This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Buy Alaska Miles with up to a 50% bonus promotion = 1.97 cents a piece.

I’m a big fan of Alaska, and keep a decent grip of points, but when I see miles discounted this much, I’m tempted to add to my balance. It used to be that Alaska would do a quarterly bonus on purchased miles, but as we’ve seen with most airlines programs these days…there is a lot of profitability in selling points.

The biggest reason these point sales are so valuable to those of us who know how to use them ( hint…not on domestic economy tickets ) is the ability to use the points to buy insanely expensive business and first class flights for a fraction of the cost. Keep in mind, Alaska changed its program terms to restrict those who aren’t elites to buying just 150k a year, if you carry at least MVP, you can buy to your heart’s delight ( more on that in the post ).

Of course, I never recommend buying any points currency on speculation. So only buy if you foresee a good use for them.

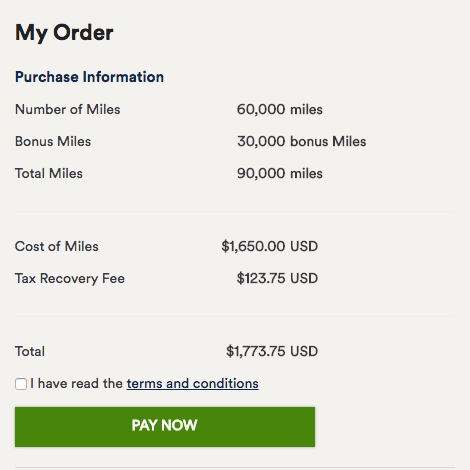

The 50% bonus on purchased Alaska Miles is tiered so you’ll see this:

The more you buy, the bigger the bonus:

- Buy 10,000-19,000 miles, receive a 20% bonus

- Buy 20,000-39,000 miles, receive a 35% bonus

- Buy 40,000-60,000 miles, receive a 50% bonus

Terms and conditions ( biggest is the 150k limitation)

As you can see in the terms listed below, and aforementioned in the opening paragraph, if you don’t carry Alaska Elite status you are limited to just 150k miles per year. In case you’re wondering, a 50% bonus is the biggest we’ve ever seen, so if you max your purchases out during this deal, you are purchasing at a historical high bonus. If you don’t…we’ll see another bonus this year, but who knows if it will be 30/40/50%. It’s also worth noting that just because you’re limited to 150k in your account it doesn’t mean you can book tickets out of multiple accounts.

If you carry elite status…good on ya, you can buy unlimited miles.

- Transactions must be completed between 6:00 AM PST April 17, 2019 and 11:59 PM PST May 19, 2019 to be eligible for bonus miles.

- Miles are purchased from Points.com Inc. A 7.5% Federal Excise Tax*, and GST/HST for Canadian residents will be applied.

- Miles are non-refundable and do not count toward MVP and MVP/Gold status.

- You may purchase and gift Alaska Airlines Mileage Plan miles in increments of 1,000 miles to a maximum of 60,000 miles per transaction.

- Your Mileage Plan account may be credited up to a maximum total of 150,000 miles acquired through Points.com in a calendar year, whether purchased by you or gifted to you.

- MVP, MVP Gold and MVP Gold 75K Mileage Plan member accounts have no annual limit on the number of miles which may be purchased or gifted through Points.com.

- Offer is subject to change and all terms and conditions of the Mileage Plan Program apply.

- *Points.com Inc. is collecting Federal Excise Tax on behalf of Alaska Airlines Inc.

- Alaska Airlines Inc. has the obligation to collect Federal Excise Tax and remit the tax to the appropriate government agency.

I’d never recommend buying points speculatively, but price it out.

But when offers come up to get valuable points at a discount, I always think it’s worth considering when planning a trip. Often times simply buying points can result in a cheaper out of pocket cost than just buying the flights outright. For instance, I flew to Australia in Qantas First Class for 70k miles. That ticket sells for north of $10k easily, and with points…under $1400. Obviously this is an extreme example, but it works for a domestic flights as well. Often times Alaska will have a one way premium transcon flight priced over $1000…but also priced at 25k points. Easy redemption there.

If you’d like to read more details, including great redemptions ideas ——-> Read this post

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.