This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

A question that I get a lot on Instagram and TikTok is how do I credit my flight to another airline, and why would I want to do it. I’ll answer the latter part of the two pronged question first.

Why would you want to credit your flight to a partner airline?

The program your flying isn’t great

Let’s take Delta for example. Over the past several years, Delta has continually devalued their program and left loyalists with a bad taste in their mouth. I don’t think SkyMiles are worth a whole lot compared to most of airline loyalty programs, and the elite status is getting harder to achieve and yields fewer benefits. But…you live in a Delta hub and will continue to fly Delta.

You can fly Delta, but credit your flight to one of their partners. You wouldn’t earn Delta SkyMiles or anything toward their elite status, instead, you’d earn the partner miles and potentially even the partner elite status.

This is exactly what I do. I value the miles of “Virgin Atlantic Flying Club” and “Flying Blue” ( KLM/Air France ) way more than I do Delta. Why? Because you can often find a lot better deals with those programs flying internationally, and both of those programs are transfer partners of Bilt, Chase, Amex, Capital One, and Citi. So, if I’m short on the miles, I can easily transfer into them.

You want to credit to the airline your earning status with

For several years, when I lived on the west coast, I was an Alaska Airlines loyalist. Why? They have an incredible loyalty program that still maintains a relatively good award chart, great partners, and you could earn a massive amount of points flying their partners. At that time they didn’t even have a minimum number of flights needed on Alaskas to maintain status ( they do now ).

But, because I was aiming to maintain Alaska status, I would want to credit partner flights to them instead of the partner loyalty program. For instance, if you fly British Airways, you can earn an incredible amount of Alaska Miles crediting your flight to Alaska Mileage Plan vs British Airways Avios.

With no Alaska status:

If you were to fly a 5500 mile British Airways Business Class flight in booking class C/D between LAX and LHR ( which I often did ) and you matched your 2024 Delta Gold Status to Alaska Airlines MVP Gold this is how many miles you’d earn

- 5500 Base

- 5500 * 2.5 = 13,750

- Gold 100% bonus = 5500

- Total = 24,750 miles on a single one way flight ( 49,500 r/t ).

That is unreal seeing as though you can fly one way from The US to Europe starting at 57.5k miles.

I’d also earn 27,500 Elite miles, more than enough for MVP status on a single flight ( I’d still need to pick up some Alaska flights ).

How do I credit my flight to a partner

One thing to note, when you add a partner loyalty program, if you have status with that partner, you may enjoy some benefits associated with your status. For instance, if you are flying British Airways economy, but maintain Alaska MVP Gold or American Platinum Elite status and credit your flight to AS or AA, you could enter the British Airways Business Class lounges + select seats free of charge, and even get a free checked bag. These are all called reciprocal benefits and each differ depending on the alliance and partnership. I’ll provide some more info on the US based ones below.

3 Major Airline Alliances

There are 3 major airlines alliances where you can fly on a member airline and not only credit your flight to another member, but also enjoy reciprocal elite benefits. I’ve listed the US based members below

- SkyTeam

- Delta

- One World

- American and Alaska

- Star Alliance

- United

Stand Alone partnerships

Emirates isn’t a part of an alliance, but it’s partnered with JetBlue, United, Air Canada, Korean, Copa, Qantas and more. This means you may be able to earn miles flying partners, but also use the miles of Emirates, or those programs, to book award flights on another partner. Most airlines have stand alone partnerships alongside their alliance partnerships.

Delta

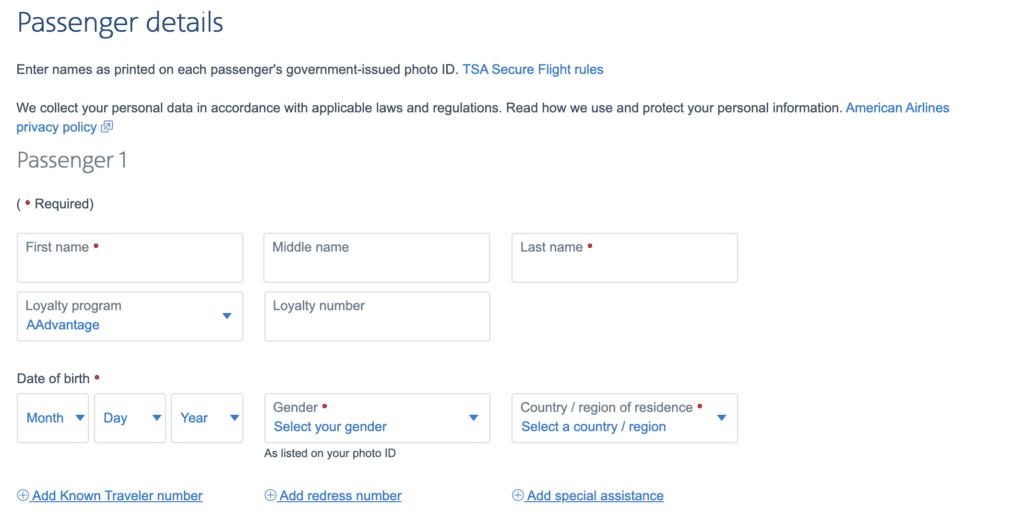

Let’s take Delta for example since I typically credit my Delta flights to partner airlines. You can see during the booking process that you’ll be asked to enter your frequent flier information – most of the time, you’ll be able to enter your partner frequent flier account number.

American

Same sort of situation, on the page where you enter your information

United

Basically the same as the others – on the page where you enter your information. I usually credit my United flights to Air Canada Aeroplan since their program is much richer than United’s

How do I know how many miles I’ll earn crediting my flight to a partner?

The easiest way to find out is using a site called “where to credit”

Let’s take this Delta flight for example. You can see that in “main cabin” I would be flying a Fare Bucket called “V”

In the flight summary we can see the cost breakdown

In the flight summary we can see the cost breakdown

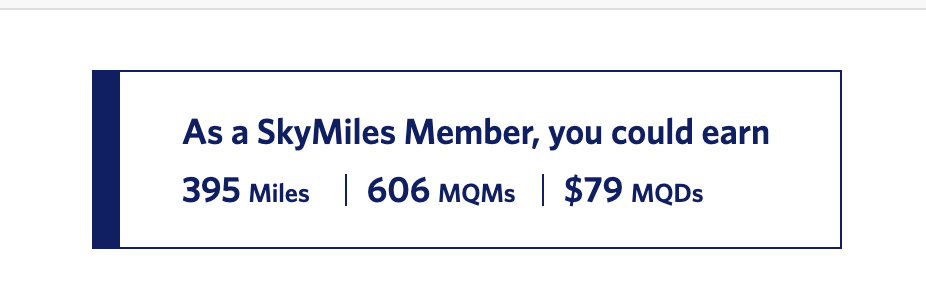

And Delta even tells you how many SkyMiles and MQD you’d earn

And Delta even tells you how many SkyMiles and MQD you’d earn

I can then go to Where to Credit and Enter the Airline and Booking Class/Fare Bucket

And then it gives me a chart that tells me the earn rate of each partner airline.

And then it gives me a chart that tells me the earn rate of each partner airline.

Comparing Delta to Virgin and Flying Blue

- Delta = 395 SkyMiles

- Virgin = 50% of 606 miles = 303 Virgin Miles

- Flying Blue Air France/KLM = 25% of 606 = 152 Miles

You can use MileCalc.com to calculate flight distance or just Google it. Some airlines include it as well at the time of booking.

You may look and think, well Zach, I’m earning fewer miles crediting to either of those programs compared to Delta. And, at face value, you’d be correct. The difference comes when it’s time to use those miles.

You may look and think, well Zach, I’m earning fewer miles crediting to either of those programs compared to Delta. And, at face value, you’d be correct. The difference comes when it’s time to use those miles.

- Virgin and Flying Blue are partners with far more programs, so it’s much easier to add miles to the accounts

- Throughout the year Bilt/Chase/Amex/Citi/Cap1 will have transfer bonuses to these programs

- The rates for redemption are far, far more attractive.

This is a chart of Business Class on Air France/KLM from North America to Europe. Just 41,250 in business class. Without a glitch, you’ll never come close to finding a deal like this on Delta.

Overall

Crediting flights to partner airlines is something I consistently do so that I’m earning points that are most valuable to me. A side note,

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.