This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How to change American Express “Pay Over Time”

American Express offers a plethora of card options and Amex Pay Over Time has become a feature steadily introduced over their ecosystem. I’m a huge fan of American Express. I think they’ve done an excellent job throughout the pandemic of introducing new category bonuses, statement credits, and features that prove valuable to cardholders in their strange times. Personally, I keep Amex cards primarily because of their points.

Amex points are transferrable to over 20 transfer partners which open the door to some truly incredible travel opportunities. As you can imagine, my affinity for points has resulted in a quite a few cards. In fact, I personally keep 7 Amex cards and when you include my fiancee, we’re easily over a dozen.

There is a rule about holding so many American Express cards. You can only have 4 “credit cards” at any one time. In the past, a credit card has been most easily defined as a card issued to you with a limit attached to it. If you were given a card with no preset spending limit, odds are, you didn’t hold a credit card. Amex “Pay Over Time” has blurred those lines a bit.

DOC recently reported that Amex Green holders were being affected by “Pay Over Time” rules when they go to acquire a new card. Specifically, their Amex Green was now being considered a credit card and for those who already had 3 other Amex credit cards they couldn’t get their new card of choice. It looks as those this is specifically affecting those who acquired their Amex Green post October 2019.

If you have been affected by this, and you’re thinking of getting a new card, one way to circumvent the credit card label being applied to your Amex Green is to remove the Pay Over Time enrollment feature. Here’s a quick an easy way to do that if you’re affected.

I never carry a balance and recommend paying your accounts in full and on time. This is the best way to stay on top of your credit score and maintain its health.

Go to Account Services at the top of your login –

As you can see, I have an Amex Green so I have done this with my card.

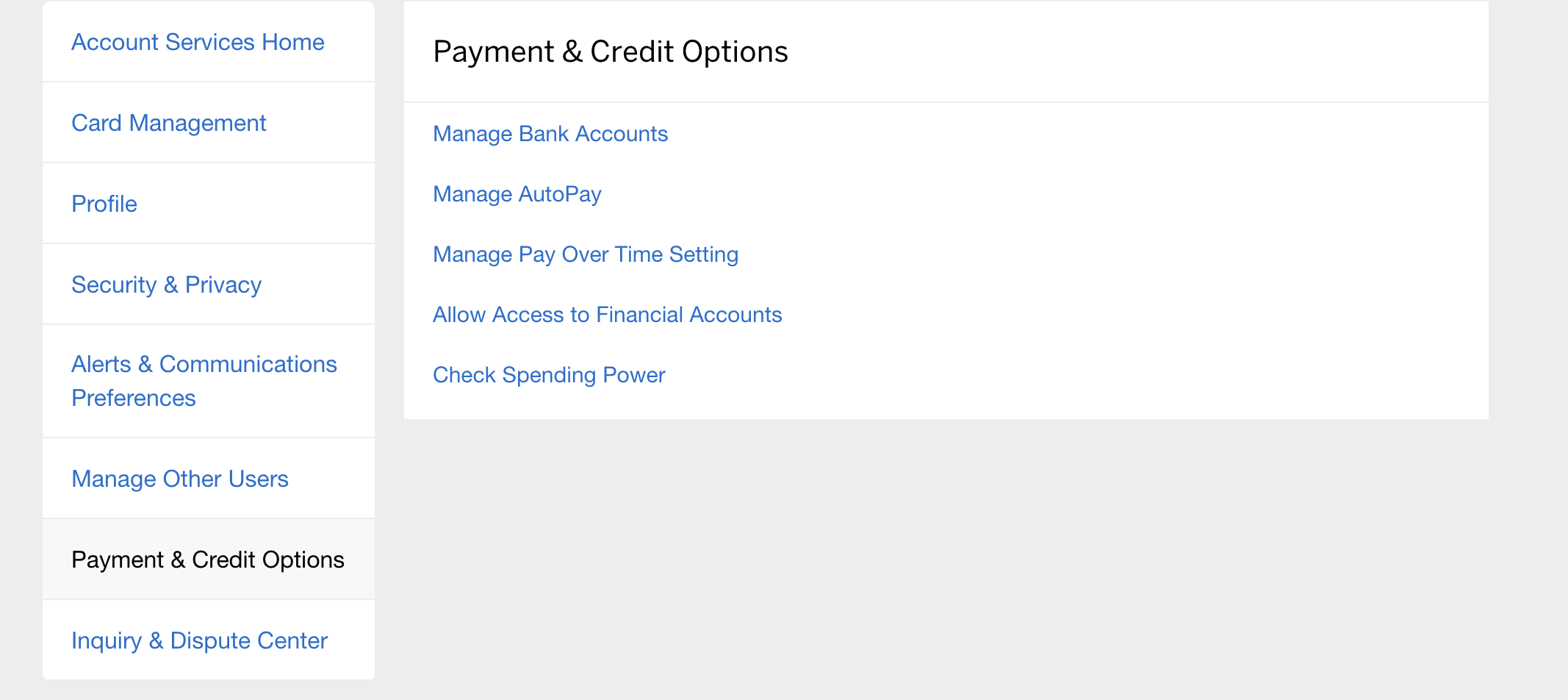

Go to Payment and Credit Options Manage Pay Over Time settings

Manage Pay Over Time settings

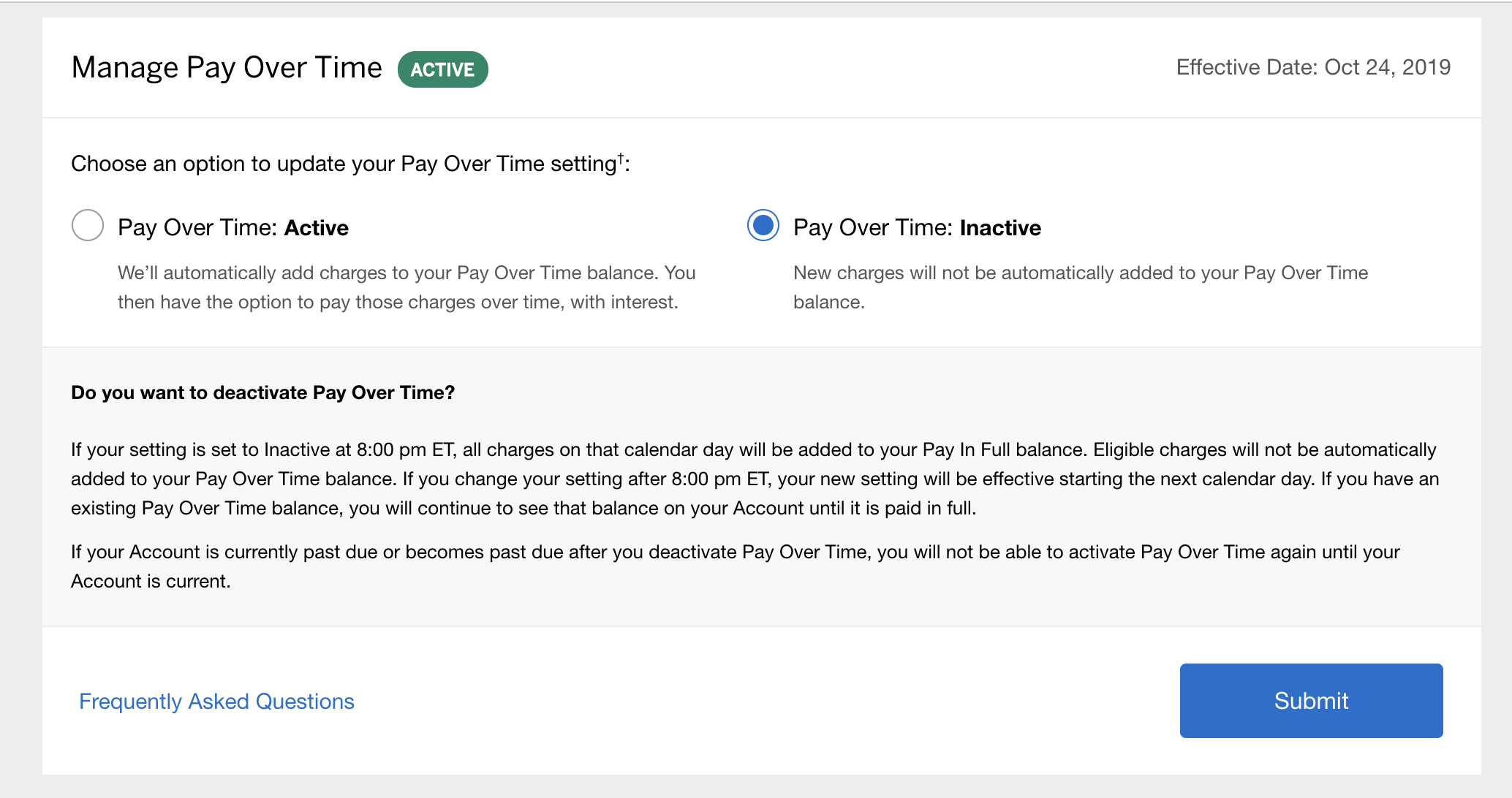

Here you can see the option to eliminate the function

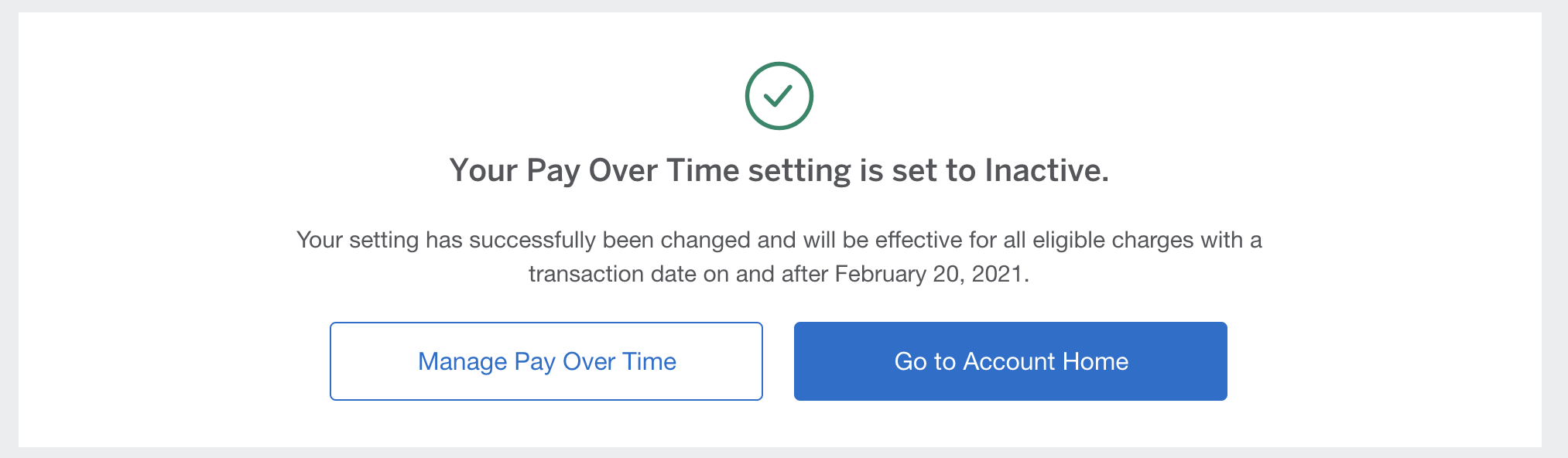

Complete!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.