This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

No Annual Fee and fantastic earn rates, yes please where do I sign. While we will certainly get a full review done on this, I wanted to hit you with the key points. The Freedom will be gone, replaced by the new Chase Freedom Flex ( which you can product change on September 15th ) and the Freedom Unlimited will have some new bennies. Let’s quickly see what Chase has in stow.

Don’t forget…

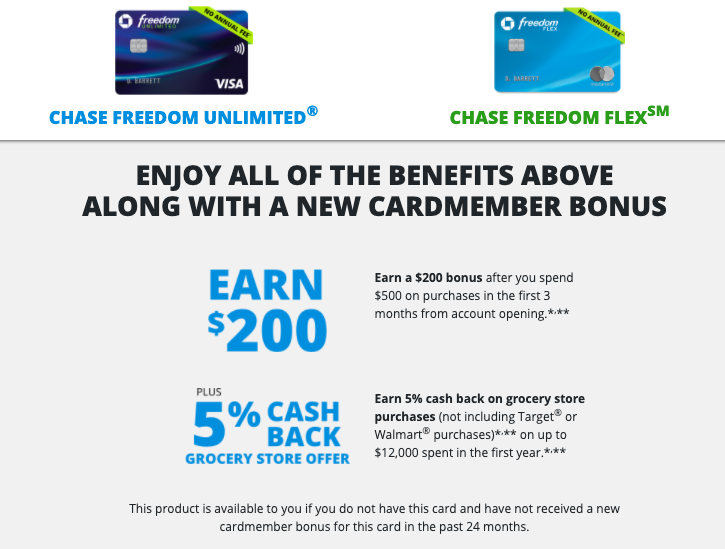

New Freedom Flex and Unlimited cardmembers will receive $200 cash back after spending $500 on purchases in the first three months, plus 5% cash back on grocery store purchases for the first year (on up to $12,000).

Chase Freedom Flex

Personally I think the Chase Freedom Flex and Unlimited are best used in tandem with a Chase Sapphire Preferred so you can transfer Ultimate Rewards to partners.

- 5% on purchases in Chase Travel Portal

- 3% Drugstores

- 3% Dining, including delivery services

- 5% up to $1500 per quarter on rotating categories ( this is similar to the existing Freedom )

The Freedom Flex is also getting:

There are perks with Fandango and Boxed, but these are of most interest to me.

- Mobile Phone Insurance – up to $800 per claim and $1k per year against damage and theft. That is massive and means I’ll put my mobile phone bill on the Freedom Flex.

- Lyft – For every 5 rides you’ll get $10 credit applied to your account once per month.

- ShopRunner – get 2 day shipping at participating retailers with a free shoprunner membership

World Elite Mastercard

No longer a Visa the Freedom will be. It’s now flexing World Elite Mastercard status. That comes with a bevy of benefits – you can read about some of them here.

Apply or call in to change

You can apply for this card, or if you already have a Chase Freedom, you can call in to request your current Freedom by converted into a Freedom Flex on September 15th.

Chase Freedom Unlimited

In addition to the 1.5x on all purchase, the Chase Freedom Unlimited is now going to also have the following earn rates

- 5% on Travel purchased through Chase Ultimate Rewards

- 3% on Dining

- 3% on Drugstore purchases

Honestly, this is still a card everyone should have in their wallet. It’s almost a sin that I don’t, but I do carry the business version of the card, and plan to add it to my wallet ASAP.

Both Cards will get 5x at Grocery ( not Walmart or Target for 12 months )

Earn 5% cash back on grocery store purchases (not including Target® or Walmart® purchases ) for the first year on up to $12k of spend – after that it’ll revert to the cards normal earn rate.

Both Cards will have the same welcome bonus – $200 or 20k Ultimate Rewards after spending $500 in the first 3 months

Verdict

These are massive wins for cards that already had great perks and carry no annual fee. If you don’t have them in your wallet, I’d recommend picking them up with the added grocery bonus.

I would suspect that since this is a completely new card with Mastercard as the payment processor vs Visa that you would be able to get this card even if it hasn’t been 24 months since you picked up the Freedom. I’m not 100% sure about this, but I want to say that I think this would be the case. Regardless, Chase has made it explicitly clear you can hold both cards concurrently

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.