This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

One of the quarterly credits on the American Express Platinum Card® is an up to $75 credit to Lululemon. While it’s popular knowledge at this point that you can walk into the store and buy a gift card to use later, or anecdotally buy one online, did you know that doing this direct with Lululemon is leaving money on the table. I’m going to show you how you can take that $75 credit and whip it into a minimum of $150, and even more depending on how you value Bilt points.

The flow goes like this.

- Enroll your Platinum Card for the Lululemon credit

- Sign up for Rakuten with a spend $50 get $50 back

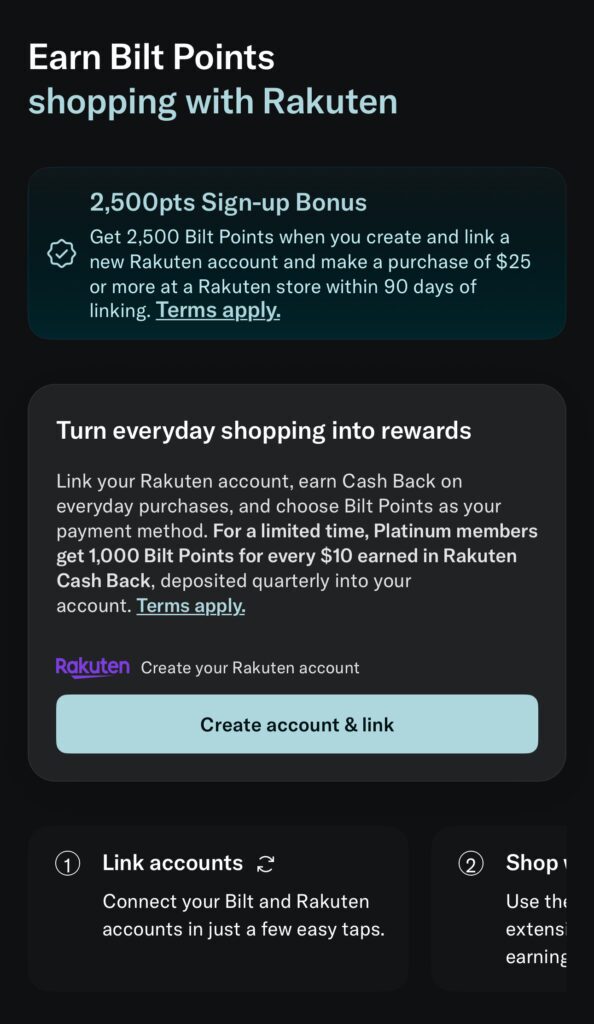

- Link your Bilt account to earn a bonus 2500 points when you spend $25

- MAKE SURE YOUR EMAILS ARE THE SAME

- Sign up for Bilt…it’s free… if you don’t have one

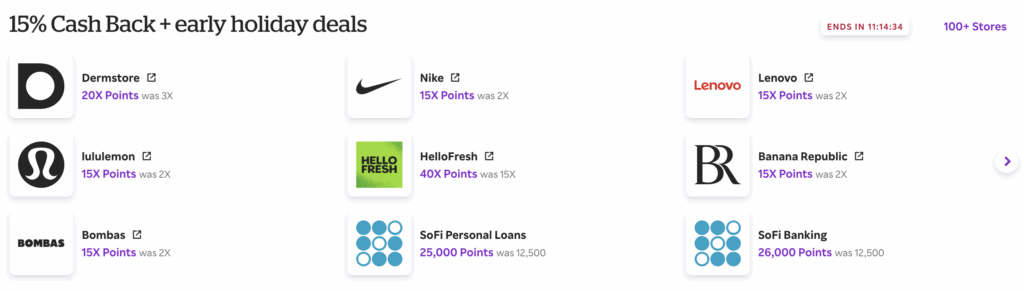

- Wait until Lululemon is at 10-15% cashback/points at Rakuten.

- Buy $75 worth of merch at Lululemon and trigger them all

This strategy would net you the following

- $75 statement credit with Amex

- $50 back via Rakuten

- 2500 points

- 10-15% back on the $75 which is $7.50 to $11.25

- Total = $132.50 to $136.25 + 2500 Bilt points ( worth at 2 cents or 1.25 cents in travel portal )

- = $163.75 to $186.25

If you did the whole thing in points you’d get $75 back via Amex + 5000 Bilt Points + 2500 Bilt Points + ( 750 to 1125 points ) = $75 + 8250 to 8625 Bilt Points. This is the avenue I’d go since it nets the best points in the business.

First off…the Amex Platinum $75 Lululemon credit – enroll here

Make sure your card is enrolled

Next…sign up for Rakuten with the Spend $50 get $50 bonus – my referral

Next…sign up for Rakuten with the Spend $50 get $50 bonus – my referral

Don’t spend anything yet…let’s link to Bilt Rewards next.

Next you want to link your Bilt account to Rakuten to get the bonus 2500 points – Make sure your emails match

If you don’t have a Bilt account you can sign up here

Go back to Rakuten and select Bilt as your payment method

Go to account settings where you’ll find “How you’re getting paid”:

You may need to sign out and back in for the Bilt account to actually populate. If it doesn’t go here for Help which has a chat function to see why your Bilt account isn’t populating.

Now wait until Rakuten puts Lululemon on 10-15x promo – I’d guess we will see this around Black Friday/Cyber Monday

And voila…you’d make a killing on your Amex Lululemon Statement Credit

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.