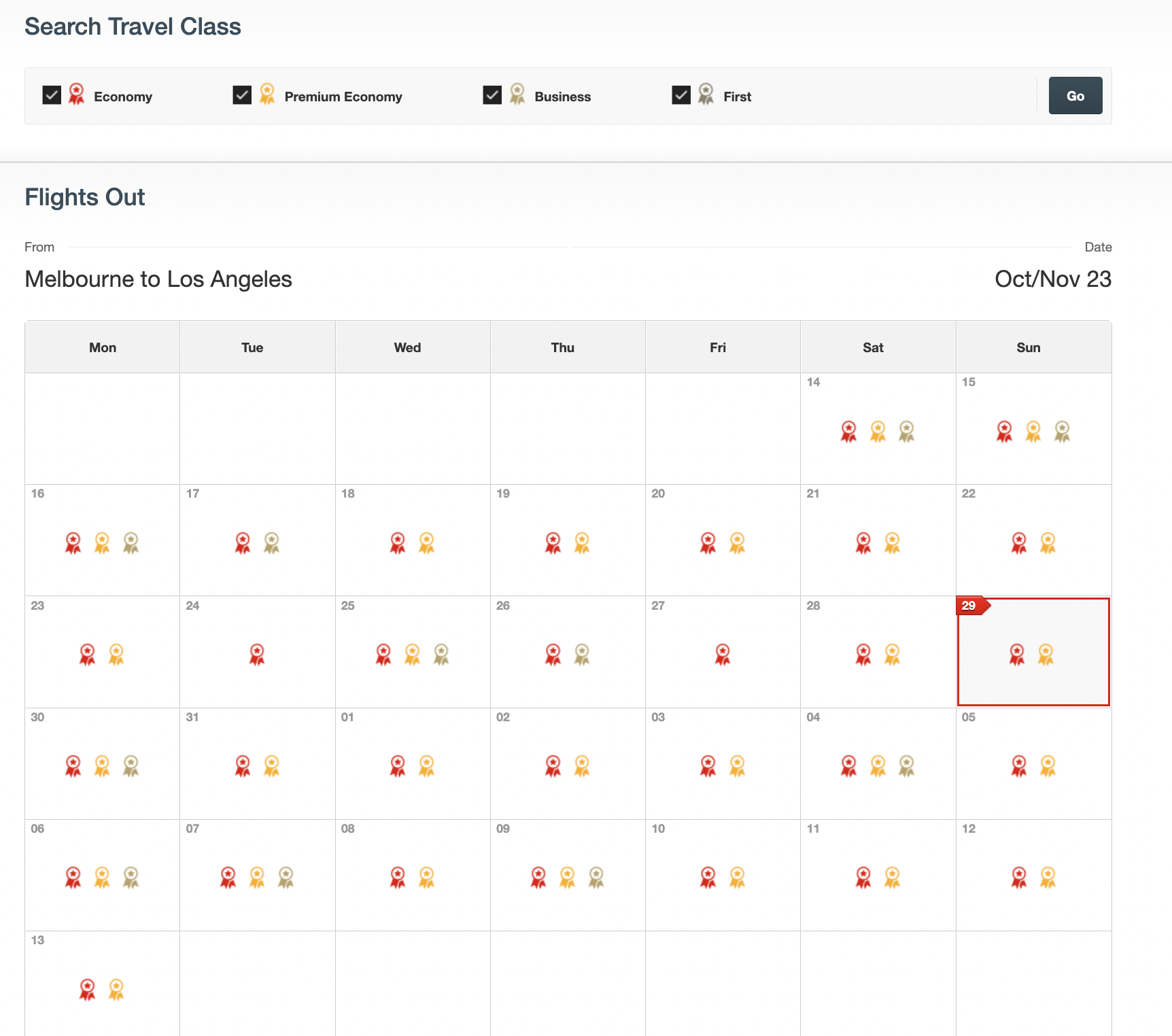

Find space: Search on Qantas with these 3 things selected

Ok, now you understand how you can book them. It’s time to locate award space that is available to you.

- Select Use Points

- Click Flexible Dates

- Click Multi-CIty

Populate the calendar function through multi-city + flexible dates

That will then populate this next page with blocks to fill out with multiple destinations. Here’s the secret…you don’t need to fill out multi-spots. You can just fill one, just make sure you click “flexible dates”.

Use the legend to see dates that have availability

I have no idea why they made business class and first class so similar in color – one could have been blue or green or something that is easier to distinguish.

One thing that is very annoying with this calendar function is the inability to select direct flights only, and non mixed cabin. As you can see below, on 10/30/23 there is a direct flight with Qantas. WAHOOOOO – but you’ll quickly realize that this was a lucky find as the calendar will also show business class available on the Mel-Syd-Lax route that only has one leg available in business. This unfortunately results in a lot of falseflags.

You found the space on Qantas! Now time to confirm on a British Airways

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.