This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Sapphire Reserve® Full Review

The new Chase Sapphire Reserve® comes with a bevy of benefits, travel credits, and increased earn rates. It also comes with a new $795 annual fee, a litany of credits, 4x on hotels and airfare booked direct, 3x dining, lounge access with 2 guests.

But the question most people will ask? Is it worth it compared to having the Chase Sapphire Preferred® Card? Personally, I think the CSP is a better fit for most people, but if you’re a big spender who wines, dines, and travels a lot. This card could make a lot of sense. If not…I’d direct you over to the CSP.

What are the new Chase Sapphire Reserve® details?

Annual Fee

- Annual Fee of $795

- Authorized Users are $195

Credits

- $300 Annual Travel Credit

- $500 annual The Edit℠ credit

- Chase Travel℠’scollection of over 1,100 hand-picked hotels and resorts

- Get up to $250 in statement credits from January through June, and again from July through December for a maximum of $500 annually for prepaid bookings made with The Edit℠.

- Two-night minimum

- Purchases that qualify will not earn point

- $300 annual dining credit and primetime reservations at Sapphire Reserve Exclusive

- Tables, available for booking on OpenTable

- Split into 2 $150 credits every 6 months

- $250 annual value through complimentary subscriptions to Apple TV+ and Apple Music

- $300 annual StubHub credit on concert and event

- $120 application fee credit every four years for

- Global Entry, NEXUS, or TSA PreCheck(R).

- $120 Peloton credit

- $10 monthly credit

- $120 Lyft credits

- $10 monthly credit

Earning + Benefits

- 8x points on all Chase Travel℠ purchases

- 4x on hotels and airfare booked direct

- 3x on dining

- 1x on everywhere

- Redeem points via Chase Travel℠ and new program Points Boost where members may get up to 2x

- IHG One Rewards Platinum Status

- Lounge

- Enjoy complimentary access to every Chase Sapphire Lounge by The Club with up to two guests,

- Access to 1,300+ Priority PassTM airport lounges worldwide.

- Also get access to select Air Canada Maple Leaf Lounges and Air Canada Cafés in the U.S., Canada and Europe with an eligible boarding pass

- No Fx fees

- Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

Spend over $75k annually

- IHG One Rewards Diamond status

- Southwest Airlines A-List status

- $500 Southwest credits

- redeemable within Chase Travel℠

I use Chase Ultimate Rewards to transfer to Hyatt to stay at incredible places like the Alila Villas Uluwatu in Bali

Do you qualify for the new Chase Sapphire Reserve® ?

First things first…Chase has quite stringent sign up rules for their Sapphire Products in general which includes their flagship Sapphire Reserve Let’s break those down.

What kind of credit score do you need for New Chase Sapphire Reserve®?

It’s our opinion that you should be good to go as long as you’re over 720 – nothing is published on this though.

What are the sign up rules for the New Chase Sapphire Reserve®?

So these rules are quite convoluted and I’ll try my best to make them clear.

5/24

- Almost all of Chase’s cards are a part of their 5/24 rule. This means that you can not sign up if you have opened more than 5 credit cards in the last 24 months.

You can get the card, but you won’t get a bonus if:

- If you’ve received a Sapphire Reserve bonus in the past

You can get the card and get the bonus

- You’ve never received a welcome bonus on the Sapphire Reserve

Can I get the bonus if I have the Sapphire Preferred?

Yes, as long as you haven’t received a Sapphire Reserve bonus in the past, you’re eligible.

Is this the best offer we’ve offer seen?

See our best offer spreadsheet for more data

What is the Annual fee?

The annual fee is $795 and is not waived for the first year.

$300 Annual Travel Credit

This an annual travel credit that is issued per anniversary year is credited toward any travel purchase you make on the card. This differs from other card issuers who stipulate that purchases must be in a portal. The Sapphire Reserve does not. Here is how Chase defines travel

Merchants in the travel category include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages

Rent a Tesla and use your Sapphire Reserve …you’ll trigger your $300 travel credit

$500 Annual “The Edit℠” Credit

- $500 annual The Edit℠ credit

- Chase Travel℠’s collection of over 1,100 hand-picked hotels and resorts

- Split into 2 credits every 6 months of $250

- Must be a 2 night stay

Chase Sapphire Reserve® Earn Rates

1x Everywhere

The Chase Sapphire Reserve® earns 1x on every single purchase, but earns increased earn rates on select categories:

4x Hotels and Airfare booked direct

As long as you book direct with the airline or hotel, you’ll trigger 4x points. This is a big deal on airlines like British Airways, which is a transfer partner, since they charge high taxes and fees even when you book with points. I’d earn 4x points on those fees which is great!

Chase Travel℠ earns 8x

When you book travel via the travel portal you will earn at the following rate

- 8x across the board

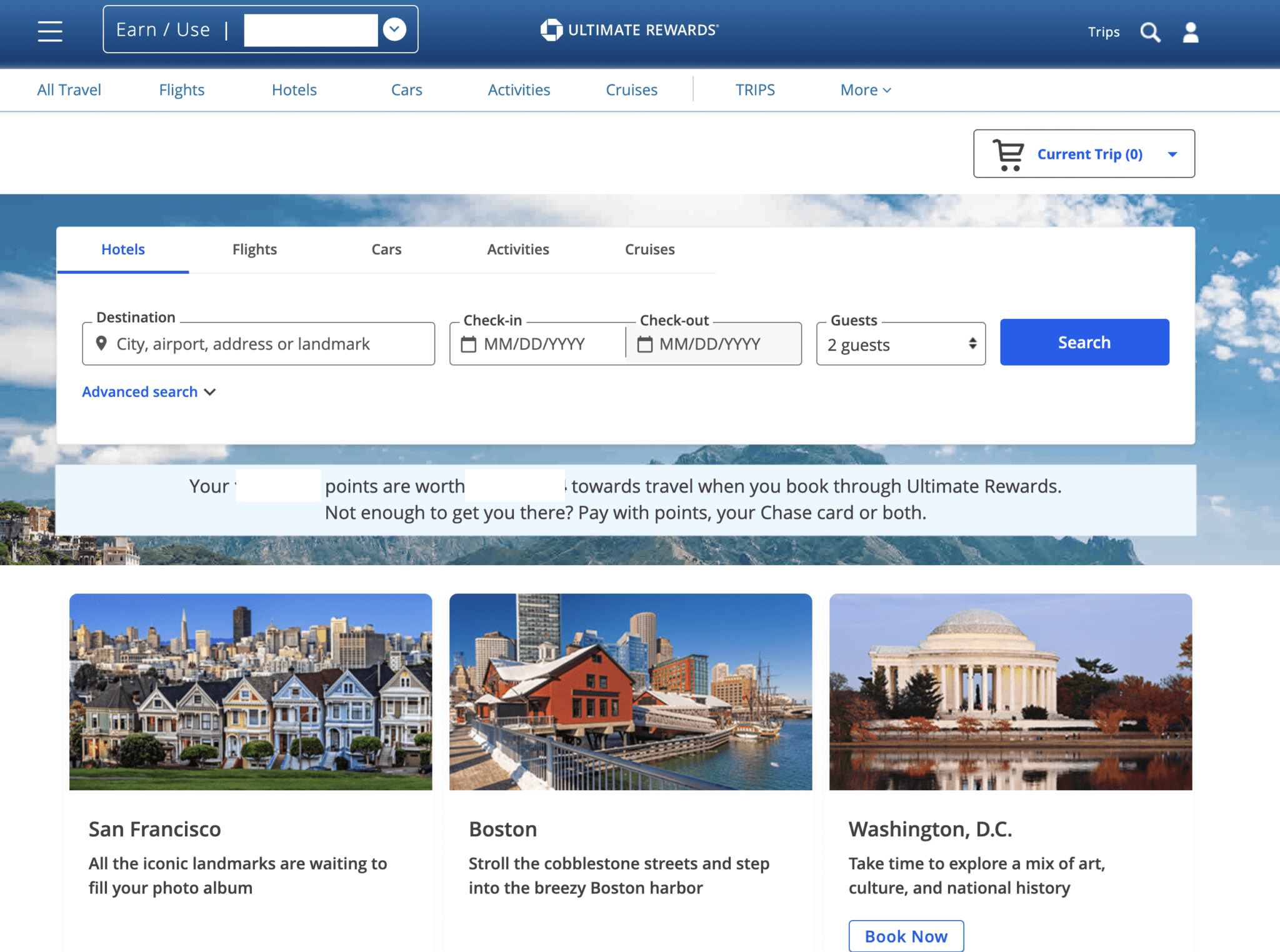

Redeeming Chase Ultimate Rewards with the Chase Sapphire Reserve®

Chase has implemented a new program called Points Boost where Select travel will be redeemable at a 2c per point valuation in Chase Travel(SM) – all other travel will be a penny per point.

Transferring points

Chase offers some of the richest points in the business with a great list of both domestic and international partners. With partners like Hyatt, United, Southwest, Marriott, and IHG I believe they have some of the easiest to redeem points.

I have used Chase Ultimate Rewards to fly in some of the world’s best first class products as well as stay in incredible 5 star hotels via transferring points like Emirates First Class

Lounge Access – Chase Sapphire Lounge® by The Club + Priority Pass

Access

- Chase Sapphire Reserve, J.P. Morgan Reserve and The Ritz-CarltonTM Credit Card primary cardmembers and authorized users have lounge access with their complimentary Priority PassTM membership.

- Sapphire Reserve and J.P. Morgan Reserve cardmembers may bring up to two guests per visit for free, and additional guests for $27.

- There’s no additional charge for children under two.

- Ritz-Carlton cardmembers may bring unlimited guests at no charge.

- Access is based on lounge capacity

|

|

Overall

The Sapphire Reserve is a super premium card that comes with an incredible amount of benefits and when you factor in this new increased welcome offer, I think you can justify getting it over the Chase Sapphire Preferred® Card for at least the first year.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.