We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Shopping Portals to earn more of your favorite points and miles

If you’re not using a shopping portal to originate your online purchases, you’re seriously missing out on one of the easiest ways to earn bonus points and miles. If you’re unfamiliar, loyalty programs have their own online shopping portals that will code your order to earn points in their program. The purchasing process is exactly the same you just start it via a portal.

It’s a super easy way to earn a boat load of extra points, keep your points alive, and with certain portals ( AA Simply Miles ) earn points that will qualify you for status. All you have to do is log into the mall and then link into the retailers’ normal site. You’ll not only earn your credit card points, but you’ll also earn the points of the portal you’re using.

Personally, I use the Rakuten portal most since it earns

Here’s a list of some of our favorite shopping portals:

Airlines

- Aeromexico

- Air Canada Aeroplan

- Air France Flying Blue

- Alaska Airlines

- ANA

- American Airlines

- American Airlines Simply Miles ( mastercard required )

- British Airways

- Cathay Pacific

- Delta

- Etihad

- Finnair

- Hawaiian

- Japan Airlines

- JetBlue

- KLM

- Lufthansa

- Qantas

- Singapore Airlines

- South African Airwaysf

- Southwest

- United

- Virgin Atlantic

- Virgin Australia

Hotels

Banks

- American Express: Rakuten

- Bank of America

- Barclays

- Capital One

- Chase

- Citi

Cashback

- BeFrugal

- Giving Assistant

- Mr. Rebates

- TopCashback

- Upromise

- Rakuten

- Fluz

- Lemoney

Note… I use Rakuten the most since it has the ability to earn Amex points which I value quite high – referrals range between $30 and $40 after you spend the same amount.

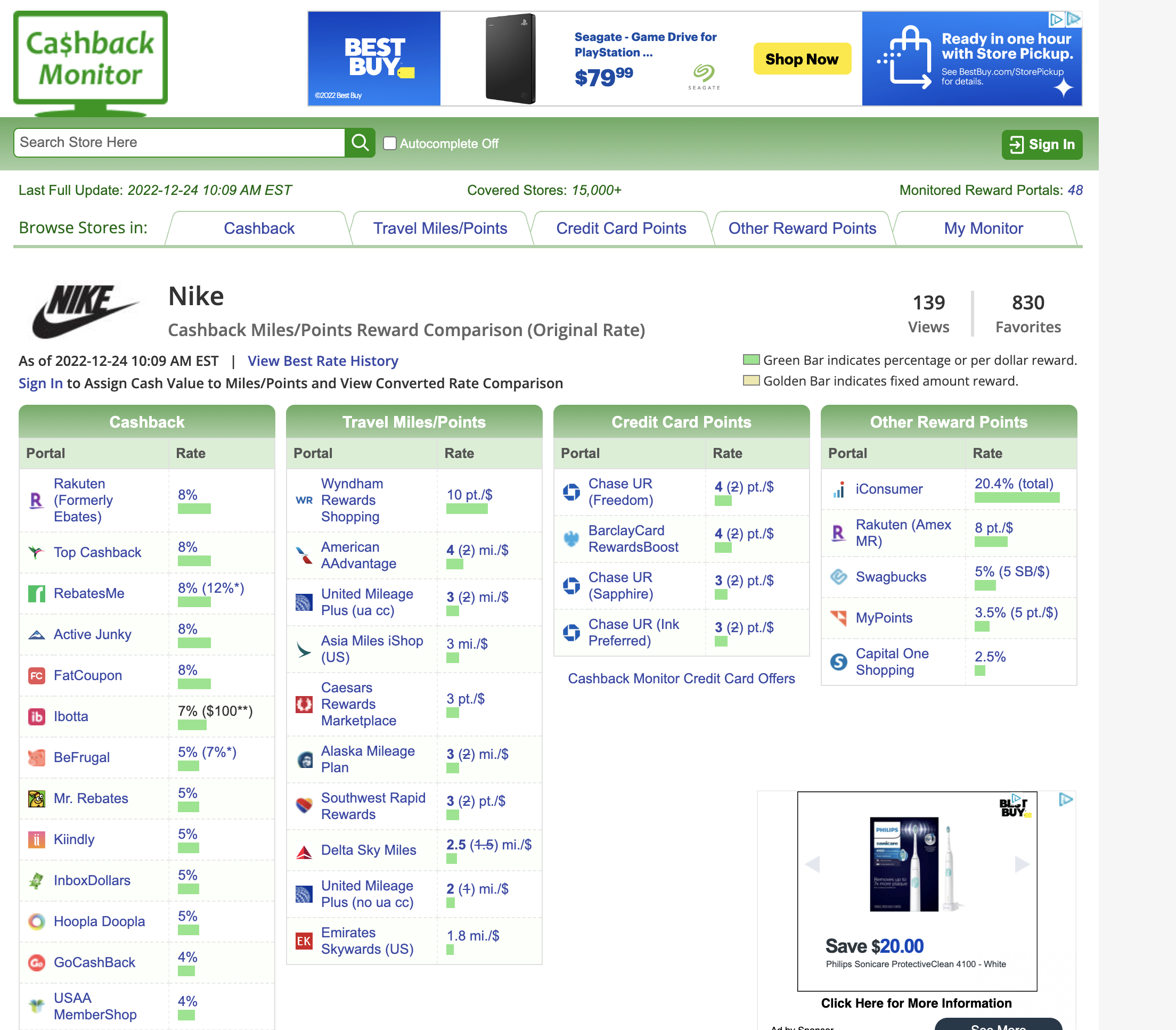

How do you know where the best deal is?

Personally I always reference CashBackMonitor which lists an absolutely massive array of shopping portals telling you which portal is offering what return on your spend. Every person values points a bit differently, so this will hopefully guide your decision making process. For instance, if you’re really trying to hit AA status, you may choose a lower rate of return via Simply Miles than Rakuten.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.