This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Forbearance has been a hot topic word, specifically regarding home loans, since it was included in the CARES act. It’s also something that credit card borrowers can seek, but before you do, it could result in negative effects. While the CARES act specifically protects home loan borrowers from having missed payments recorded on their credit report while in forbearance, it doesn’t preclude the lenders from making notes on your account.

Forbearance

If you’re unfamiliar with forbearance, it’s a pause in payments, and depending on the deal you strike, paused payments are usually due in full when payments restart. This is in stark contrast to deferment which simply adds the unpaid payments on to the end of your mortgage, extending it by the forbearance period. Many think they’re signing up for deferment, when in fact, they’re hit with a bill for all missed payments + normal fees, interest, etc are due.

CARES act guidance on forbearance

You can see below the exact language from the bill, but as long as your loan is federally backed and you’re impacted by COVID, you can get up to 360 days of forbearance. All of your payments, fees, and interest will be due on the following payment. I’m not really sure what they were thinking, but I would guess if you have faced financial hardship that results in forbearance, and you can’t pay a few months of mortgage payments, odds are, you won’t be able to pay all the months off at once when the forbearance period ends. One would have thought, and maybe this is the result of lobbyists poisoning the well, that deferment would have been a far better strategy for the CARES act.

(1) IN GENERAL.—During the covered period, a borrower with a Federally backed mortgage loan experiencing a financial hardship due, directly or indirectly, to the COVID–19 emergency may request forbearance on the Federally backed mortgage loan, regardless of delinquency status, by—

(A) submitting a request to the borrower’s servicer; and

(B) affirming that the borrower is experiencing a financial hardship during the COVID–19 emergency.

(2) DURATION OF FORBEARANCE.—Upon a request by a borrower for forbearance under paragraph (1), such forbearance shall be granted for up to 180 days, and shall be extended for an additional period of up to 180 days at the request of the borrower, provided that, at the borrower’s request, either the initial or extended period of forbearance may be shortened.

(3) ACCRUAL OF INTEREST OR FEES.—During a period of forbearance described in this subsection, no fees, penalties, or interest beyond the amounts scheduled or calculated as if the borrower made all contractual payments on time and in full under the terms of the mortgage contract, shall accrue on the borrower’s account.

c) Requirements For Servicers.—

(1) IN GENERAL.—Upon receiving a request for forbearance from a borrower under subsection (b), the servicer shall with no additional documentation required other than the borrower’s attestation to a financial hardship caused by the COVID–19 emergency and with no fees, penalties, or interest (beyond the amounts scheduled or calculated as if the borrower made all contractual payments on time and in full under the terms of the mortgage contract) charged to the borrower in connection with the forbearance, provide the forbearance for up to 180 days, which may be extended for an additional period of up to 180 days at the request of the borrower, provided that, the borrower’s request for an extension is made during the covered period, and, at the borrower’s request, either the initial or extended period of forbearance may be shortened.

(2) FORECLOSURE MORATORIUM.—Except with respect to a vacant or abandoned property, a servicer of a Federally backed mortgage loan may not initiate any judicial or non-judicial foreclosure process, move for a foreclosure judgment or order of sale, or execute a foreclosure-related eviction or foreclosure sale for not less than the 60-day period beginning on March 18, 2020.

Forbearance “notes” can negatively affect your future lending odds

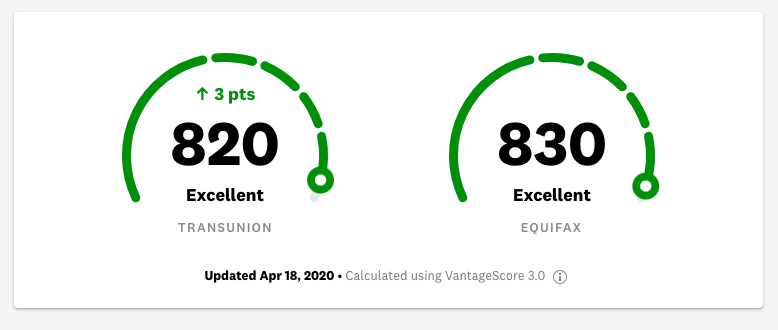

The spirit of the law was to give home loan borrowers some cover while times were tough without the missed payments being noted on their credit report. And this is how I understand it is being administered – you won’t see missed payments noted in your “payment history” portion of your credit score, and they will be regarded as current.

However, it doesn’t prohibit the borrower from making notes on your account. It’s these notes that can be seen by a future lender and could negatively affect your ability to borrow.

While we don’t know how future lenders are going to interpret these notes, if a lender can see that you sought forbearance, are they more likely to hesitate to lend you money?

Lending standards have tightened substantially since the pandemic hit, and are likely to remain quite tight as we gain more insight into how bad the economy really is, and how we will recover.

Forbearance regarding credit cards

*note these are not protected or guaranteed by the CARES act, but simply some advice from yours truly

If you’re considering credit card payment forbearance I would seek the terms and conditions of the agreement so you can see how they will regard the forbearance request on your credit report. The payments should remain current, but one of the biggest terms you should seek is a pause in interest and late fees. If not…you could be hit with a substantive amount of money due that doesn’t even begin to erode your principle.

There are also many credit cards currently offering 0% interest on balance transfers. Personally, if you can get approved, this would be a far better strategy to delay payment and pause interest while you pay them down.

These are my 3 favorite options…

- The Amex Every day and Every Day Preferred are both offering 0% for 12 months on new purchases and balance transfers.

- Citi Double Cash is offering 18 months interest free on purchase and balance transfers

Conclusion

These are extremely trying times, unemployment rates are skyrocketing, and many people are seeking refuge via lending forbearance or rent postponement. I’d highly caution utilizing these tools without fully understanding the intrinsic risk, and your liability at the end of the forbearance period. I’d hate for people to enter into these agreements without regarding the full weight of the outcome, and what it could do to their future credit viability. While your account will show current, the notes that lenders can place on your account may negatively affect your future borrowing ability.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.