We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

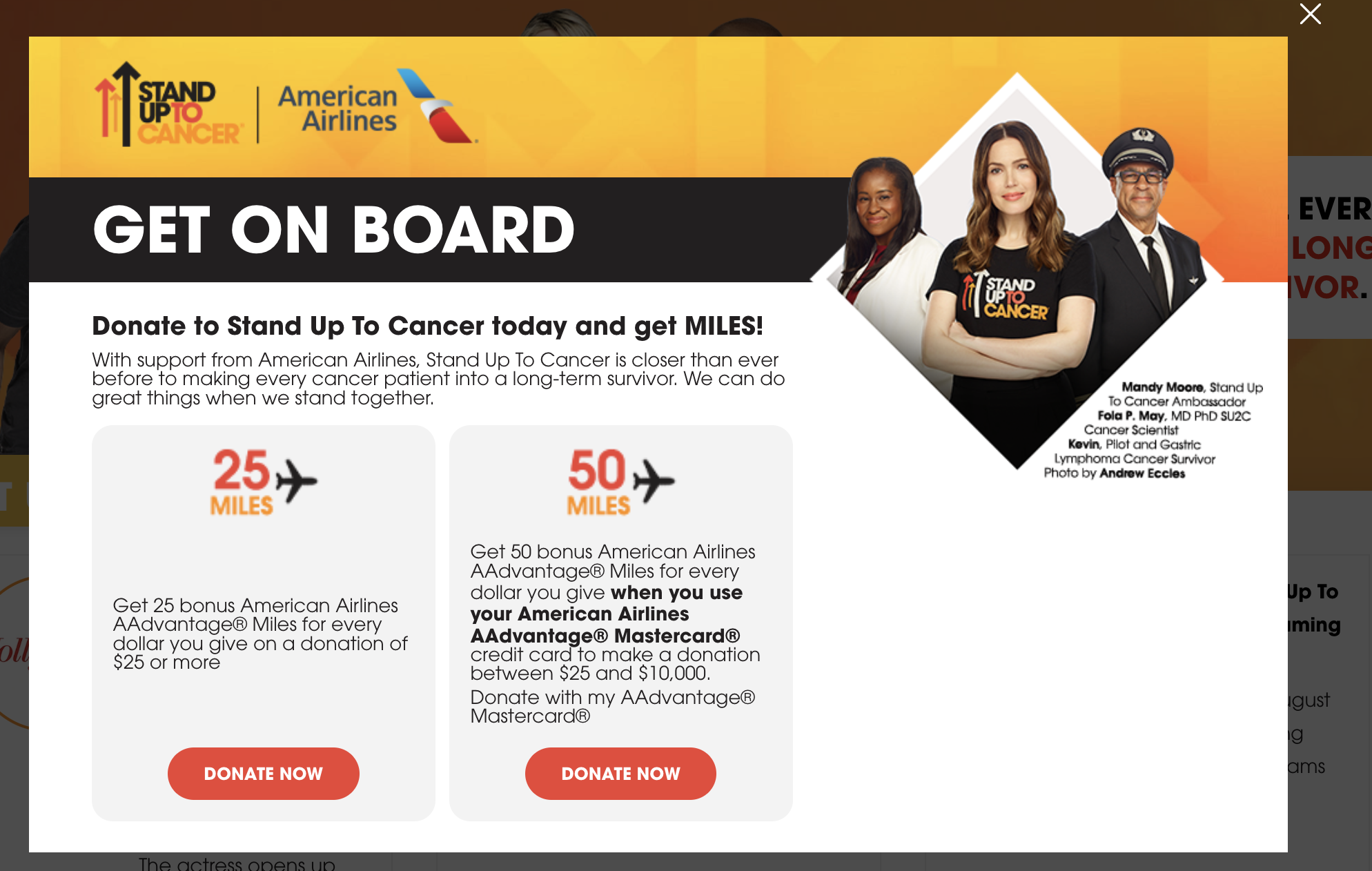

Earn up to 50x AA miles on donations to Stand up to Cancer

Stand up to Cancer and AA are running a bonus miles promotion for donations that yields 50x if you’re an AA Mastercard cardholder and 25x if you’re simply an AA member that donates. A minimum of $25 is required to trigger the promo and a maximum of $10k can be donated and yield the bonus points. The promo ends on 9/30/22 or when they hit $1M in donations. Note that it stipulates that donations above $75 are not tax deductible because of the receipt of miles and these miles do not earn Loyalty Points which are status qualifying

As an FYI…

Stand Up To Cancer is a division of the Entertainment Industry Foundation (EIF), a 501(c)(3) charitable organization.

EIF is a Charity Navigator 4 Star Charity and meets all 20 BBB Charity Standards. Stand Up To Cancer and Stand Up To Cancer Brand Marks are registered trademarks of EIF.

Details you should know

- Donate between $25 and $10k

- Runs from 8/01/2022 at 12:01am PT and ends 9/30/22 at 11:59pm PT

- or when the maximum donation to SU2C of $1,000,000 dollars is met

- 25x for AA member who a non-cardholders

- 50x for AA Mastercard cardholders

- Miles are non-qualifying and don’t earn Loyalty Points

Terms and conditions:

*Between August 1, 2022 and September 30, 2022, when American Airlines AAdvantage® members contribute between $25.00 and $10,000.00 to SU2C through StandUpToCancer.org/american-airlines-donate-50-mile using their American Airlines AAdvantage® Mastercard® credit card issued in the USA, American Airlines, with support from Mastercard®, will award donors with 50 miles for every dollar donated, up to a total promotion maximum of $1,000,000 donations received. Donations must be made online at StandUpToCancer.org/american-airlines-donate-50-mile using an American Airlines AAdvantage® Mastercard® credit card issued in the USA. Minimum $25 donation required. Maximum miles-eligible donation amount per primary cardmember is $10,000. Bonus American Airlines AAdvantage® miles do not count toward status qualification. Please allow up to twelve weeks for the bonus miles to be posted to your AAdvantage® account. Donations can only be accepted in U.S. dollars. Donations made in connection with bonus AAdvantage® miles program are not refundable. For charitable deduction purposes, each bonus mile is valued at 3 cents per mile. The receipt of miles may reduce the tax deductibility of your contribution. Bonus miles offer starts 8/01/2022 at 12:01am PT and ends 9/30/22 at 11:59pm PT, or when the maximum donation to SU2C of $1,000,000 dollars is met, whichever is earlier. In order to qualify for this offer, your American Airlines AAdvantage® Mastercard® credit card account must be open and in good standing at all times. If your credit card account is closed for any reason, you may no longer be eligible for this offer. AAdvantage® credit cards issued outside the USA are not eligible and are not participating in this promotion.

American Airlines may, at any time and without notice, change, stop or end this offer in part or in full.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.