This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Freedom Flex®

The Chase Freedom Flex® is an all out beast of card. Hands down, it’s one of the best on the market and offers category earn rates that beat out many cards that come with a big annual fee. If you don’t have a Chase Freedom Flex®, get it. I challenge you to find another card on the market that offers up to 3x to 5x rates earn rates on various categories, offers World Elite Mastercard benefits, Mobile phone insurance, and comes without an annual fee. It doesn’t exist.

A full breakdown of the benefits:

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

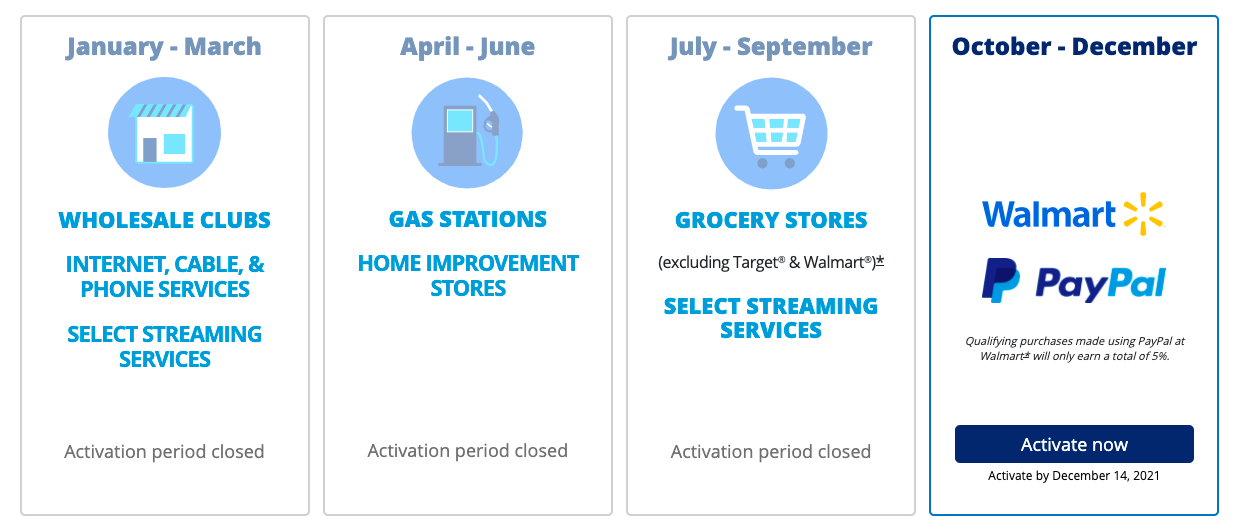

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate.

- Enjoy new 5% categories each quarter!

- 5% cash back

- on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% cash back

- on drugstore purchases

- dining at restaurants, including takeout and eligible delivery service,

- Unlimited 1% cash back on all other purchases.

- No minimum to redeem for cash back.

- You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- No annual fee

- Member FDIC

In addition to all of those…you’ll get World Elite Mastercard benefits, including

- Mobile Phone Insurance – Up to $800 per claim and $1,000 per year on mobile phone protection

- theft and damage on users listed on the phone bill paid by the cardholder

- Lyft – $10 in credit for every five rides taken in a calendar month

- This gets applied to the next ride

- 1x per month

- ShopRunner – free membership

- 2 day shipping at over 100 stores

- Fandango – 2x VIP+ points on movie tickets bought on the Fandango app or Fandango.com

Pairing Chase Freedom Flex® with Chase Sapphire Preferred® ( or Chase Sapphire Reserve®, Chase Ink Business Preferred®) makes your points transferrable

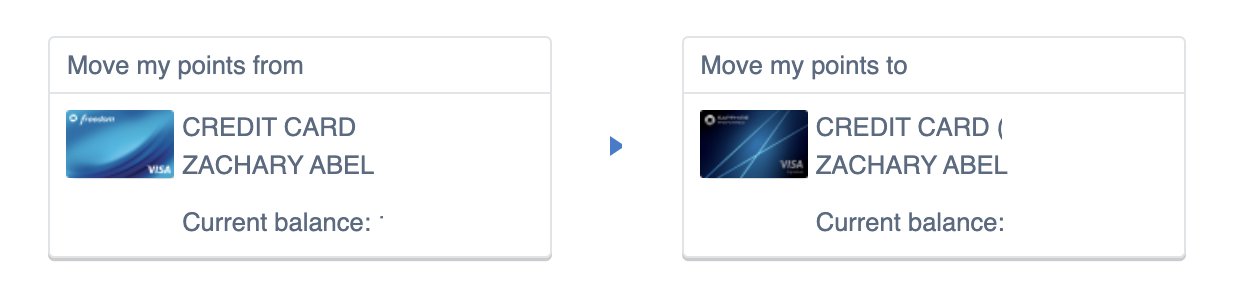

The Chase Freedom Unlimited® credit card is a cash back card when held on its own. This means you’ll earn your points or rewards in the form of Ultimate Rewards which can be used as cashback/statement credit or within Chase Travel at a penny a point. However, since its in the family of Ultimate Reward cards, if you hold a Premium Ultimate Reward card, you can transfer your points from the Chase Freedom Flex® to one of the premium cards 1:1.

This would give you access to Chase’s great list of transfer partners so you could potentially get even more value.

Explaining the cashback to Ultimate Reward aspect futher.

The Chase Freedom Flex® is technically a cashback card, meaning the Ultimate Rewards you earn can’t be transferred into the partner programs that we so often speak about. However…if you carry either a Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Preferred you can move them into one of those accounts and then transfer.

Below is a picture of the new Singapore Suites – a transfer partner of Chase Ultimate Rewards (available when this card is paired a premium Chase credit card like the Chase Sapphire Preferred )

The Sign up Bonus: $200 bonus or 20k Ultimate Rewards

Oh yeah, there is a lucrative sign up bonus as well. You’ll get $200 in the form of 20k Ultimate Rewards after you spend $500 in 90 days after card opening.

There is a reader referral offer that fluctuates and offers an extra 5x bonus category. Go here to see that

What are the sign up rules for the Chase Freedom Flex®?

This is a new product so, even if you hold the Chase Freedom, which this card is replacing, you can apply for the Chase Freedom Flex® .

5/24

- Almost all of Chase’s cards are a part of their 5/24 rule. This means that you can not sign up if you have opened more than 5 credit cards in the last 24 months.

How can the Chase Freedom Flex® help you achieve you travel goals?

First off… our travel goal here at MM is to travel in the best possible way to anywhere our heart desires. I, pre pandemic, traveled around 125k to 150k miles a year and tried to review as many new hotels, and airline cabins as possible. It drives my desire to eek out every point out of every dollar I spend. That desire also aligns with readers who aren’t so bothered by the best cabin, hotel, and prefer to stretch your points out in low to mid range hotels. Ultimately, it doesn’t matter, you want to earn as many points as possible and this card helps you do that quickly. Personally…I’ll be looking to use my points on flights like Lufthansa First Class

A quick example of how you can earn 60k points by spending $500 a month in your first year.

This is without a single purchase on dining, pharmacies, or travel. All of which would earn you 3x

- Spend $500 in first 90 days = 20k Ultimate Rewards

- 5x Rotating category bonuses = 30k Ultimate Rewards

- $1500 per quarter or $6k a year multiplied by 5x earn rate

Overall:

This is a no brainer card. There is no annual fee and you get an overwhelming amount of benefits and ability to earn a ton of points.

Personally, I’d recommend pairing this with either a Chase Sapphire Preferred or Ink Business Preferred. The would mean your annual fee would be under $100 and your earn rates would be fantastic with the ability to transfer to partners. If you’re looking oustide airlines, one of my favorite redemptions has been the Alila Uluwatu in Bali, booked with Hyatt points – transferred from Chase.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.