This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

You can see from the interaction below the line break that roughly a month ago my Emirates account was frozen due to a data integrity inquiry. A couple of days ago it was finally resolved and I have full access to my account. It took well over a month to resolve, and I wanted to highlight a few data points that I thought were relevant should you end up in the same situation.

- I had a booking from the Maldives via Dubai to Frankfurt that occurred in the midst of my account being frozen

I was worried that for some reason this would get flagged as fraudulent since that seemed to be the impetus behind my account being frozen. I was able to take that flight without any hiccups or concern and even had a great golf cart transfer at Dubai’s airport to the Emirates First Class lounge.

- My account seemingly was linked to two separate Amex Membership Rewards accounts

In addition to the issues listed below, I believe that this was an obstacle in clearing my account up sooner. A few years ago we had problems transferring points to my mother’s account, and ended up linking my account to her Amex and transferred as an authorized user. Back then it was basically instantaneous, but now it takes 90 days to do. I didn’t think twice about this, but it looks like that somehow broke the Emirates rules, or at least flagged something in their system.

I was asked to provide my number, but it didn’t match the one they had on file. The only thing I can reconcile is that the one they had on file was my mother’s but I didn’t go to the trouble of requesting her MR number. It requires a phone call as far as I know.

Ultimately, my account is now unfrozen, but it took a long time and at least half a dozen emails including signed documents, passport copies, and providing my Amex Membership Rewards number. Oddly, I have transferred into that account from Amex, Chase, and Brex – but they only wanted MR.

The most important lesson I learned….even if I book a ticket for someone else aside from the account holder, I’ll make sure the payment used is in the name of the account holder. I believe booking my wife’s ticket from my dad’s account but paying for it with my card is what created this mess in the first place.

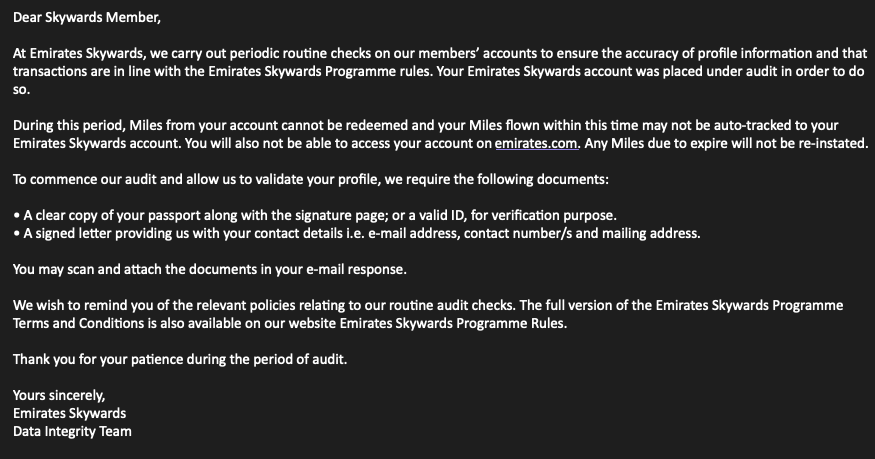

I’ve been planning a surprise honeymoon and have booked and canceled a few Emirates bookings between my account and a family member’s account to book tickets for myself and my wife. Somewhere along the line I ended up triggering a security warning that has rendered both of our accounts frozen. Luckily, the flights I currently have booked aren’t for quite some time since I can’t access my account or my family members account and have no idea if the flights I’ve booked are even still valid. Today I received the following email.

The odd thing is my account has only been used to book flights for myself and there has only been two cancellations. Nothing that extreme, really, and all of my information corresponds to my account.

My wife’s tickets have been booked via my family members account since miles were going to expire and I was able to easily shore the account up via Brex ( I simply added my family member as an account manager ) to the needed amount. I The issue I think that triggered the freezing of both accounts is this

- The Skywards account name and my wife aren’t the same

- I paid for the taxes and fees with my credit card ( the same card for my ticket and my wife’s )

- I used my email for both tickets from both accounts which corresponds to my Emirates account, but not my family members

- I believe this is what got my account suspended

In addition to what was requested up above from me, the wanted the following info to unlock my family member’s

- A scan of my wife’s passport including signature page

- A signed written letter that my wife paid no revenue for this booking

- A signed written letter with my wife’s phone number, email, etc

Long story short, I don’t think this is going to be a problem and will be resolved, but it’s pretty intense and I’ve never had to deal with anything like this before with another airline. It’s also interesting that its guised as a routine check; however, this is clearly not the case and correlated to my booking activity. I ended up drafting emails for both accounts and submitting all of the required information with an explanation of why we were booking what we were booking. I can’t imagine this is an issue, but I’ll keep this post updated with how it’s resolved.

Anyone ever confront anything similar to this?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.