We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Citi Premier® Card

Citi Thank You points are an important part of the points and miles universe. So why don’t we hear more hype for a card that guarantees 3x points on air travel, hotels, supermarkets, dining, and gas purchases with just a $95 annual fee?

I think this program is often overlooked because ( aside from JetBlue ) it doesn’t have any US carriers or hotel partners. But Citi Thank You points have tremendous value if you know how to use them. The program provides access to some cool partners like Turkish and Qatar, but has the ability to transfer into programs like Avianca, Air France, Emirates, and Virgin which are partners of many other programs. This makes it easier to combine points for a specific award booking.

Having the ability to transfer into more programs means increases the probability that you’ll land the redemption you desire. This is the goal I have for you, and anyone I’m trying to help by illustrating all of the wonderful ways points and miles make travel dreams a reality.

If you don’t have any exposure to Citi’s Thank You program – this is a great time to jump in.

Table of Contents

The Citi Premier® Card benefits:

- 60k bonus Thank You points after spending $4k in the first 3 months

- This has a 48 months rule in effect, meaning if you’ve gotten the bonus in the past 48 months, or closed the card in the past 48 months, you’re ineligible.

- For a limited time, earn a total of 10 ThankYou(R) Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel(SM) portal through June 30, 2024.

- 3x points on

- Air Travel

- Hotel

- Supermarkets

- Dining

- Gas

- Access to Mastercard World Elite benefits

- No foreign Transaction fees

- $95 annual fee *See rates and fees

The Citi Thank You system has incredible transfer partners

Citi Thank You also overlaps many of Amex, Bilt, Chase, and Capital One partners. This is fantastic news because it means you can diversify your transfers and stay very agile when it comes time to redeem for the optimal trip. Most of these partners listed in the pretty picture below are 1:1 transfer partners

Some of these partners may be unfamiliar to you, but many of them have incredible sweet spots hidden within them. For instance, Etihad, who is famous for their insane premium cabins, has one of the best charts for flights on American Airlines. In fact, you can still fly to Asia for just 50k miles if you use Etihad to book AA business class. That’s phenom.

Is this the best offer we’ve seen?

80k after $4k spend in 3 months is the best offer we’ve seen. We saw it in 2021 and 2022 for several months each year.

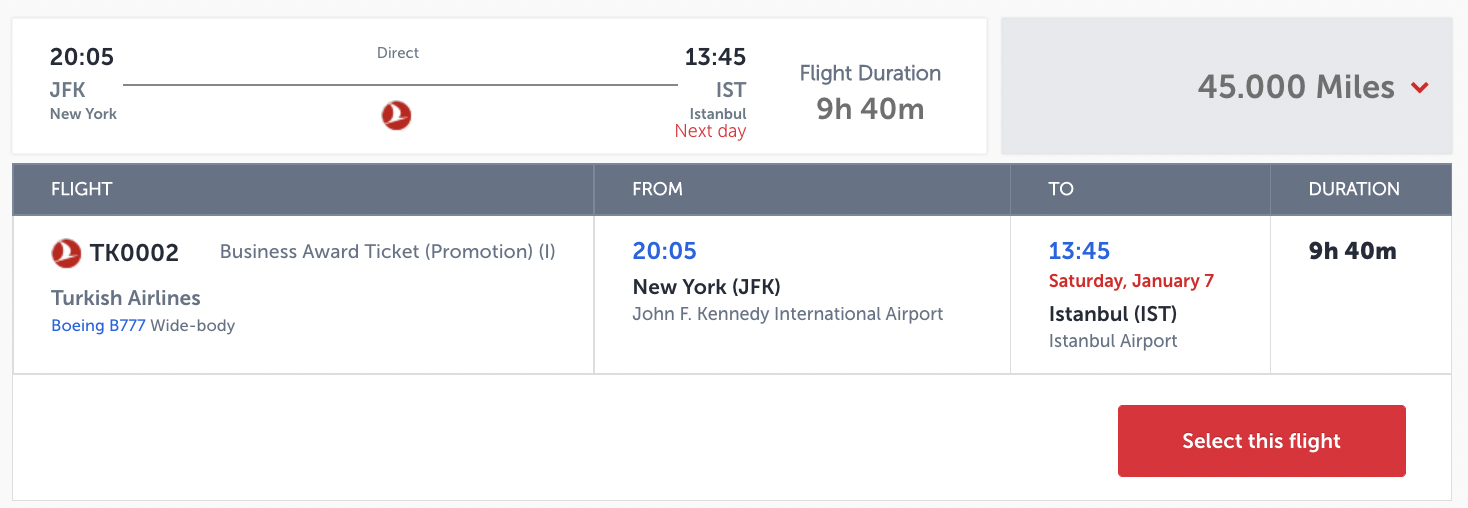

I’m angling to book Turkish Business Class

Turkish has a great award sweet spot from US to Europe. You can fly business class for just 45k miles. I’m hoping to take this trip in early January

Keep an eye out for their best business class found on the 787s

Keep an eye out for their best business class found on the 787s

You also get extended Purchase Protection

The Citi Premier® Card offers an extension of the original manufacturer’s warranty up to 24 months, and it offers the ability to return items up to 90 days for a full refund. This is valid on items with a manufacturer’s warranty that is 5 or less years and $10k per item. Check out the details

Create Citi Virtual credit card numbers for increased privacy.

We wrote an entire article on Virtual numbers here that you can read.

What are the rules for Citi welcome offers?

- 1/8 and 2/65 rules

- 1 card application every 8 days

- This applies to personal and business

- 2 two card applications in a 65-day window.

- 1 card application every 8 days

- Only 1 business card every 90 days.

- 24 month rule

- if you’ve gotten the bonus in the past 24 months, or closed the card in the past 24 months, you’re ineligible

- this is still showing up on some cards, but not all

- 48 month rule

- if you’ve gotten the bonus in the past 48 months you’re ineligible, but there is no language pertaining to closing

?

Citi has compiled a great list of partners, but many of them may be unfamiliar to you if you’ve been focused on US based airlines. Let’s take a look at just a few of some really cool redemptions you could do with Citi Thank You points.

Avianca LifeMiles is a great way to hop to Europe or South America

You can fly in business class for 63k or first class for 87k from the US to Europe or South America. Amazing price imo.

Here are some great business class/First Class redemptions:

- Swiss Business Class

- United Polaris Business Class

- Lufthansa Business Class

- Lufthansa First Class

Asia Miles

This is the loyalty program of Cathay Pacific and it has come awesome redemptions, namely flying in business class to Asia starting at 70k miles, and First Class for 110k.

You can read about them here

- Cathay Pacific Business Class

- Cathay Pacific First Class

Qatar Airways Privilege Club

One of the coolest ways to fly in the world is Qatar Airways QSuites. One of the standout redemptions is to fly on QSuites from the States to Doha for just 70k miles, or the Maldives for 85k. That is a stunner of a deal. My family had the opportunity to fly QSuites in 2019 and it was everything we’d hoped for. You can read about our experience here. I also flew them for my Honeymoon!

Singapore Airways

Singapore has some really cool redemptions, but much of their flight network has been grounded. Fingers crossed those A380s and US routes get back up and going because they offered some incredible redemptions options.

Singapore Airlines Business Class from Houston to Manchester for 72k points

Or in Suites from JFK to Frankfurt for 86k miles. You can also fly this intra Asia for just 53k miles. Note…these A380s aren’t currently in operation, but hopefully will be by end of year

Air France

You can fly in Virgin Atlantic Upper Class for 72k Flying blue miles and a couple hundred in taxes and fees ( much less than Virgin would charge you for the same flights.

Or fly on KLM or Air France business class starting at around 53k points and $200

Emirates has amazing sweet spots as well

- 90k roundtrip to Milan or Athens in Business Class

- 85k in first class

EVA to Asia one way for 75k or 80k in EVA business class

Turkish Miles and Smiles – 90k roundtrip in business class US to Europe

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.